Insight Focus

Urea prices rose with Iran’s export curbs and increased demand. Processed phosphate prices held this week due to limited supply and Chinese export restrictions. Potash prices stagnate, while ammonia prices are expected to fall with increased supply.

Urea Prices Climb Amid Demand

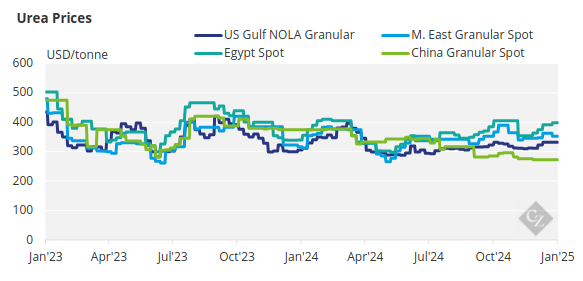

Urea prices are edging upwards, with CFR levels in Southeast Asia approaching USD 400/tonne or more. India is reportedly issuing another tender on January 10 in response to the modest 187,000-tonne results from the previous tender.

A granular urea tender in Indonesia, closing on January 10 with bids valid through January 13, will provide further price discovery. Sales of granular urea to both Thailand and Vietnam also saw prices around the USD 400/tonne CFR level.

Egyptian prices have reached USD 430/tonne FOB for February shipment, with Turkey driving prices due to the closure of all but one of Iran’s production units because of gas issues. This represents an increase of USD 70/tonne over the past two months. Pardis is reported to be operating, but sales are limited to the domestic market.

Although not relevant without exports, FOB levels have been raised to USD 340/tonne. Iran is a major urea producer with a total capacity of around 9 million tonnes and exports around the 5 million tonne mark—all this despite Iran being a sanctioned country for most markets except Turkey and Brazil.

In 2024, Brazilian imports of urea rose by 1 million tonnes year over year, reaching 8.3 million tonnes — the highest on record. Oman/Iran, Nigeria and Russia were the largest suppliers, each with above 1.5 million tonnes.

Urea imports to the US from January to November reached 1.03 million tonnes, with Canada supplying 173,000 tonnes and Qatar being the largest offshore supplier at 232,000 tonnes. January barges last traded at USD 343-345/short ton (USD 377-379/tonne) FOB NOLA.

With China still not exporting, Iran not exporting due to gas shortages, and an expected pick-up in demand from the US, Europe, and possibly Australia, the outlook for urea prices is bullish.

Once USD 400/tonne FOB is reached in the Middle East, with some markets now trading as high as USD 385/tonne FOB, it is not unreasonable to anticipate much higher prices soon.

Phosphate Imports Rise Amid Limited Supply

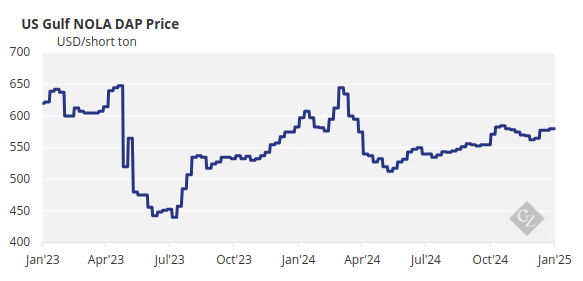

On the processed phosphate side, a report indicated that Ma’aden sold 30,000 tonnes of DAP to India at the prevailing last sales price of USD 633/tonne CFR. Domestic sales of DAP in India are reported to be 9.48 million tonnes, down from 11.1 million tonnes in 2023.

India produced 4.04 million tonnes in 2024, below the average of 4.25 million tonnes from 2021-2023. Imports in 2024 totalled just 4.56 million tonnes, with a domestic stock draw of nearly 800,000 tonnes. Much of the reduction in imports is attributed to limited availability, with China restricting exports.

Brazil’s combined imports of DAP, MAP, NP, NPK, TSP and SSP reached 12.71 million tonnes, up 2.3% year over year. However, MAP imports dropped 19% to 4.21 million tonnes, down from 5.2 million tonnes in 2023. DAP imports decreased 20% year over year, totalling 198,248 tonnes.

TSP/SSP imports sored, with TSP rising 10% to 1.5 million tonnes on the year, with OCP of Morocco being the major beneficiary, seeing a 58% increase to 1.09 million tonnes. SSP imports rose 20%, reaching 2.64 million tonnes.

Price upside and downside both appear limited, as tight supply offsets limited demand and affordability concerns, with phosphate prices remaining high compared to downstream agricultural commodities and other fertilizer nutrients.

Potash Prices Steady as Deals Slow

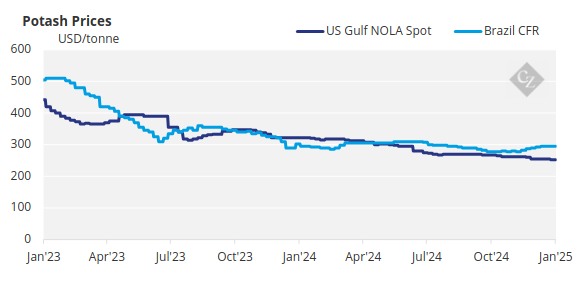

Potash prices were stagnant globally this week as the bullish market momentum from recent months began to show signs of faltering. The Brazilian market held steady at USD 305-310/tonne CFR, with spot transactions being scarce.

Most producers have shifted to selling for February onwards, with offers now starting at USD 310/tonne CFR. Despite the limited spot deals, USD 300/tonne CFR was rumoured to still be achievable in the market, though this was promptly dismissed by many market players. This comes as Brazil’s latest import data from GTT reveals record-high volumes of 14 million tonnes.

Standard MOP prices in Southeast Asia were little changed after firming to their highest levels since early April 2024, reaching USD 290-310/tonne CFR. Producers remain hopeful of reaching USD 300/tonne CFR or higher in the coming weeks, supported by increased demand for palm oil crop usage. However, one distributor reported difficulty in selling for higher than USD 295/tonne CFR this week.

India saw an uptick in cargoes throughout the week, with January imports now expected to total around 120,000 tonnes of MOP. Indian importers are still waiting for negotiations to begin, and in the interim, volumes are likely to continue until the 2024 180-day contract range of USD 283-285/tonne CFR.

Ammonia Prices Struggle as Demand Wanes

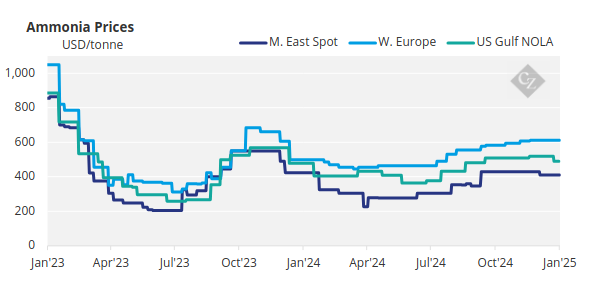

The slow start to the year continued for ammonia this week, with further transparency needed on both sides of the Suez to determine the extent to which prices are expected to fall through January. There is healthy supply and only limited pockets of demand.

East of Suez, the Middle East appears long, with some producers now reported to be offering at levels 10-15% below the USD 400/tonne FOB mark. This news is likely to be met with positivity by importers in India. Although Indian demand remains limited for the time being, delivered CFR values also seem to be easing as phosphate manufacturers deliberate between producing NPKs or DAP/MAP.

Prices in most markets are expected to register declines through January, though the extent to which benchmarks will ease remains unclear.