This update is from Sosland Publishing Co.’s weekly Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- If realised, the USA could make the 2nd highest amount of sugar on record this year.

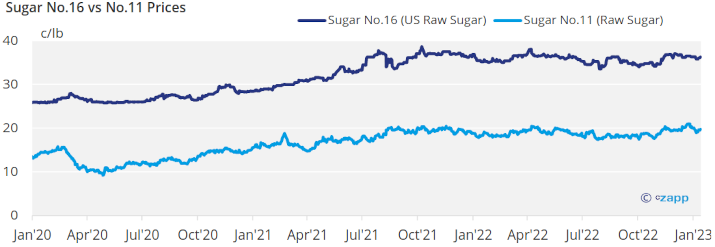

- Nevertheless, cash sugar prices were unchanged in the last week.

- Deliveries of beet sugar have been steady so far in January.

Sugar market activity was in its winter lull during the week ended Jan. 13, but the US Department of Agriculture provided a spark in the Jan. 12 World Agricultural Supply and Demand Estimates report with a forecast of higher 2022-23 US sugar production. Cash sugar prices were unchanged.

The USDA raised from December its forecast for 2022-23 US sugar production, slightly lowered imports and left deliveries unchanged, resulting in a jump in the ending stocks-to-use ratio to 14.9% from 13.5% as the prior forecast.

Sugar production in 2022-23 was forecast at 9,248,000 short tons, raw value, the second highest on record if realized, including beet sugar at 5,048,318 tons, up 2.5% from December, and cane sugar at a record 4,199,000 tons, up 2.1%. Louisiana cane sugar production was raised 88,216 tons, or 4.3%, from December, putting to rest concerns about damage from a late-December freeze.

US sugar imports were forecast at 3,458,000 tons in 2022-23, down 35,480 tons from December as higher high-tier imports only partially offset lower tariff-rate quota imports.

Cane sugar was offered by one refiner at 62¢ a lb f.o.b. at all locations for spot sale. Cane refiners were either sold out or were highly sold. Beet sugar prices for 2022-23 were nominally at 59¢ to 60¢ a lb f.o.b. Midwest with processors offering small amounts if available. Supplies mainly were available from distributors.

Sales for 2023-24 were ongoing at a slow pace. Recent offers for 2023-24 were unchanged at 51¢ a lb f.o.b.

Midwest for beet sugar and 52.50¢ a lb f.o.b. Southeast for cane sugar. It was noted that large buyers could find sugar under those levels, especially for beet sugar. Traders indicated that much of the October-December 2023 business has been completed. Buyers still were hoping for price weakness before adding coverage for January-September 2024 or for calendar 2024. Also, some sellers still were not aggressively seeking 2023-24 business.

It should be noted that most sugar contracted for the 2022-23 marketing year (through Sept. 30) was only modestly up from the prior year and was well below spot prices. The high spot prices were paid by either users who were slow to complete coverage or who had needs above expectations for a relatively small volume of sugar. Thus, the 2023-24 offers are well above where most sugar was sold in 2022-23 and delivered more “sticker shock” to buyers than may be expected.

Deliveries of contracted beet sugar were steady so far in January, termed “decent” by one processor but not stronger than expected. That’s not unusual for early winter, but it also is something to monitor going forward.

The trade continued to monitor the sugar cane harvest in Mexico, where production through December was down “at least 15%” from the prior nine-year pace, the USDA said.

Corn sweetener business mostly was routine with some buyers still seeking supplies for 2023.