Insight Focus

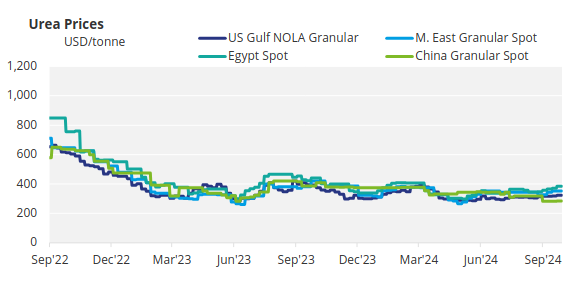

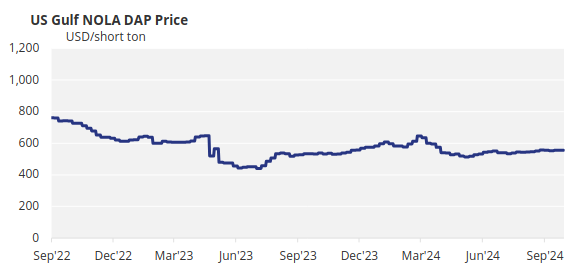

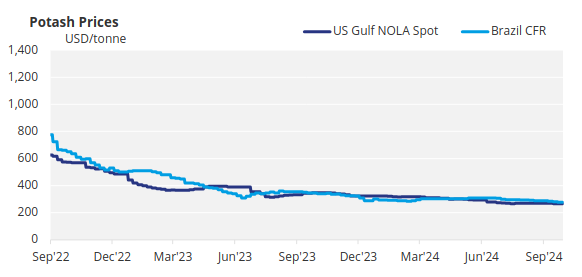

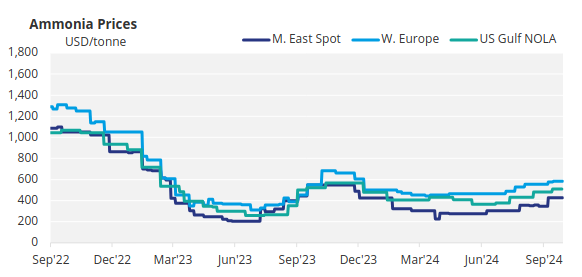

Urea prices are rising globally, fuelled by Indian tenders. India is expected to continue DAP purchases, while Brazil’s granular potash prices have declined slightly. Meanwhile, ammonia markets are slow due to seasonal low demand and maintenance at export hubs.

Challenges in India’s Urea Tender

The RCF India urea tender, which closed on October 3, was thrown a curveball with one offer of USD 364.50/tonne CFR West coast, compared to USD 389/tonne CFR East coast. This resulted in no bidders matching the West coast price, leaving the East coast to carry the tender on volume. To date, RCF has a total of 566,000 tonnes in hand, but no awards have been made as of the time of this writing.

Prior to the tender, it was expected that RCF would secure more volume, given the anticipation that India will need to import a total of 2 million tonnes between now and the end of January. It is therefore likely that India will return to the market with at least one more tender—possibly two—following the first. Any subsequent tender is likely to see increased prices, as producers are now comfortable with sales through October and parts of November.

Middle East netbacks from this tender are in the mid-to-high USD 360s/tonne FOB. One cargo has been reported sold for the India tender at USD 371/tonne FOB. Egyptian producers have also seen a rapid increase in FOB levels, with the highest prices paid at USD 407/tonne. Traders are positioning for expected European demand.

Other markets remain quiet. Brazilian buyers are being offered prices at USD 380-390/tonne CFR, compared to the last done deal at USD 375/tonne CFR, and USD 360-365/tonne CFR just two weeks ago. Uncertain weather and heavy lineups, which are keeping ports busy, are holding buyers at bay.

The NOLA/US markets saw a slight increase due to the Middle East crisis but have since settled at around USD 330/tonne FOB barge. Chinese domestic prices also spiked sharply this week, ruling out any possibility of exports.

The outlook for urea prices remains firm, with India providing liquidity. The Brazilian and European markets are also expected to return soon.

Phosphate Prices Steady in India

Global prices for DAP (diammonium phosphate) and MAP (monoammonium phosphate) were largely stable this week, although US prices firmed on improving demand and concerns over limited availability.

All eyes have been on DAP imports to India, where prices increased by 3% over the past week and as much as 24% since the end of May. However, Indian buyers now appear to be stepping back before the second round of purchases. Market sources estimate that India still needs to import an additional 1-1.5 million tonnes of DAP within the next two months, a task considered challenging due to limited cargo availability. Chinese export restrictions continue to tighten supply, and India has now sourced DAP from a wide range of suppliers. Prices have stabilised at around USD 640-645/tonne CFR.

Brazil imported 3.32 million tonnes of MAP from January to September this year, a 14% decline compared to the same period in 2023, according to the latest Global Trade Tracker (GTT) data. During this period, Brazil imported 1.74 million tonnes of MAP from Russia, down 6% year on year. Imports from Morocco dropped 19% to 852,332 tonnes, and imports from Saudi Arabia fell 20% to 520,561 tonnes.

Meanwhile, the volume from China jumped 45% to 156,257 tonnes, while imports from the US plunged 70% to 56,528 tonnes. Low year-to-date MAP imports have resulted in a stock drawdown in Brazil, supporting an increase in market demand and boosting prices.

The outlook for DAP prices is closely linked to Indian import activity. Once Indian demand subsides, prices are expected to correct downwards.

Potash Prices Diverge in Brazil, Southeast Asia

Potash prices fell modestly in Brazil, while the Southeast Asian market is pushing for higher prices, driven by improved demand linked to strong palm oil prices. In Brazil, granular MOP spot prices were assessed at USD 280-285/tonne CFR, down by an average of USD 2.50/tonne.

Prices have declined by 10% since the start of the year, although market players still expect limited demand and ample supply to continue driving spot prices down further. While demand remains seasonally slow, it may be supported by strong affordability in the region.

In Southeast Asia, demand continues to improve due to higher palm oil prices and strong affordability. An influx of tenders is expected in the coming weeks, which will provide further price direction. Recently, buyers and sellers have diverged in their price expectations, with some producers targeting higher prices of USD 280-300/tonne CFR, while buyer price ideas have stagnated.

The Indian potash contract price remained at USD 283/tonne CFR this week, pending further confirmation. Parties involved declined to comment on rumours of contract prices at USD 285/tonne CFR from October onwards, and no deals at USD 285/tonne CFR have been reported so far.

Ammonia Market Remains Quiet

The international ammonia market was subdued this week, with little trade due to seasonal low demand. Additionally, the regional IFA conference in Hong Kong kept traders busy with meetings, offsetting the impact of planned turnarounds at major producers.

Discussions on 2025 supply contracts are ongoing globally, and the results of major purchasing tenders for next year are eagerly awaited. The outlook for ammonia prices remains stable for now, with expectations of lower prices toward the end of the year.