Insight Focus

US corn fell as the March WASDE disappointed, and tariffs kicked in. Meanwhile, wheat had a positive week in both US and Europe. We expect volatility through the end of the month on the back of uncertainty around import tariffs, but the focus will turn to the USDA quarterly stock report and planting intentions at the end of March.

There are no changes to our forecast for Chicago corn for the 24/25 crop (September/August), which is expected to average USD 4.55/bushel.

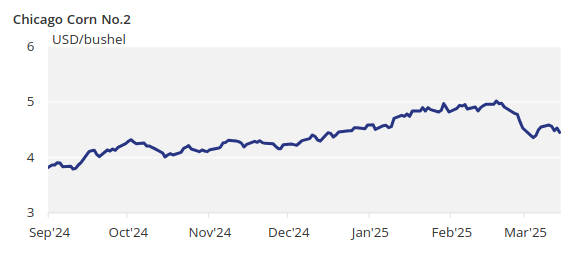

The average price since September 1 is running at USD 4.40/bushel. US corn prices fell as the March WASDE Report disappointed and tariffs kicked in, while European corn prices traded higher. Wheat saw a positive week in both regions.

Looking ahead, we expect continued volatility through the end of the month due to uncertainty surrounding import tariffs. However, attention will shift to the USDA’s quarterly stock report and planting intentions at the end of March, which will likely confirm corn acreage around 94 million acres but with lower quarterly stocks. We also anticipate that lower Argentine production will be recognized sooner or later. Overall, there is flat to upside risk, but volatility is expected.

Corn Drops Following March WASDE

Chicago corn rallied before the WASDE publication last Tuesday and consolidated its gains. However, it dropped on Wednesday as the market widely expected a reduction in the US corn carry and as the trade war escalated with Canada and the EU. The EU imposed retaliatory measures targeting US agricultural goods, although the details are still undefined.

Chinese tariffs on US goods, including agricultural products, also went into effect last week, although they were announced the previous week. Additionally, US corn inspections exceeded expectations last Monday, contributing to the early-week rally.

The March WASDE report left US corn supply and demand unchanged, not recognising the higher ethanol usage and exports we had anticipated.

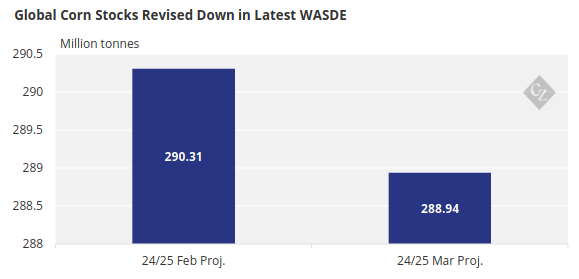

Global stocks were reduced by 1.4 million tonnes, with lower production in Russia (-0.75 million tonnes), and higher production in South Africa (+1 million tonnes) and Ukraine (+0.3 million tonnes). Production estimates for Argentina and Brazil were left unchanged.

Source: USDA

In Brazil, Safrinha planting is 83.1% complete, compared to 86.2% last year. The summer corn harvest is 34.5% complete, up from 25.3% last year. CONAB slightly increased its production forecast to 122.7 million tonnes, up from 122 million tonnes previously.

In Argentina, corn harvesting is 8.1% complete, compared to 3% last year. BCR lowered its estimate to 44.5 million tonnnes, down 1.5 million tonnes from its previous forecast. This is in contrast to BAGE’s estimate of 49 million tonnes and the March WASDE’s estimate of 50 million tonnes.

WASDE Increases Global Wheat Stocks

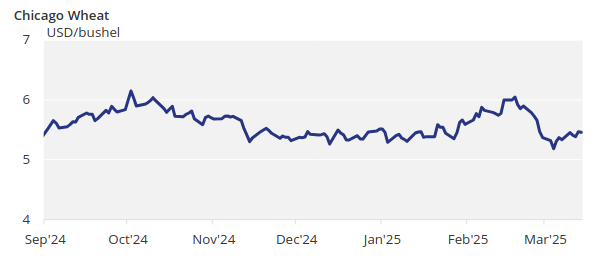

On the wheat front, the WASDE report disappointed, as the market had expected flat US ending stocks and lower world stocks. US wheat inspections were much lower than expected, contributing to a negative start to last week.

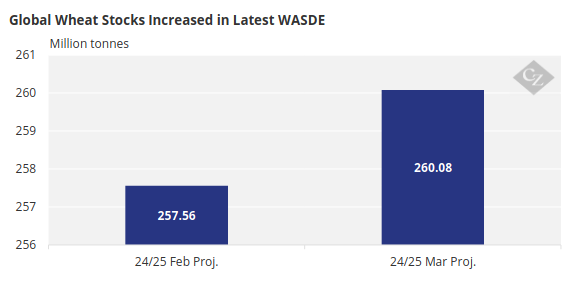

The March WASDE report increased US ending stocks by 25 million bushels, all coming from 10 million bushels of higher imports and 15 million bushels of reduced exports. The USDA also increased global stocks by 2.5 million tonnes, with most of it coming from 2 million tonnes of higher initial stocks. Argentina’s production forecast was raised by 0.8 million tonnes, Australia’s by 2.1 million tonnes, and Ukraine’s by 0.5 million tonnes.

Source: USDA

Coceral projected EU+UK wheat production at 137.2 million tonnes in 2025, up from 125.1 million tonnes in 2024, but down from its previous estimate of 140.4 million tonnes.

French wheat conditions are 74% rated good or excellent, unchanged from the previous week, and up from 66% last year.

Dry conditions in US wheat-growing areas are starting to raise concerns. Heat in Brazil is also a worry, though rains are expected this week, including in Argentina. Europe is expected to experience wet and warm conditions, benefiting soil moisture, while the Black Sea region will remain dry and warmer than average, accelerating snowmelt.