Insight Focus

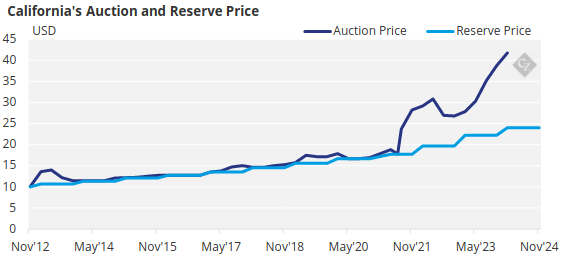

California’s carbon allowance prices reached record USD 41.76 in the February auction and traders are now waiting for further clarity on the adjusted cap. The RGGI market also at record levels amid the reform process.

Regulators Target Ambitious Emissions Targets

Carbon allowance prices in the two main US markets have both set record highs in 2024 as traders keep an eye on ongoing reform processes on both coasts that could slash the number of permits issued, with regulators targeting steeper reduction goals towards 2030.

California Carbon Allowances (CCA) reached a record USD 41.76/tonne in the first quarterly auction of the year in February, and secondary market prices have been trading at near the same level since then.

The strong auction outcome reflected speculation that the current program review may recommend a significant tightening of allowance supply as regulators work to bring the carbon market into line with the state’s 2045 net zero target.

California’s Air Resources Board, which administers the cap-and-trade programme, is believed to favour an emissions reduction target of 48% by 2030 as the most effective way towards net zero, compared to the current 2030 legislated goal of 40%.

Achieving this target would require a reduction in allowance supply of more than 260 million tonnes over the rest of the decade, compared with an annual cap of about 280 million tonnes in 2024.

The reduction in supply would be split between a drop in the number of permits made available through the Allowance Price Control Reserve (APCR), which injects additional allowances if auction bids reach certain threshold levels, and the general auction allocation to the market.

Analysts forecast CCA prices to average between USD 44-45/tonne in 2024. On Friday May 17 the December 2024 futures contract settled at USD 39.69/tonne on ICE Futures.

The steadily declining cap may also require state regulators to reduce holding limits for companies participating in the market. According to one analyst, this could trigger the sale of as many as 50 million CCAs as speculative and compliance traders trim their holdings to meet new rules.

RGGI Market Faces Changes

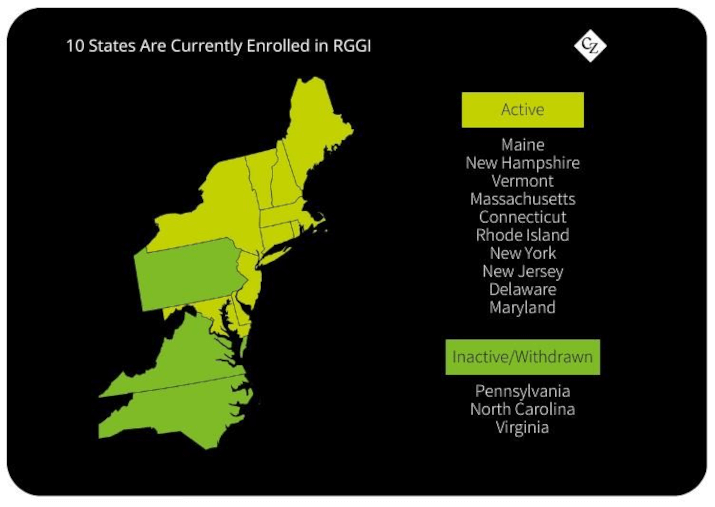

Across the country, the ten-state Regional Greenhouse Gas Initiative market is also grappling with reforms that could see a sizeable adjustment in the volume of permits sold at auction going forward as compliance entities and speculative traders hold a large tranche of unused allowances.

Previous adjustments to the RGGI market have featured so-called “bank adjustments” that cancel future supply to match the volume of unused permits circulating in the system. These adjustments are akin to the EU ETS’ market stability reserve, and they are carried out by reducing the number of permits to be sold in the following market phase.

For example, in 2014, RGGI member states made a reduction of 195 million allowances for the 2014-2020 period, and a further cut of 95.5 million for the 2021-2025 phase.

The secondary market has traded to a high of more than USD 22/short ton in recent weeks, far in excess of previous years. The first quarterly auction of 2024 saw strong demand, with both the main auction volume as well as the price containment reserve sold out at USD 16/ short ton.

Trading in RGGI has also reflected a more volatile political environment, as member states Virginia and Pennsylvania have withdrawn from the market amid a flurry of legal challenges and disputes in state capitals.

Virginia was admitted to the market in 2020, but in 2022 incoming governor Glenn Youngkin signed an executive order to withdraw from RGGI, and the state left the market at the start of this year.

The neighbouring state of Pennsylvania, one of the country’s top emitters, became a member of RGGI in 2022 but has not participated in the market while the future of its membership is challenged in court.

One other state, Washington, launched a carbon market in 2023 and has carried out several auctions already. Furthermore, there are efforts being made to link Washington’s new market with California’s cap-and-trade program, though these plans suffered a setback when opponents of the system succeeded in scheduling a referendum later this year on shutting down the Washington carbon market.

Secondary market prices in Washington’s trading have traded as high as USD 40/tonne, though interest has waned as traders wait for the outcome of this November’s referendum.