Insight Focus

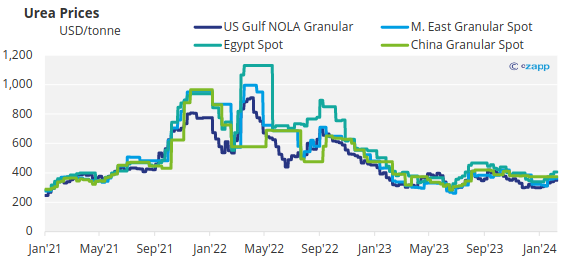

- Urea prices are edging higher.

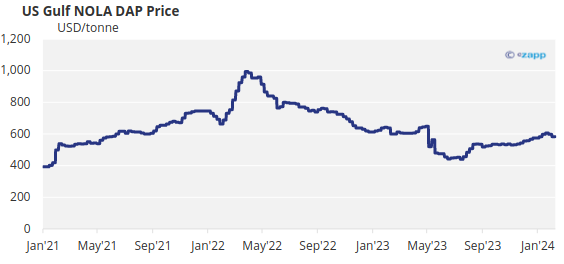

- The processed phosphate market remains balanced as limited supply offsets sluggish demand.

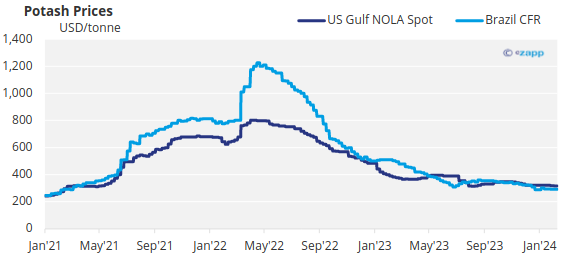

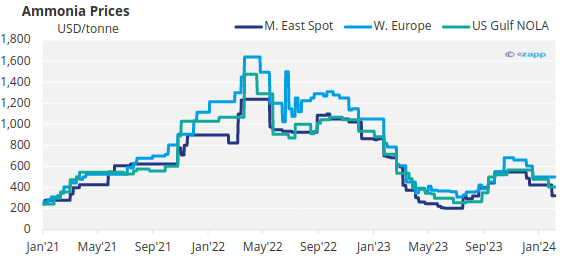

- The potash and ammonia markets are both bearish.

Urea Price Hangs on India, China

The international urea market is humming along nicely with prices edging up, albeit at a slower pace than a couple of weeks ago.

A Middle Eastern producer is reported to have achieved USD 385/tonne FOB for April shipment – this is up from the mainstay prices of the past week reported around the USD 370-380/tonne FOB region. Egyptian urea is said to have reached as high as USD 410/tonne FOB on the back of demand from Europe.

Brazil is reported to have paid as high as USD 400/tonne CFR from an incoming vessel but there appears to be little interest in forward buying. There is an expectation that US demand will pick up once the spring season begins.

The two big questions looming in the urea market are India and China. Firstly, when is India coming back in the market with a tender? And secondly, when will China resume exports? Each is a moving target.

Some say India will come back at the end of February and that China will only export after the domestic season is over. However, some think that upon the conclusion of Lunar New Year Celebrations at the end of February, some news could emerge on exports. If India comes into the market before Chinese exports resume, this will boost the market price of urea in the coming weeks.

Petronas of Malaysia has resumed production at one of its plants but is said to be fully booked for March via long term contracts. Brunei-based producer BFI reportedly has March availability with prices edging towards USD 400/tonne FOB.

Imports of urea to Australia reached a record high of 3.185 million tonnes in 2023. The UAE was its biggest supplier at 775,000 tonnes, up 24.35% on the year and Qatar took second place with 641,000 tonnes, up 20.15%.

The outlook for prices for the next couple of months is positive but a second quarter with China back in the market could swing the pendulum to a more bearish sentiment.

Processed Phosphate

The processed phosphate market is balanced with tight supplies offset by sluggish demand. Brazil’s MAP price has been stuck at USD 560/tonne CFR for a few weeks. Buyers are staying away due to concerns about farmer affordability with sluggish soybean prices.

The DAP price in India is also stuck at USD 595/tonne CFR due to the ongoing uncertainty over government subsidy increases. Importers of DAP to India are said to be losing more than USD 100/tonne at the current subsidy rates. Over the past two weeks, India imported around 205,000 tonnes of DAP but this last week has been quiet with no deals reported.

The US market is tight on supplies and importers are now looking at both Senegal and South Africa for supplies for the upcoming spring season.

Again, China is a big question mark looming over the market. But it is not expected to resume exports until the domestic spring season has come to an end and domestic prices have come down. Chinese full year production of DAP in 2023 was 14.2 million tonnes, up 8% year on year. MAP production was 13.3 million tonnes, up 10% year on year.

The outlook for processed phosphate prices is stable with limited upside. There is downside risk in the second quarter when China comes back into the market.

Potash

The potash market is bearish with granular MOP in Brazil down an average of USD 12/tonne this week with a new range of USD 275-290 CFR. The expectation is that this price, which is the lowest since early February 2021, has reached its floor. With increased demand expected in the next few weeks, prices should increase.

India is in the process of negotiating a new potash import contract and is said to be looking for sub-USD 300/tonne CFR, down from the current re-negotiated price of USD 319/tonne CFR.

Prices in Southeast Asia are also down with buyers holding back in anticipation of price guidance from upcoming tenders.

The US imported 11.85 million tonnes of MOP in 2023, up 8.13%, of which Canada supplied 10.5 million tonnes, up 12.5% year on year.

The outlook for potash is bearish with too much supply chasing few buyers unwilling to commit to new volumes.

Ammonia

The ammonia market has been quiet this week with prices ranging from stable to soft. Middle East ammonia is down an average of USD 75/tonne and is now in a range of USD 300-350/tonne FOB. Prices in the Far East have also slumped to a new range of USD 320-360/tonne FOB, down an average of USD 15/tonne.

Domestic ammonia prices China have also taken a beating with losses of around USD 24-35/tonne. Lunar New Year Celebrations mean business will be quiet over the next 10 days.

The outlook for ammonia prices in the east is bearish whilst production issues in the west may keep prices stable over the next few weeks.