709 words / 3.5 minute reading time

- The May WASDE usually sets out early production forecasts for the domestic sugar crops in the US.

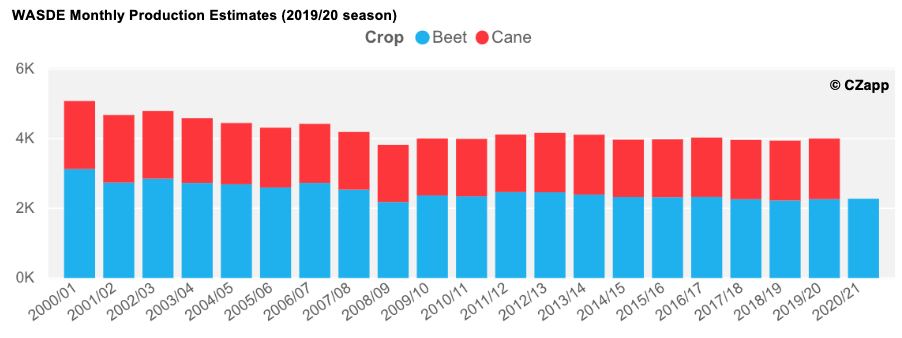

- We expect the early estimates this time to predict over 9m tons of production; this is a rebound of 1m short tons.

- However, before the market can return to ‘normality’, crops need seven months of good weather, so the risks remain.

You can track the US crop progress by state, using our USDA Dashboard.

Beet Production: Bouncing Back in 20/21?

- After the turbulent 2019/20 season, the US sugar industry might be hoping for a more straightforward 2020/21.

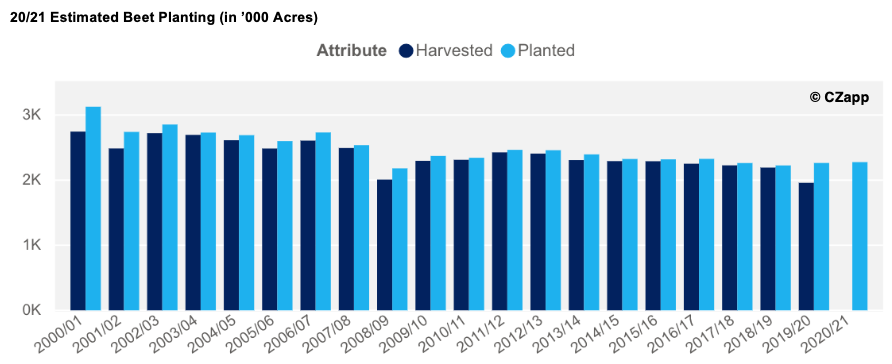

- The early estimates expect beet planting to increase by up to 20k acres year-on-year (YoY).

- The initial beet crop estimates expected the crop to reach a record high, until it hit harvesting troubles.

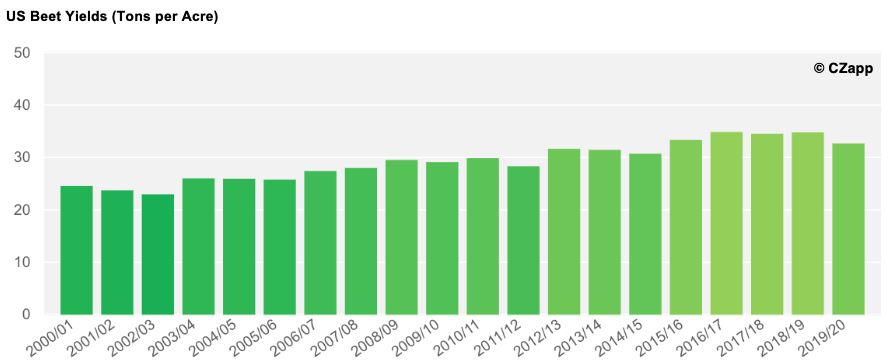

- Even though the beet area has decreased since 2000/01 by 27%, the sugar yields from beet have been steadily increasing.

- This is because yield progress has been continuous throughout this period.

- However, the majority of the work still needs to be done to ensure the beet crop is successful.

- Last season’s crop was first hit by flooding in May, and then freezing in October, leaving over 300k acres unharvested.

- The beet areas of the USA still need seven months of good weather, before we can deem the beet crop successful.

- Adverse weather warnings will have us on the edge until then…

- The biggest threats to the crop are delayed plantings, wet summers, and early freezes in the spring.

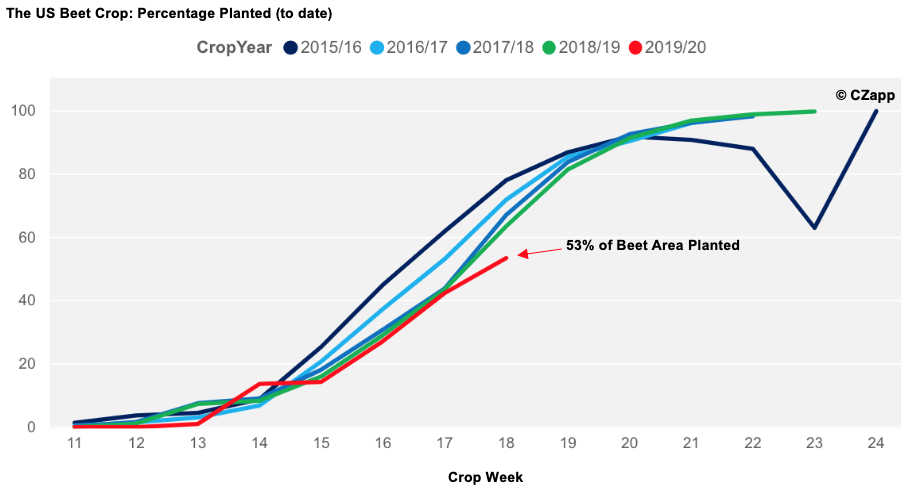

- So far, the overall plantings are slightly behind the five year average.

- The plantings can recover and finish by the end of May, but strong rains and unseasonal snows could stop this from happening.

- Delayed plantings mean the beet needs to remain in the ground further into November, which increases the risk of cold weather disruption during the harvest.

- The earlier the beet is planted, the earlier it can be harvested come autumn.

You can follow the weekly planting progress in the Production – Crop Speed section of the USDA Dashboard.

Cane Production: Rebound Expected

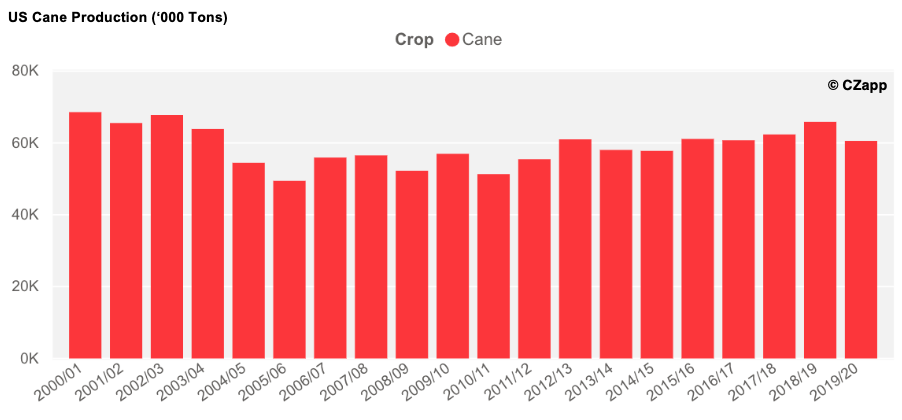

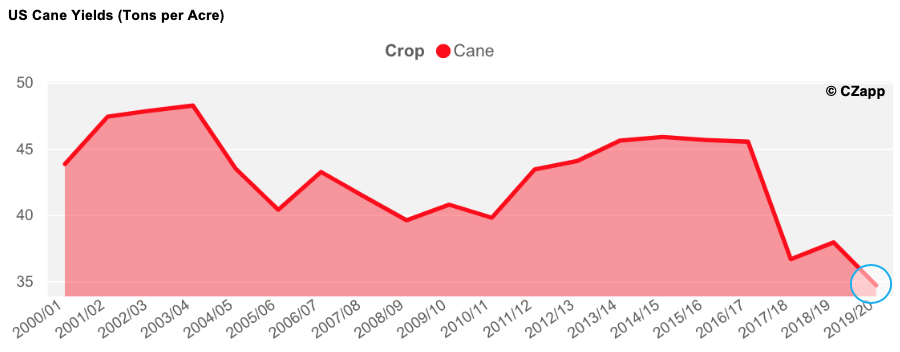

- The cane crop also suffered last season, but to a lesser extent than the beet crop.

- Total cane production fell by over 5m tonnes, due to the effects of frost in Louisiana in early November.

- Fortunately, cane usually recovers well in the long term from short-lived frosty conditions.

- We, therefore, believe this season should see a recovery in cane yields.

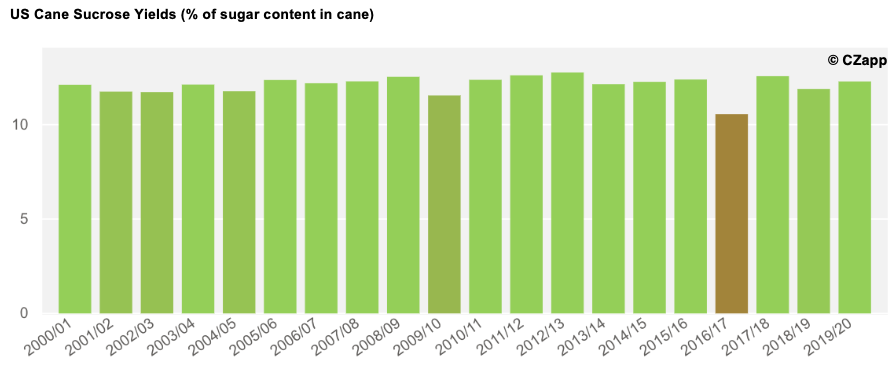

- The decline in cane production was partly offset by an increase in sucrose yields (ie. the % sugar content in cane).

- We expect the early estimates for the cane crop to predict around 4m tons of sugar.

- Projections should be optimistic for the crops this early in the season.

- For example, last season, the May WASDE estimated over 9m tons of sugar and revised this down throughout the season.

- Whilst, last year, we saw minor adjustments during the summer, the real downgrades in the crops occurred in November.

What Does This Mean For Imports?

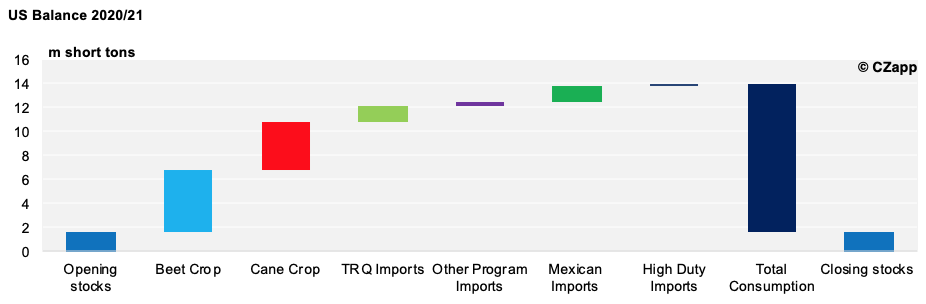

- The repercussions of a poor domestic crop are directly passed onto the import quotas.

- This season, we saw a dramatic fall in production balanced out by a significant increase of imports.

- If both crops perform as per these expectations, the Mexican quota will be revised to ensure the market is not oversupplied.

- The current estimate for the Mexican Quota stands at 1.36m short tons (1.2m tonnes).

- The above model expects consumption to remain constant YoY, as a result of coronavirus-related economic downturns.

- Any changes in the consumption estimates, both positive and negative, will have direct impacts on the Mexican quota.

- With normal performance, it is unlikely we will see any changes to the usual TRQ allocations, or any extraordinary white import quotas.

- But again, this is all depends on the weather not throwing any curveballs during the next eight month.