Insight Focus

- US Corn harvesting has started and is 5% complete same level as last year.

- In Brazil, Safrinha Corn is 93,1% harvested vs. 98,5% last year.

- The French government increased their production forecast to 11.5 million tonnes.

Forecast

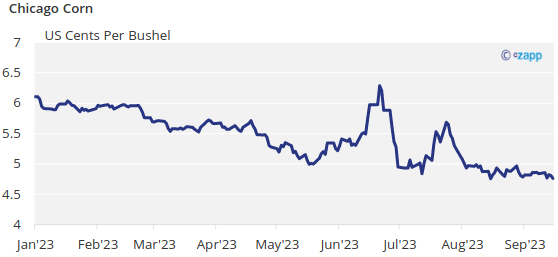

No changes to our Chicago Corn average price forecast for the 2022-2023 September-August crop in a range of USD 6 to USD 6.5 per bushel. The average price since 1 September is running at USD 6.23 per bushel.

Market Commentary

The September WASDE surprised publishing higher Corn acreage in the US and lower global Wheat production sending Corn and Wheat prices in opposite directions.

The September WASDE reduced ending stocks of the old Corn crop marginally by 5 million bushels all coming from higher imports of 5 million bushels, lower usage for Ethanol, and 50 million bushels of higher exports. New crop Corn saw stocks increasing by 19 million bushels taking stock to use to 15.4% vs. 15.3% before and vs. 10.6% of the old crop. The bulk of the higher stocks came from higher production in a combination of higher acreage more than offsetting a lower yield. It’s worth highlighting the USDA increased the relationship between planted and harvested acres to the highest since the 2015-2016 crop so we shouldn’t be surprised if we finally have lower harvested acres. Also, worth mentioning the yield of 173.8 bpa is very much in line with last crop’s yield of 173.3 which makes sense when comparing crop condition of both seasons.

World Corn stocks were increased by 3 million tonnes with higher US production (1 million tonnes higher) and other minor changes in other countries.

US Corn harvesting has started and is 5% complete same level as last year. Condition worsened 1 pt to 52% good or excellent vs. 53% last year. Corn area under drought increased by 5 points and is now 54%. French Corn is 82% in good or excellent condition up two pts week on week and vs. 44% last year. The French government increased their production forecast to 11.5 million tonnes vs. 11.2 before, immaterial to the market. Harvesting made no progress for a second week in a row staying at 1% of the expected planted area vs. 13% last year.

In Brazil, Safrinha Corn is 93,1% harvested vs. 98,5% last year.

In the Wheat front, the Sep WASDE left US ending stocks unchanged at 615 million bushels somehow expected given harvesting has virtually finished. But world Wheat ending stocks were reduced by a sizable 8 million tonnes vs. the August WASDE with production reduced in Argentina (1 million tonnes down), Australia (3 million tonnes down), Canada (1 million tonnes down) and the European Union (1 million tonnes down).

In Argentina, BCR reduced their Wheat crop forecast marginally by 600k ton to 15 million tonnes.

US spring Wheat is 87% harvested vs. 83% last year. The area of US Wheat under drought increased 12 points to 59%. Winter Wheat is now 7% planted vs. 9% last year but in par with the five-year average. Russian Wheat is 73.6% harvested.

In the weather front, some rains are expected in the US Midwest benefitting Wheat planting and rains above average are expected in the Corn Belt. Brazil is expected to receive rains and cold weather in the south, but the centre west is expected to remain dry. Europe is expected to be wet this week.

There was some progress in Ukraine with a first vessel fixed to load grains after Russia pulled out of the Black Sea corridor. We still need to see that everything runs smooth before seeing that trade flow is restored.

A small part of summer Wheat is pending to be harvested in the northern hemisphere so the focus turns to crop development of the southern hemisphere and Argentina, and Australia are suffering from dry weather and potential downgrades to their crops. This should help to see some support in the market offsetting some of the harvest pressure.

But on the Corn side, harvesting has started in the northern hemisphere and the new crop is big in the US and Europe, on top of Brazil which has almost finished harvesting. Is true we are coming from two consecutive years of low stocks, but the jump in production this year is substantial. We think we could see sub USD 4 per bushel prices in Chicago.

The September WASDE surprised publishing higher Corn acreage in the US and lower global Wheat production sending Corn and Wheat prices in opposite directions. Corn harvesting has started in the northern hemisphere and the new crop is big in the US and Europe, on top of Brazil which has almost finished harvesting. Is true we are coming from two consecutive years of low stocks, but the jump in production this year is substantial. We think we could see sub 4 USD/bu prices in Chicago. No changes to our average price forecast for Chicago Corn for the 22/23 (Sep/Aug) crop in a range 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,23 USD/bu.