This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- The sugar beet harvest is coming to an end this week with strong results and unchanged pricing.

- There is speculation that high sucrose content could alleviate concerns over the condition of the Louisiana cane crop.

- Momentum is already building in the corn sweetener market ahead of Thanksgiving.

Strong Beet Production Takes Pressure Off Cane

The sugar beet harvest was complete in some areas and made strong progress in others in the week ended November 3. Spot and forward sugar prices were unchanged. Negotiations for 2024 corn sweetener contracts picked up noticeably after a quiet start.

Recent beet sugar offers for 2023-24 were unchanged in the range of 57 cents/lb to 59 cents/lb FOB Midwest. Spot refined cane sugar was offered at 68 cents/lb nationwide through December 31. Cane sugar was offered for calendar year 2024 at 63 cents/lb FOB Northeast and West Coast by one refiner. Offers were in the range of 59 cents/lb to 61 cents/lb FOB Gulf and Southeast, unchanged for the week.

Even with stronger-than-expected beet tonnage and in some cases higher-than-expected sucrose content, there was no indication of softness in beet or cane sugar prices. Price support came from concerns about the drought-reduced cane crop in Louisiana, and possibly more so from declining forecasts for Mexico’s cane crop, which many in the industry expect will be smaller than last year’s drought-reduced production.

One major beet cooperative in the Red River Valley (Minnesota-North Dakota) left 9% of its crop unharvested as full harvest would have exceeded beet processing capacity. Beet yields also were above expectations in Michigan with sugar content deemed to be about average. Other beet processors indicated good but not bumper crops, all of which will help to offset lower cane sugar production in Louisiana. Late harvest weather has been nearly ideal for sugar beets.

Hopes of High Sucrose Content to Save Louisiana Cane Crop

The sugar cane harvest in Louisiana continued to run about a week behind the average pace. The condition rating declined in the latest week after edging higher in the prior two weeks. It remains historically low at just 28% good. Indications of higher-than-expected sucrose content in harvested Louisiana cane may help offset drought-reduced cane yields to some degree.

Sellers continued to report a mixed pace in the delivery of contracted sugar. Some said the improved delivery of sugar in October continued into November. Others indicated deliveries continued slower than expected.

Inquiries about pricing refined sugar for 2024-25 continued, but few if any actual sales were indicated.

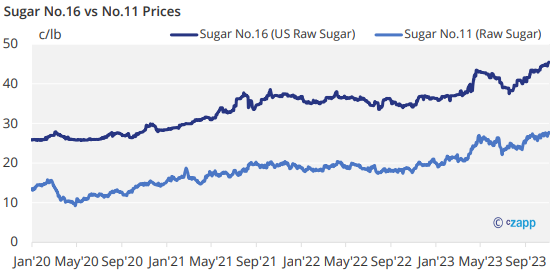

Domestic raw cane sugar futures (No. 16 contract) set fresh decade-plus highs on 2023-24 supply concerns.

There was noticeable movement in 2024 annual corn sweetener contracting with traders expecting momentum to build for targeted completion ahead of Thanksgiving to avoid carrying negotiations into the holiday period. Major refiners indicated they had booked some large volumes in late October, and more deals were on the table. With refiners seeking flat-to-higher prices and buyers seeking flat-to-lower prices, business appeared to be getting done in the middle at mostly flat levels compared to 2023 contracted prices, which were up sharply from 2022.