Insight Focus

California prices peaked early then declined amid regulatory uncertainty. RGGI prices continue to forge ahead and set records all year. Meanwhile, the Washington state market is in limbo ahead of the November referendum.

US carbon prices have experienced mixed fortunes in the first half of 2024, as the two main markets anticipate ambitious reforms to the respective cap-and-trade systems. But while prices on the east coast RGGI market rose steadily to reach a record USD 25 in July, California prices hit an early peak before stabilising over the first six months of the year.

California Price Falls Amid Uncertainty

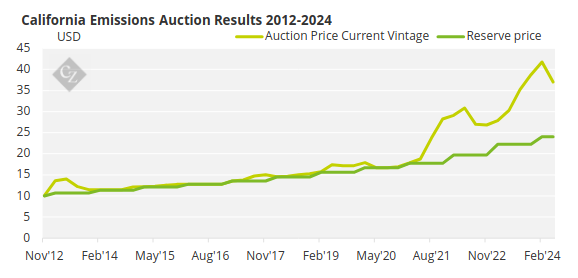

California carbon allowance (CCA) levels rose to USD 43.61/tonne early in the year as traders amassed positions for the new year and anticipated a strong Q1 auction. There was also some speculative buying as investment funds looked ahead to regulatory developments.

The California Air Resources Board (CARB), which regulates the cap-and-trade programme, has been working on changes to the market for the period 2025-2030, including a tighter cap on total emissions and potential changes to holding limits for participants.

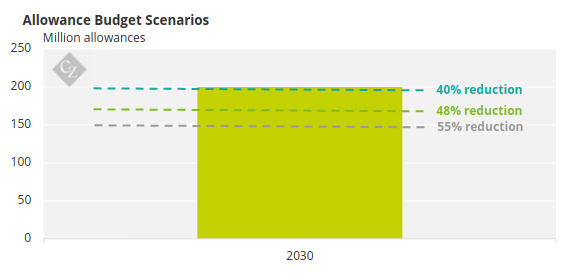

CARB staff have modelled the impact of a tightening of the cap from the current 30% to cuts of 40%, 48% or even 55% in emissions from 1990 levels by 2030. This is expected to leave the market short of allowances on an annual basis through 2030, gradually absorbing the current total surplus which is estimated at around 350 million tonnes.

Source: California Air Resources Board

The first CCA auction of the year in February cleared at a record USD 41.76/tonne, well above the reserve price of USD 17.72 and around 8% higher than the previous sale in November.

Source: California Air Resources Board

CCA prices fell to as low as USD 36/tonne in March, while the second auction of the year cleared at USD 37.02/tonne, as the market reflected a lack of certainty amid the ongoing reform process.

Nevertheless, a lack of clear progress in the rulemaking process eroded some of the bullish sentiment. While CARB has held several briefings for stakeholders on its discussion over the reforms, the most recent event revealed that regulators are now considering delaying the implementation of changes to the market cap by one year.

Stakeholders point out that while this will not change the eventual long-term target, it leaves the market in its current (longer) supply-demand balance for an additional year and is therefore bearish in the short term.

RGGI Market Continues to Rise

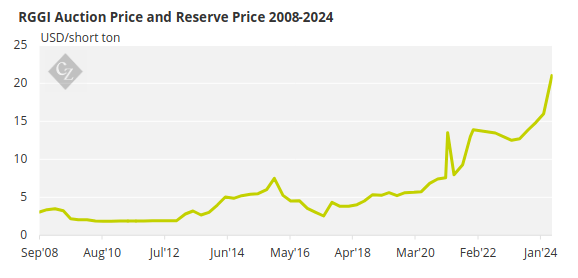

Meanwhile, on the east coast, the Regional Greenhouse Gas Initiative (RGGI) market began the year trading around a record USD 16.50/short ton and continued to rise, topping USD 17/short ton before the first auction of the year.

Source: RGGI

That sale cleared at USD 16/short ton, a record for RGGI auctions that also triggered the release of additional permits from the Cost Containment Reserve. The bullish sentiment and strong demand helped pushed the market to a new record of USD 20/short ton by early April, with traders pointing out that the CCR volumes were now exhausted for the year.

The market’s second auction in June extended the gains, with the sale setting a new record at USD 21.03/short ton and driving secondary market prices above USD 21/short ton for the first time.

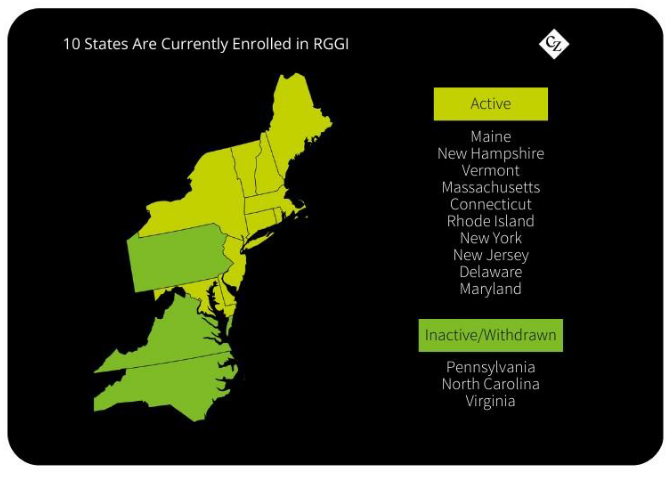

While regulators are busy with the northeastern market’s next reform, the process has been considerably quieter and less public than California’s. RGGI rules are agreed among representatives of the 10 member states and then implemented by each participating jurisdiction.

Stakeholders anticipate there will be a significant adjustment to the market’s cap, as well as a cut to auction supply to offset the existing surplus among participants, and this has contributed to an overall bullish sentiment.

RGGI prices have continued to set records, with the benchmark futures contract exceeding USD 25/short ton towards the end of July.

Opposition Drives Washington Price Down

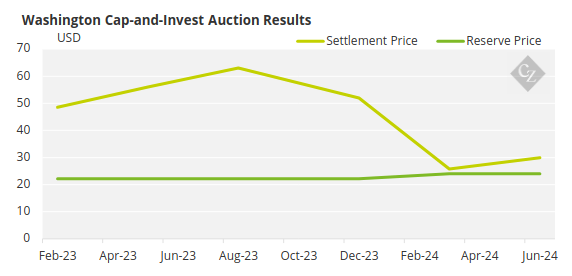

The third US market, Washington state’s cap-and-invest programme, has seen prices drop steeply this year as political opposition to the system crystallised. A state-wide referendum in November will ask for voters’ views on whether the carbon market should be discontinued, less than three years after it was launched.

Washington state allowances had traded at as high as USD 45/tonne but weakened sharply in the first quarter to around USD 33.50/tonne by February. The market has since remained in the mid-USD 30s/tonne as participants await the outcome of the November vote.

Source: Washington Department of Ecology

Despite the political uncertainty, state lawmakers in Washington have continued to press ahead with plans to develop the market further. The state Senate passed in February a bill that would align the system with California’s much larger market, raising the prospect of linking the two systems.

At the same time lawmakers in California and Quebec have also agreed to consider a market link with Washington.