Insight Focus

India’s urea tender delay hit the US/NOLA market. Phosphate prices are expected to drop as Chinese exports resume. Potash prices are rising on increased demand, while ammonia prices are falling due to ample supply.

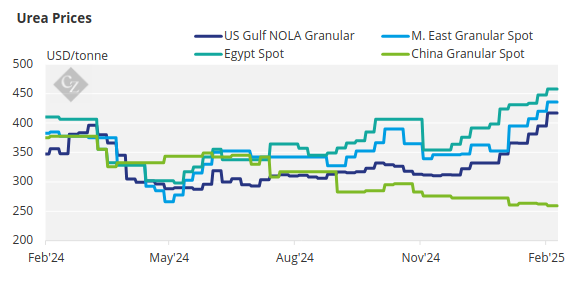

Urea Prices Falter

Urea price increases came to a sudden halt this week due to major concerns over the delayed India tender, with an announcement still forthcoming. In the highly liquid US/NOLA market, urea prices took a significant hit, with February barge values trading USD 38/short ton (USD 41.88/tonne) below the mid-month peak and the market losing USD 30/short ton in just a handful of trading sessions.

The US market still has a few weeks to go before the main import season begins, but strong demand is anticipated given the expected planting intentions. Meanwhile, Brazil is out of season, with only scattered demand for small volumes. Australian spot urea buying has also come to a standstill, with fears that farmers will delay purchases until the season starts in May, resorting to hand-to-mouth buying due to challenging weather conditions and deteriorating farm economics.

Thailand’s imports are mostly on a contract formula basis, primarily from major Middle Eastern producers, with spot buying infrequent and at lower prices than before. Middle Eastern producers are holding the fort and not offering, opting to wait and see when the India tender announcement will be made. The last known spot price in the Middle East was USD 437/tonne FOB ex-Qatar for a full cargo, with producers attempting to achieve above USD 440/tonne FOB, though with little or no traction. Southeast Asian producers are also seeing demand but with lower price expectations.

The last Indonesian export tender for 6,000 tonnes of prilled urea ex-Gresik received bids in the mid-to-high USD 430s/tonne FOB, but the owners’ floor price of USD 441/tonne resulted in the tender being scrapped. A Pupuk Indonesia granular urea export tender is expected to be announced soon.

Current granular urea prices in Southeast Asia are around USD 430/tonne FOB, give or take a couple of dollars. Dangote of Nigeria failed to sell two cargoes of granular urea, with expected prices of around USD 435–440/tonne FOB, while bids were reportedly in the USD 420s/tonne FOB region.

Indorama, the other Nigerian producer, is not offering due to contract commitments and the downtime of one urea production line. The EABC Ethiopia urea tender received seven valid offers in its latest tender, which closed on February 20, for multiple lots of 50,000 tonnes, totalling 300,000 tonnes, with shipment required between March and May/June. The lowest offer in the tender was USD 427/tonne FOB Oman, with the next lowest at USD 437.50/tonne FOB Oman.

The underlying outlook for the urea market remains stable to firm but is subject to the imminent announcement of an India urea purchasing tender.

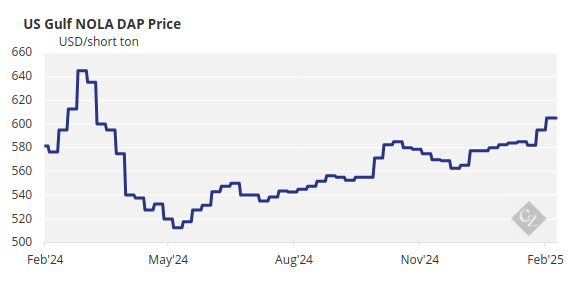

China’s Return to Impact Phosphate Prices

The processed phosphate market is expecting China to emerge again in the export market, with a 27,000-tonne DAP late-March shipment deal rumoured for Thailand. A Chinese return will certainly change the pricing dynamics of DAP/MAP/NPS, with expectations of price drops, opening opportunities for traders shorting the market.

With China on the sidelines, both Ma’aden and OCP have enjoyed much less competition in major markets. This week, Ma’aden sold a DAP cargo to India at a slightly higher price of USD 636/tonne CFR, compared to the latest price of USD 633/tonne CFR.

India’s government has increased the NBS for the Kharif season, but it remains insufficient for importers to make a profit. India is in desperate need of DAP, with inventories at much lower levels than in each of the previous five years. Pakistan is struggling with drought and significant economic hardship, with the latest bulk DAP imports occurring in November 2024. Last week, it emerged that 21,000 tonnes of DAP was imported in containers at prices ranging between USD 608–615/tonne CFR, with traders selling OCP origin.

In Brazil, MAP prices have remained stable since July 2024, at around USD 630–635/tonne CFR, due to slow demand supported by limited availability. Ethiopia’s EABC closed a tender for 540,390 tonnes of DAP on February 20, receiving offers on six of the nine lots in the session, according to sources. The loading laycan requirements for the nine lots ranged from early March to mid-May 2025.

Offers came from 10 traders (with two subsequently cancelled), comprising supplies from Russia, Saudi Arabia, China, Egypt and Kazakhstan. FOB prices per tonne ranged from a low of USD 625/tonne to a high of USD 641.75.

Ma’aden Phosphate Company has started construction of Phase 3 at a cost of USD 7.5 billion, which will increase total production capacity to 9 million tonnes by 2029. The first 1.5 million tonnes is expected to be completed by the end of 2026.

LIFOSA of Lithuania is making progress in its production of DAP/MAP, with full-year 2024 output reaching 250,000, up from around 110,000 the year before. However, it will take some time for LIFOSA to return to its peak production levels of around 900,000 tonnes.

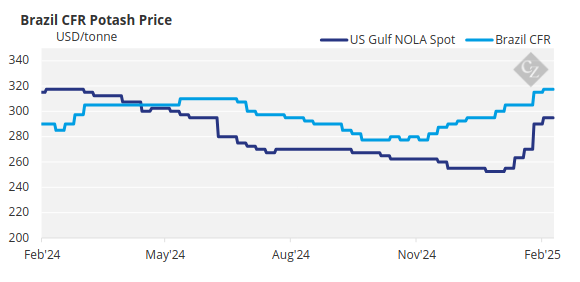

Potash Prices Rise Amid Strong Demand

Potash prices rose in China, Brazil, and the US, while other regions saw little change, as Pupuk Indonesia closed two tenders and Uralkali cut production in Q2. The Southeast Asia MOP market took the spotlight this week, with Pupuk Indonesia closing two tenders. The importer received five offers for its 20,000 tonne sMOP tender, with initial offers ranging from USD 335–360/tonne CFR for May shipment.

The volumes for this tender are much lower than the previous tender volume of 350,000 tonnes issued on January 29, which was scrapped after suppliers rejected the new price formula process. Pupuk Indonesia’s gMOP tender received six offers from suppliers, ranging between USD 335–435/tonne CFR.

Neither tender has been reported as awarded at the time of writing. In the meantime, prices in the region held at an average of USD 310/tonne CFR for standard MOP material, with gMOP priced at an average of USD335/tonne CFR.

Chinese port wholesale MOP prices jumped to an average of RMB 2,925/tonne (USD 402/tonne) FCA, fuelled by stronger demand for the spring application season and constrained supply. A bullish sentiment is prevailing in the market. Potash prices in northwest Europe have shifted, with most deals now occurring at the higher end of the range. Still, larger buyers suggest that lower levels are still possible.

With the global market strengthening, strong demand for sMOP and limited availability for March loading are expected to drive prices higher in the coming weeks. The bullish outlook from producers has been strengthening week by week in the region. Spot prices in Brazil increased by USD 5/tonne despite limited demand, as bids at USD 315/tonne CFR were firmly rejected.

Demand is expected to pick up after Carnival in Rio de Janeiro. Producers are still aiming for higher prices, with an unconfirmed rumour of a deal at USD 330–335/tonne CFR for March delivery. In the US, the potash market remained rather stagnant as cold weather dampened buying interest. Benchmarks rose modestly despite limited demand, with further increases expected as the weather improves in the coming weeks.

In the northwestern European standard SOP market, prices remained at an average of EUR 580/tonne FCA this week. However, strong demand and rising MOP prices suggest that prices may rise in the coming months.

In other news, Uralkali plans to cut MOP production by 300,000 tonnes at its Berezniki-2, Berezniki-4 and Solikamsk-3 facilities in Q2 for maintenance. However, CRU does not expect this to support significant price increases.

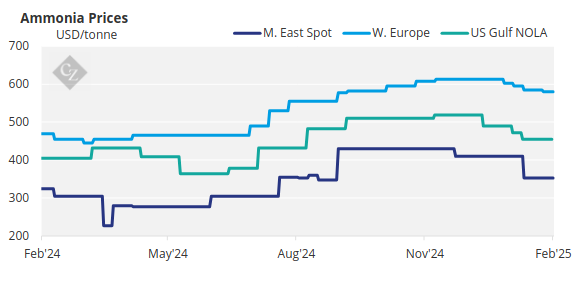

Ammonia Prices Drop Amid Weak Demand

On the ammonia side, to underscore the bearish sentiment on pricing over the past few weeks, Trammo sold 25,000 tonnes of ammonia to phosphate major OCP at USD 459/tonne CFR for 2H March delivery to Jorf Lasfar, sources confirmed on February 20.

The previous sale into Morocco was concluded at USD 535/tonne CFR in December 2024, with that deal also involving Trammo. The latest transaction is expected to impose further downward pressure on regional FOBs west of Suez. The figure is USD 41/tonne below February’s Tampa ammonia settlement between Yara and MOSAIC, amid speculation that the benchmark could decline again for March.

The outlook for east of Suez remains weak due to healthy supply and subdued demand. In the West, although Northwest European demand appears to be providing token support for pricing both there and in Algeria, this uptick is not expected to last. The March Tampa settlement is likely to further weigh on regional prices.