Insight Focus

President Trump’s new Executive Order seeks to halt sub-national carbon markets on both coasts. California has successfully resisted previous legal challenge. Allowance prices plunged as uncertainty hit market sentiment.

Trump EO Targets State Carbon Markets

President Donald Trump has launched a renewed effort to shut down state-level carbon markets in the US, claiming that these systems weaken the country’s national security and help to drive up energy costs across the country. In an executive order entitled “Protecting American Energy From State Overreach“, issued on April 8, the White House ordered the Attorney General of the US to “identify all State and local laws…burdening the …use of domestic energy resources that are or may be unconstitutional, pre-empted by Federal law, or otherwise unenforceable.”

The Attorney General was further instructed to “take all appropriate action to stop the enforcement of State laws” and to report on progress in 60 days.

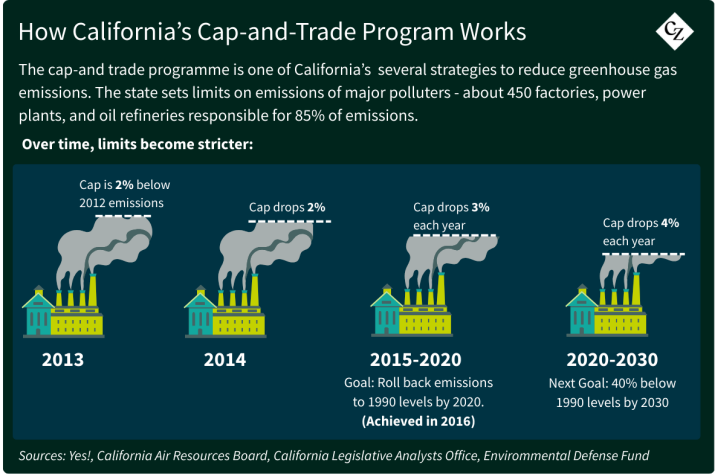

The Executive Order targeted California’s cap-and-trade program, asserting that the state “punishes carbon use by adopting impossible caps on the amount of carbon businesses may use, all but forcing businesses to pay large sums to ‘trade’ carbon credits to meet California’s radical requirements.”

The Order is one of several actions taken by President Trump seeking to roll back “all illegitimate impediments to the development, production, investment in, or use of domestic energy resources — particularly oil, natural gas, coal, hydropower, geothermal, biofuel, critical mineral and nuclear energy resources.”

President Trump has issued other Orders with a goal of boosting the country’s “reliable and affordable energy production”, including fossil fuels and in particular “clean coal”. He has also set up a National Energy Dominance Council, with a goal to “preserve and protect our most beautiful places, reduce our dependency on foreign imports, and grow our economy.”

Market Reacts Sharply to Executive Order

The initial market reaction in California to the Executive Order was dramatic. December 2025 California carbon futures prices dropped from USD 29.83/tonne on April 8 to a low of USD 22.50/tonne on April 9, in the wake of the White House announcement. That’s USD 3.37 below the reserve price for allowance auctions in 2025.

By last Friday, the market had bounced back slightly, ending the week at USD 26.72/tonne.

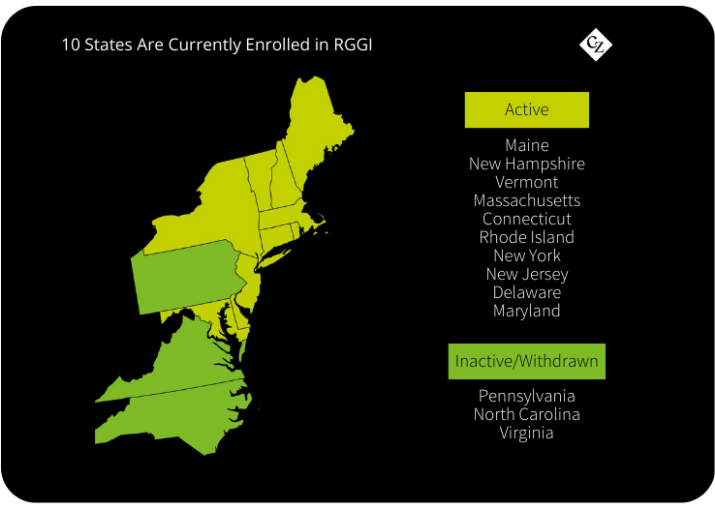

On the east coast, the RGGI price fell from USD 21.62/short ton (USD 23.83/tonne) to USD 18.62/short ton from April 8 to April 9, but extended its losses to end the week at USD17.61/short ton, as some observers predicted that the RGGI market, which covers 10 states, may be more vulnerable to federal action.

Trump’s Prior Battle Against California

This is not the first time President Trump has targeted California’s carbon market. In 2019, the Justice Department filed a lawsuit in a federal court seeking to stop California from implementing a 2013 agreement with the provincial government of Quebec, Canada, which aimed to harmonise their greenhouse gas reporting and cap-and-trade programs into one linked market.

This Justice Department case hinged on an interpretation of Article 1, Section 10 of the US Constitution that disallows states from entering into “any Treaty, Alliance, or Confederation,” and requires that they obtain the “consent of Congress” in order to “enter into any Agreement or Compact with…a foreign Power.”

However, as numerous experts have pointed out over the years, “states conclude many agreements with foreign governments and almost never seek congressional approval.”

The federal court eventually dismissed the suit in 2020, pointing out that the US “failed to identify ‘a clear and express foreign policy that directly conflicts’ with the cap-and-trade program.” And while it agreed that the linking pot cap-and-trade programs between California and Quebec did indeed extend beyond the traditional limits of state powers, “the US failed to show that the cap-and-trade program impermissibly intrudes on the federal government’s foreign affairs power.”

It’s not yet clear what argument the Attorney General may develop to justify the closure of state cap and-trade markets. The Executive Order requires that the AG find actions that “may be unconstitutional, pre-empted by Federal law, or otherwise unenforceable”, and a study by the University of Michigan in 2015 warned that Article I, Section 8, Clause 3 of the Constitution could represent a “formidable” potential challenge to cap-and-trade.

The so-called ‘Commerce Clause’ states that the US Congress shall have the power “to regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes,” but legal experts also note that this clause has become dormant as an expression of Congressional power, but has been used more to target state-level legislation that prevents inter-state commerce.

It is not just California’s market that is under attack from the latest Executive Order. The northeastern RGGI is also likely to be targeted, as is Washington state’s cap-and-invest market, while other state-level market-based systems exist in Colorado, Massachusetts and Oregon.