Insight Focus

The Indian urea tender failed to find sellers, while processed phosphate prices continue increasing on the back of limited supply. Both India and China settled annual potash contract prices at much lower numbers from previous contracts. Ammonia markets are affected by production curtailments in major exporting markets.

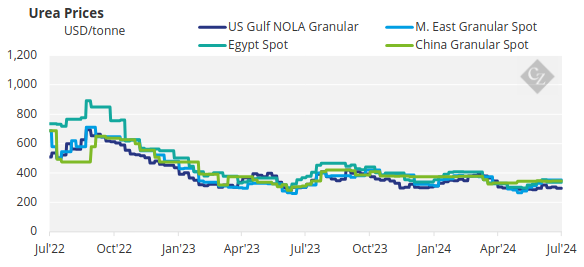

Prices Hold in Muted Urea Market

The India IPL urea tender with shipments before August 27 has failed to attract interest from both producers and traders. With a price difference of USD 14.50/tonne between East Coast (USD 365/tonne CFR) and West Coast India (USD 350.50/tonne CFR), sellers took a step back to look for better places to direct product than India.

Although tender offers are valid until July 18 and it is expected that India will come forward with more counters – albeit not necessarily improved counters — to date India has only received 180,000-230,000 tonnes to the West Coast.

India is not expected to come back into the market soon after this tender with inventories of urea in India said to be in excess of 11 million tonnes, causing some to ask why the country held this latest tender in the first place.

In other markets, TCP of Pakistan announced a 150,000-tonne urea tender closing July 29 with August shipments, while Ethiopia announced a similar-sized tender closing July 12 for prompt shipment. Although the total quantity for these two tenders is small, it got the attention of producers and intensified their lack of interest in the India tender.

Other markets are mute. Brazil has yet to show muscle and prices are currently at USD 360/tonne CFR. Argentina is out of the market, awaiting news on a reduced import tax. European buyers are on holidays for the next few weeks. Markets in SE Asia are inactive with only the possibility of Australian buyers stepping in for more products through August.

Egyptian producers are said to be up to 80% back on production rates and will most likely struggle to find buyers in August.

And in the background is the unpredictable China. The National Development and Reform Commission (NDRC) recently shared that there will be no exports for the remainder of 2024. But this song has been sung many times before so it would not come as a major surprise if Chinese products were exported at some stage in the fourth quarter of the year.

Overall, prices are expected to hold and possibly improve over the next few weeks.

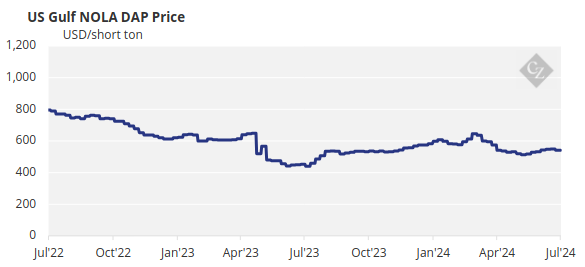

Processed Phosphate Prices Rise

Processed phosphate prices are on the rise across all origins and destinations. The India DAP price is said to be at USD 551/tonne CFR and Pakistan is in the range of USD 561-565/tonne, all on the back of limited supply.

Chinese DAP will reportedly be restricted in Q4 with focus on the domestic season. The Ministry of Agriculture of Bangladesh has awarded 390,000 tonnes of DAP at prices ranging between USD 645/tonne CFR and USD 695/tonne CFR with 300,000 tonnes reported to be of Chinese origin (although this has yet to be confirmed by Chinese producers). However, after the Bangladesh tender, the average Chinese FOB price of DAP increased by USD 15/tonne this week to between USD 560/tonne and USD 580/tonne.

India concluded Q3 2024 phosphoric acid pricing with an improvement of USD 2/tonne for 100% P2O5 at USD 950/tonne CFR on the back of higher DAP prices.

Brazil’s MAP price, which has increased USD 65/tonne CFR over the past seven weeks to USD 635/tonne CFR, is likely to have reached its pinnacle. Low affordability and reduced commodity prices are putting pressure on prices.

In summary, with low inventories of DAP in India, and limited availability of DAP exports from China, it is expected that India will have to pay higher prices for DAP in the next few weeks.

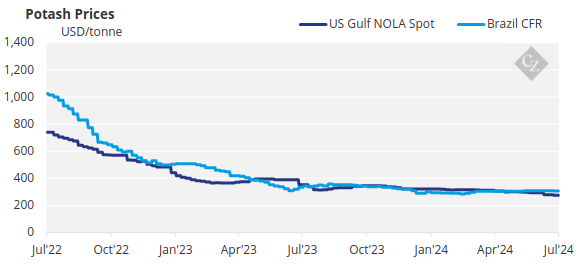

Potash Supply Strong

Some excitement returned to the international potash market with India’s IPL settling a purchase contract at USD 279/tonne CFR, down USD 40/tonne from the previous contract of USD 319/tonne CFR. China also stepped into the market with a contract price that is said to be USD 273/tonne CFR.

Brazil’s CFR price remains flat at USD 310/tonne. The markets are now adjusting to the new price discoveries in both India and China.

The Southeast Asia potash transactions remain limited, and the region is yet to see the impact of the new inputs. Some market players are expecting prices to increase in the coming weeks, but this may be limited as supply remains abundant. In the meantime, some producers still are not offering.

The general outlook for potash is flat with supplies outstripping demand.

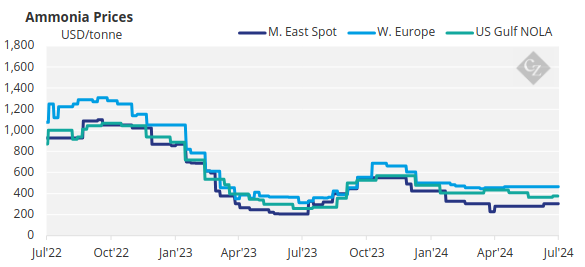

Ammonia Supported by Urea

Ammonia benchmarks will likely remain supported for as long as supply issues persist in the Caribbean, North Africa and the Middle East, with many nitrogen producers likely to prioritise urea output while prices remain profitable.

A sale of a small parcel of ammonia to BASF saw a price of USD 510/tonne, which is an average increase of USD 35/tonne from previous assessed market price. However, a sale at USD 390/tonne East Coast India for an unspecified volume baffled the market in view of the current sentiment.

In the Far East, demand from downstream players in China remains limited amid continued suggestions Chinese exports could emerge over the coming months, albeit in small lots. Elsewhere, contract prices remained more or less unchanged across South Korea and Taiwan, while term cargoes continued to sail from Malaysia and Indonesia. Reported planned maintenance works in Indonesia could see a further tightening in regional supply through July.

The outlook for the ammonia price is stable to firm.