Insight Focus

Urea prices have dipped due to India’s tender delay. DAP prices are falling as India’s Rabi season ends. Potash prices in Brazil have stabilised, while ammonia could peak with the upcoming Mosaic-Yara contract.

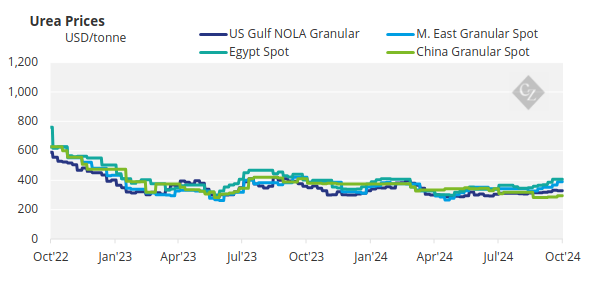

Urea Prices Retreat Amid Tender Delays

The most anticipated urea tender remains unannounced, despite persistent rumours that an announcement would be made this week. Currently, it is reported, though not confirmed, that the Indian Department of Fertilizers will hold the anticipated purchasing tender, with an announcement expected in the coming days or early next week.

This indecision seems linked to Diwali celebrations in the first week of November; therefore, a tender might be issued once Diwali concludes. The tender will likely call for shipments within December, primarily targeting India’s west coast. The urea market reacted to this uncertainty, with prices retracting in several regions.

In Egypt, prices dipped by USD 12-17/tonne to USD 390-395/tonne FOB, down from above USD 400/tonne. In the Middle East, non-US-bound urea is priced around USD 370-380/tonne FOB, while the last reported sale was rumoured at USD 390/tonne FOB.

In Brazil, farmers remain cautious about committing to larger parcels. Offers are quoted in the high USD 370s to low USD 380s/tonne CFR for October/November cargoes sourced from the Middle East, Algeria and Nigeria, against bids at USD 365-370/tonne CFR for southeastern and southern ports. Inbound cargoes are now being stored in bonded warehouses to await price stabilisation.

In Southeast Asia, an export tender from Pupuk, Indonesia of around 200,000 tonnes is possible. Brunei Fertilizer Industries (BFI) is reported to have sold small parcels at approximately USD 375-380/tonne FOB. Meanwhile, Petronas is focused on meeting contractual obligations, as one of its factories is down for maintenance.

Urea imports to Australia have surged this year, with 3.35 million tonnes arriving from January through August. Exceptional grain output and favourable weather, especially in Queensland and New South Wales, drove record imports. SABIC led suppliers with 597,000 tonnes, followed by the UAE with 571,000 tonnes, Indonesia with 539,000 tonnes and Qatar with 497,000 tonnes. Imports from China dropped sharply, from 118,000 tonnes last year to 17,000 tonnes this year.

The outlook for the urea market remains firm, though some retraction is expected due to the delayed Indian tender announcement.

Separately, Pupuk Kaltim of Indonesia plans to construct an ammonia-urea factory in Fakfak, West Papua, with an annual capacity of 600,000 tonnes of ammonia and 1.2 million tonnes of urea, at a total cost exceeding USD 1 billion. Gas feedstock will come from Malaysia’s Genting Oil & Gas facility at Kasuri, close to the project site. The estimated operational start date is 2027. This development may explain Pupuk Kaltim’s fading interest in acquiring Incitec Pivot Limited.

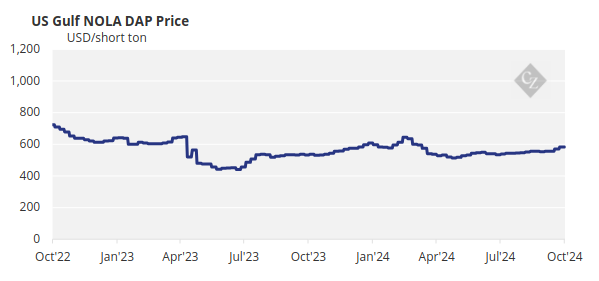

Phosphate Prices Slide as Rabi Ends

India remains the primary focus in processed phosphates, with prices currently holding at USD 640-642/tonne CFR. However, a reduction to the mid-USD 630s/tonne CFR or lower is anticipated as the Rabi season winds down. Spot export prices for DAP from China have decreased further, with mainstream transactions reported at USD 604-615/tonne FOB, down from last week’s USD 610-620 FOB.

Domestic activity in China has slowed, as purchases for the autumn application season have ended in the north. MAP prices in Brazil remain stable at USD 635/tonne CFR, with limited demand balanced by limited supply. The outlook for processed phosphate prices is bearish as Indian buying tapers off and global demand remains subdued.

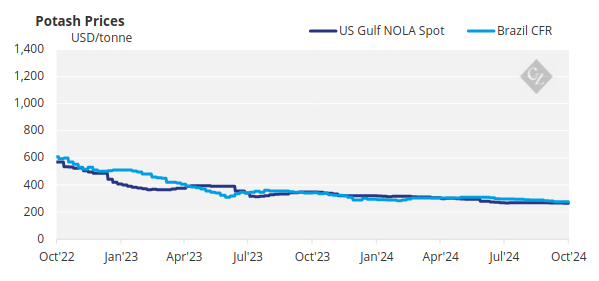

Potash Prices Stabilise

Potash prices globally have seen little change, with Brazil showing signs of price stabilisation. MOP prices in Brazil held at USD 280-285/tonne CFR for the third consecutive week, boosting producers’ confidence in a price floor. Although prompt demand remains limited, advance delivery inquiries are rising. Producers remain hesitant to sell at current levels, expecting prices to increase in the coming months.

Initial offers for the latest Pupuk Indonesia tender reportedly reached USD 315-323/tonne CFR, with a finalised price of USD 309-310/tonne CFR expected. Regional standard prices are assessed at USD 280-300/tonne. The outlook for potash prices is stable to firm, with the Brazil market appearing to have reached a floor and the Pupuk Indonesia tender supporting an upward trend.

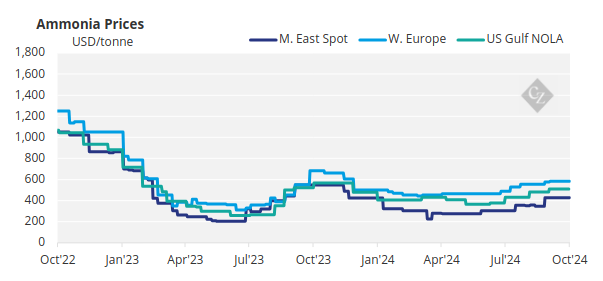

Ammonia Peaks as Contracts Approach

The international ammonia market has experienced limited activity this week as it awaits price guidance from the Mosaic-Yara November contract. A slight price increase from the current USD 560/tonne CFR mark is expected. Prices could soon reach a peak, particularly in the West, as shrinking margins may deter higher-priced business.

The supply outlook is improving as November approaches, assuming recent production turnarounds and output constraints are resolved as planned.