Insight Focus

Urea prices edged up after a successful India tender. However, there are suggestions of a substantial oversupply in China, which could prompt it to resume exports. The processed phosphate market is holding with little demand and light supply. Potash producers are looking for improved prices in 2025. Ammonia markets are starting to feel the pressure of too much product chasing few buyers.

Urea Price Rises… But For How Long?

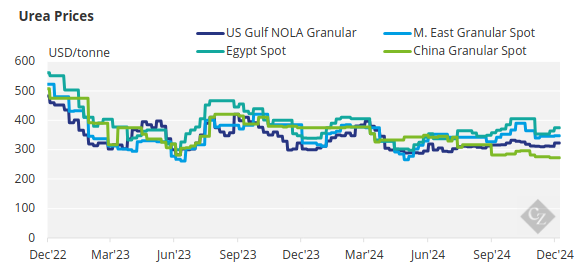

There has been a flurry of deals in the runup to the closure of the India tender on December 19 for shipment to January 10, 2025. This is particularly true for Egyptian sellers for smaller cargoes to Europe, where the latest sale was concluded at USD 393/tonne FOB for January shipment.

The market expects that the L1 CFR price in India could be anywhere from the low-USD 360s/tonne to as high as USD 375/tonne CFR. Price discovery is expected to be announced in the next few days.

In addition, Dangote of Nigeria is rumoured to have sold up to three granular urea cargoes each of 30,000 tonnes at a price in the mid- to high-USD 340s/tonne FOB region. This compares to an earlier conclusion in November at USD 310/tonne FOB.

Urea sales in Southeast Asia have reportedly been concluded by one producer in the low- to middle-USD 360/tonne FOB area for smaller lots. This price compares to prices of as low as USD 330/tonne FOB just a few weeks ago. Indonesian export of urea is still absent with the most recent tender having taken place in early November and there are no signs at this point that a tender is forthcoming.

Middle Eastern producers are keeping their cards close to their chests, awaiting results from the India tender. Producers are hoping to achieve USD 355/tonne FOB.

The all-important urea imports to Brazil have been small of late but around 30,000 tonnes is reported sold at prices in the USD 360-365/tonne CFR. Suppliers are now asking prices above USD 370/tonne CFR with products being directed to other markets in Latin America and the US. Current barge prices in the US/NOLA have traded closer to USD 330/short ton (USD 364/tonne).

Iran’s January to November urea exports were 5.34 million tonnes, up 18% or close to 800,000 tonnes year over year. Turkey was the main outlet with 2.2 million tonnes and Brazil took another 1.2 million tonnes. Iranian cargoes are now finding markets regularly in Southeast Asia with Myanmar, Vietnam and Thailand the key focus. Currently significant Iranian government cutbacks on gas supplies to urea producers have limited availability.

The obscure Chinese magazine called Agricultural Resources Alliances Network published an article on the current and future situation of the Chinese urea industry claiming that new urea capacity in China in 2025 could lead to overcapacity and depressed prices. The 2024 urea capacity in China was reported in the article at 80.45 million tonnes and the author said that in 2025, capacity could reach 90.05 million tonnes.

The apparent consumption of urea in 2023 was said to be only 58 million tonnes, while demand in 2024 according to the China Nitrogenous Fertilizer Industry should reach 62.5 million tonnes. The January to November urea industry operating rate averaged around 82%, up from 78.7% last year.

The article concludes that with such high production and operating rates and low domestic consumption, China will come to experience a serious oversupply of urea — even with exports. Chinese authorities are rumoured to be meeting the December 26 to decide if exports should be reintroduced.

In general, the outlook for the urea price is firm with both Turkey and the US needing products in the new year. If India secures 1.5 million tonnes, there will be a dogfight to find urea well into February and possibly early March.

Lack of Liquidity for Processed Phosphate

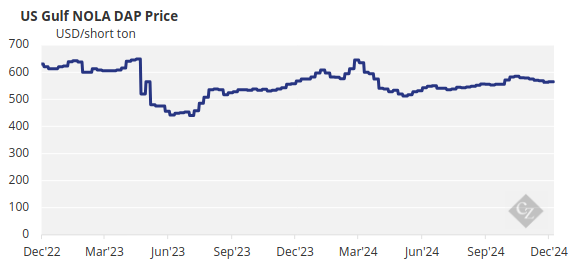

Indian end-of-year DAP stocks are provisionally rumoured to be around 1.2 million tonnes due to slowing imports. A comfortable level for Indian stocks should be around 2 million tonnes. In 2024 so far, India has imported 5.09 million tonnes compared with 6.73 million tonnes in 2023 and as much as 7.23 million tonnes in 2022. India’s DAP subsidy is expected to be raised to INR 31,000-31,800 from the current INR 27,000, which could stimulate demand.

Global spot prices for DAP and MAP remained firm this week despite a lack of spot activity, as tight availability continued to offset limited demand and poor affordability. Prices remained exceptionally high compared with other nutrients as well as downstream agricultural products.

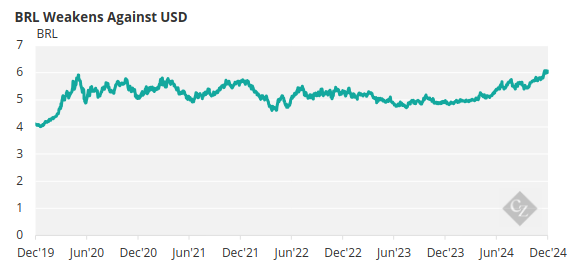

MAP prices in Brazil have been even more stubborn, with the assessment unchanged at USD 635/tonne CFR since mid-July amid a lack of liquidity. Sellers are resisting pressure for price declines as global spot availability remains tight. Weak demand during the off season has been offsetting the limited supply. Affordability concerns are also leaving buyers unwilling to buy at current MAP offer levels.

The current weakness in the Brazilian real has made buyers even less willing to pay up at current offer levels, as the currency has hit a record low against the dollar. Buyers in Brazil have focused on alternative products at more favourable prices, such as MAP 11-44, TSP and SSP.

Source: St Louis Fed

Meanwhile, market participants continue to await greater clarity over China’s current and upcoming export restrictions, as uncertainty over the country’s Q1 export availability limits potential bearishness in global spot prices. However, the restrictions continued to help push domestic prices down this week.

Potash Price Slides on Plentiful Supply

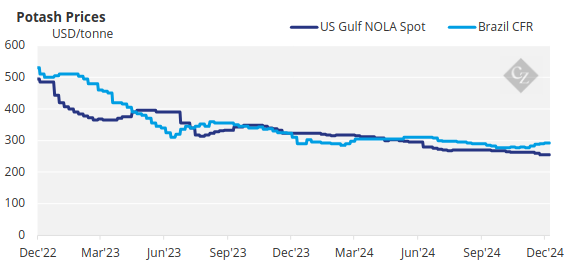

Potash producers are targeting higher prices in 2025 amid relatively firm sentiment. The most supportive fundamental in Southeast Asia is increased affordability with palm oil prices increasing relative to standard MOP prices, which are sitting at around USD 300/tonne CFR.

Source: World Bank

Stock drawdown in Brazil could lead to higher imports heading into 2025. However, countering this optimism is the fact that production cutbacks in Belarus have not materialized and although Belarus is sanctioned, MOP appears to find its way around the world with little effort. Brazilian spot prices climbed to an average of USD 300/tonne CFR this week – their highest level since mid-August.

Potash prices in the region had a year of turmoil, with average prices now USD 10/tonne lower than at the start of 2024. All offers for January shipments were reported at USD 300-310/tonne CFR, while offers in February reached USD 310-320/tonne CFR and those in March exceeded USD 320/tonne CFR from one producer. Still, with record high imports this year, all eyes will be on the stock turnover, which may dampen demand in Q1.

The Southeast Asian market remained sluggish ahead of the Christmas period. Granular MOP prices fell USD 10/tonne CFR to USD 320-330/tonne CFR, although deals were reported as low as USD 310- The Southeast Asian market remained sluggish ahead of the Christmas period. Granular MOP prices fell USD 10/tonne CFR to USD 320-330/tonne CFR, although deals were reported as low as USD 310-315/tonne CFR in Vietnam. Standard MOP prices in Malaysia continued to fall short of those in the wider region. Producers are targeting prices higher than USD 300/tonne CFR heading into 2025.

Ammonia Benchmarks Begin Slide

The final market week of the year saw relatively minimal action, though benchmarks on both sides of the Suez are very clearly beginning to trend further towards the downside following the year-high peaks seen across several indexes during 2H November-1H December.

All eyes are on the January Tampa contract settlement between Yara and Mosaic for price guidance. With further bearish sentiment beginning to creep in, it is only a matter of time before deals start to be concluded at lower levels than currently seen.