Insight Focus

The US has blacklisted Chinese shipping giant COSCO over alleged military ties. While not imposing direct penalties, this move may reshape global shipping, benefiting European rivals and driving supply chain diversification. It marks a new front in the US-China trade war under President Trump.

Chinese shipping giant COSCO has been added to a US Department of Defense blacklist, along with several other Chinese shipping companies, over alleged ties to the People’s Liberation Army (PLA).

While this Pentagon list does not impose direct penalties or restrict these companies’ operations in global trade, it could certainly discourage US businesses from engaging with them, as Washington classifies them as military-linked entities.

More significantly, this move signals a clear intent by the US government to target China’s shipping industry, creating obstacles and limiting its expanding influence in global maritime trade.

Other major Chinese firms in the shipping sector named on the blacklist include:

- China State Shipbuilding Corp (CSSC): The country’s largest shipbuilder.

- China National Offshore Oil Corporation (CNOOC): A leading offshore oil explorer.

- China International Marine Containers (CIMC): The world’s largest container manufacturer.

- China Communications Construction Group: A major global port builder.

- Sinotrans & CSC Holdings: One of China’s largest shipowners.

This move is the latest in a series of US actions targeting COSCO. In 2019, Washington briefly sanctioned the company’s tankers for transporting Iranian oil, triggering a spike in Very Large Crude Carrier (VLCC) rates to USD 200,000/day.

Strategic and Economic Implications

1. Military Logistics and Global Port Expansion

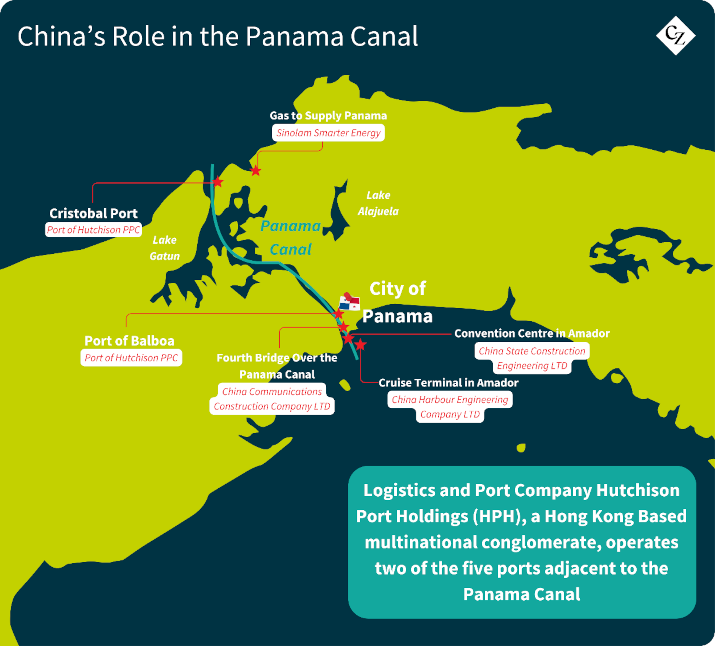

COSCO’s ties to the Chinese military raise concerns about its potential use for military logistics, particularly in scenarios involving Taiwan or regional disputes. Its expanding global port network could also become a focal point for geopolitical scrutiny, especially if China uses port control to influence maritime security and shipping routes.

2. Shifts in the Shipping Market

US firms may seek alternatives to COSCO and other blacklisted Chinese shipping companies, benefiting COSCO’s European rivals such as MSC, Maersk, CMA CGM or Hapag-Lloyd. This could lead to a realignment of global market shares, with non-blacklisted firms gaining a stronger foothold in US trade.

3. Diversification of Supply Chains

The US is ramping up trade tensions with China, pushing for a reduction in dependence on Chinese shipping and port operations. This could accelerate supply chain diversification efforts, prompting companies to explore alternative shipping routes and domestic logistics solutions.

4. Red Sea Operations and Competitive Advantage

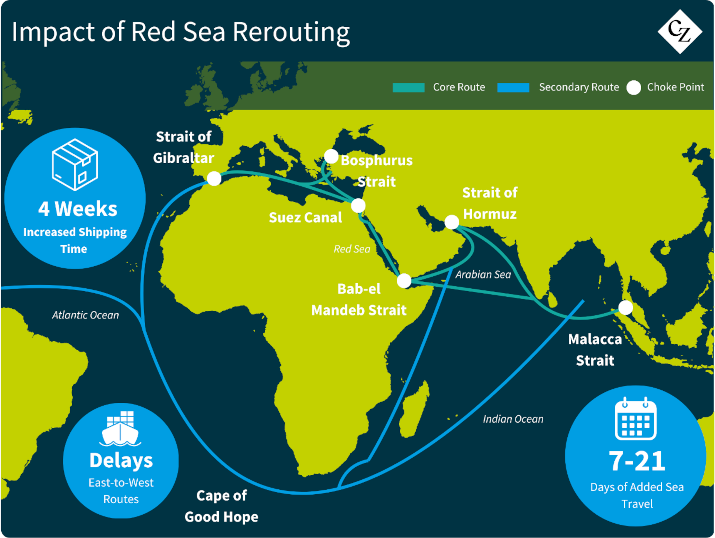

Reports of a possible China-Houthi partnership introduce additional complexity. If COSCO can maintain safe passage through the Red Sea, it would gain a competitive edge by avoiding costly reroutes via the Cape of Good Hope. Faster transit times and lower fuel costs could make COSCO a preferred carrier for Asia-Europe-Africa trade, putting pressure on competitors forced to take longer, more expensive routes.

However, the recent ceasefire between Hamas and Israel could shift dynamics in the region, potentially restoring normal operations in the Red Sea faster than initially expected.

US Aims to Limit China’s Trade Dominance

As trade tensions escalate, Washington is sending a clear message: it aims to reduce reliance on Chinese maritime logistics, particularly in key regions like Europe, Africa and the Americas. The latest developments suggest that a new front in the US-China trade war may be emerging—one that is playing out on the world’s oceans.

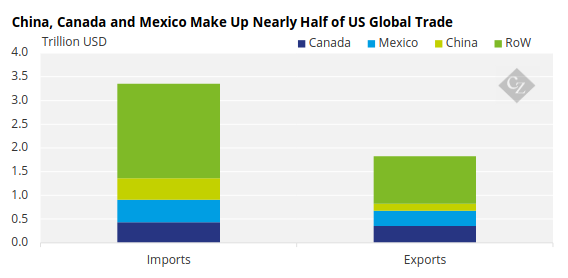

It is widely known that the new US President, Donald Trump, is determined to impose heavy tariffs on Chinese imports in an effort to curb the country’s trade dominance.

Source: UN Comtrade

More broadly, the Trump administration’s push to reduce China’s influence in the global shipping sector is becoming increasingly evident. From new tariffs and power plays over control of the Panama Canal to the blacklisting of major Chinese maritime companies, these actions suggest a growing trend—one that could escalate further in the coming months of Trump’s presidency.