This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Sales in the bulk refined sugar market continued at a sluggish pace this week.

- Buyers are trying not to make the same mistake as last year of overbooking.

- With beet slicing set to continue into June, concerns remain over beet pile quality.

Bookings Slower Than Expected

Forward sales of bulk refined sugar continued in the week ended March 22 but at a slower-than-expected pace for some beet processors, especially compared with the robust activity seen in March 2023. Prices were unchanged but there was a mixed tone.

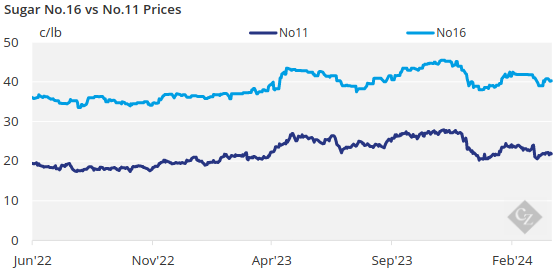

Bulk refined beet sugar for 2024-25 was offered at 53¢/lb to 55¢/lb FOB Midwest with variations above and below that range depending on volume. Bulk refined cane sugar for 2025 was offered at 60¢/lb FOB Northeast and West Coast and 56¢/lb to 58¢/lb FOB Southeast and Gulf. One seller noted more competitive pricing in the Southeast. Spot and forward sugar prices were raised 1¢/lb to 3¢/lb from a year ago due to active forward sales in March 2023.

Numerous pricing proposals and requests for prices were outstanding, with one processor indicating responses from buyers were slower than expected. Buyers appeared hesitant to book large volumes of sugar ahead of spring sugar beet planting, and with uncertainty about demand for their manufactured products in 2024-25.

Buyers were trying to avoid a repeat of the current year in which several food manufacturers overbought in 2023 (for 2024) and were not able to take all the sugar under contract, as reflected in slow deliveries to date.

All beet processors and cane refiners were in the market for 2025, with only one said to be approaching the point of withdrawing from the market in the next couple of weeks, depending on replies to outstanding pricing requests. Beet sugar prices typically firm as beet processors’ sales reach comfortable levels.

New Planting Imminent

Sugar beet planting was expected to begin in some areas near the end of March, weather permitting, with most pushing into April due to wet or cool conditions. Most sugar beet cooperatives expect growers’ full acreage allotments to be planted this year with competition from other crops varying by region.

For the current year, beet sugar was offered for 2024 steady at 55¢/lb to 58¢/lb FOB Midwest. Refined cane sugar for 2024 was offered steady at 62¢/lb FOB Northeast and West Coast and at 58¢/lb to 60¢/lb FOB Southeast and Gulf. One beet processor was withdrawn from the 2024 market, one was selling selectively, and others remained in the market.

Slicing campaigns for the 2023 sugar beet crop continued with one processor expected to be done by the end of March.

Same Issues Continue

Concerns persisted about the stability of outdoor beet piles, especially in Michigan and in the Red River Valley where warmer-than-normal winter weather has caused above-average levels of deterioration. The situation in the Red River Valley, the nation’s largest sugar beet region, was of special note because slicing operations are expected to run into early June due to the large 2023 beet crop.

Concerns also persisted about US imports of sugar from Mexico where the cane crop has been devastated by drought for a second consecutive year.

Corn sweetener markets were quiet.