Insight Focus

- High vegoil prices hit European fat-filled milk powder margins.

- Lower milk supply boosts New Zealand dairy returns.

- US logistics woes hamper some milk powder exports.

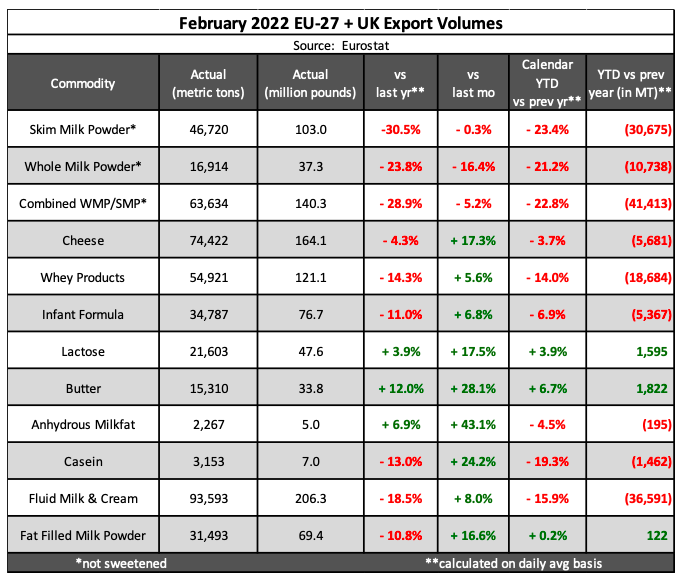

EU27 + UK

Skim milk powder (SMP) exports remained weaker into February, down 20.53k tonnes on the year with losses spread across multiple key regions, such as China (5.82k tonnes, -1.13k tonnes YoY), Algeria (5.32k tonnes, -2.36k tonnes YoY), the Philippines (1.97k tonnes, -2.62k tonnes YoY) and Nigeria (1.62k tonnes, -2.36k tonnes YoY). February SMP exports were the lowest since November 2016, but production is improving within Poland, France and the Netherlands, creating additional pressure on EU SMP prices.

Even fat-filled milk powders (FFMP) fell – a trend that likely continued into this month with the price of edible oils so high as supplies tighten due to Russia’s invasion of Ukraine. Given that Africa is the primary destination market for FFMP, exports dropped the most into that part of world, most notably into Nigeria (-3.59k tonnes YoY to 3.59k tonnes). Volume also struggled into Iraq and the United Arab Emirates. Expensive edible oil prices will dig into FFMP margins, a product that’s meant to be an affordable alternative to instant whole milk power (WMP).

Finished goods like butter and cheese fared well considering weaker milk collections and reports of light inventories. Butter shipments increased into the US to reach 2,57k tonnes, up 47% on the year, with other notable gains into South Korea (1.21k tonnes, +672 tonnes YoY) and Indonesia (1.01k tonnes, +806 tonnes YoY).

Cheese shipments also increased into the number one destination, the US (9.37k tonnes, +741 tonnes YoY), but struggled into Japan (6.52k tonnes, -2.26k tonnes) as the country looks inward and attempts to support its domestic dairy industry.

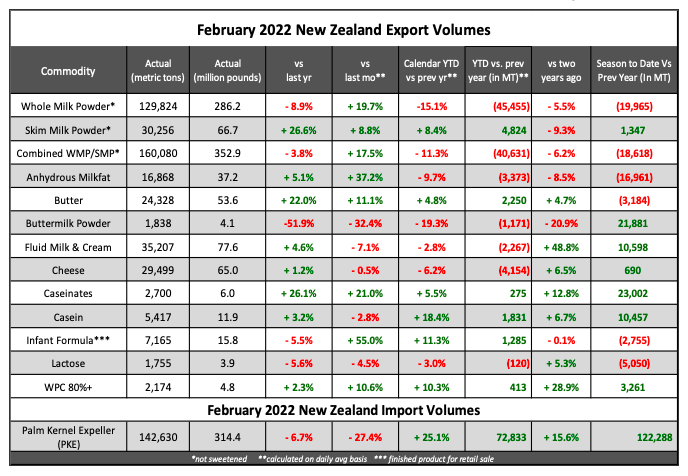

New Zealand

Dwindling milk supplies, not only on a seasonal level but due to unfavorable weather conditions, meant milk was moved into commodities that provided the best return.

Record fat prices meant more butter/SMP, which was evident within these export figures. Butter/SMP returns have outpaced WMP since August, so once WMP contracts were fulfilled, excess milk flowed elsewhere.

As New Zealand attempts to capture better margins with fewer cows, there will continue to be a transition toward premium ingredients once contracted commodity needs are met. Also, given COVID-induced challenges, there’s a shortage of staff across the food sector that may limit dairy product production.

China was outbidding the rest of the world this time last year, which left a growth opportunity for many other key export destinations in 2022. As a result, shipments were stronger into Middle East-North Africa (MENA) and Southeast Asia (SEA). Gains into SEA and MENA almost offset China’s lower volumes entirely.

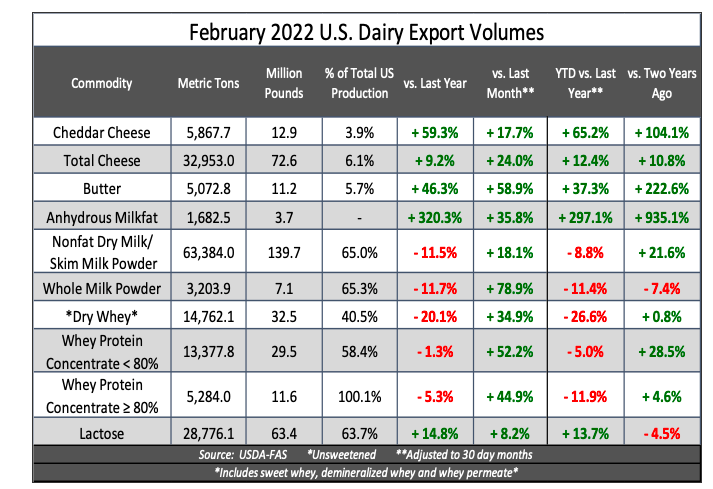

United States

February exports were the strongest on record for the month, with the volume robust enough to overcome January’s slightly weaker shipments to drive a record start to the calendar year.

The significant volume leaving US shores was impressive considering persistent logistical and shipping challenges that have shown little improvement in recent weeks as supply chains remain tangled around the globe. However, these challenges have likely impacted certain ports more than others, with the most difficulty persisting in California and negatively impacting the ability of nonfat dry milk (NFDM)/SMP to flow to overseas buyers.

Where challenges emerged in nonfat dry milk and across the whey complex, impressive cheese and butter shipments were enough to compensate and drive exports to the February record. Looking ahead, record exports during several months in 2021 will prove to be a formidable challenge to overcome this year. However, a significant volume of products will continue to leave the US, even if the sum is slightly weaker versus the prior year record.

Cheaper values for nearly all dairy products versus those in the EU or New Zealand will continue to push foreign buyers to turn to the US to secure needs, keeping shipments elevated and prices supported. China’s weaker demand has been driven by a slowdown in whey needs as China’s pig farmers, suffering record losses due to surging feed costs and weak hog demand, are switching to lower quality grain.

For additional dairy market analysis, request a free trial at highgrounddairy.com/free-trial

Other Insights That May Be of Interest…

Brazil and USA to Boost Fertiliser Output on Russian Invasion

Will Mexico Become a Regular World Market Sugar Exporter?

Explainers That May Be of Interest…