Insight Focus

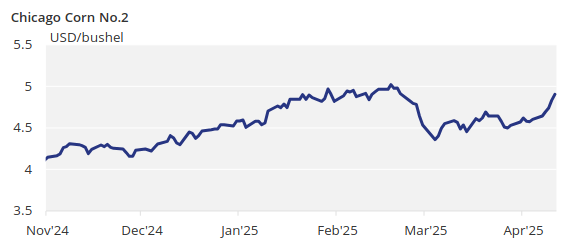

Grains rallied in the US after a bullish WASDE for corn. The market focus has shifted to fundamentals amid the trade war pause. There is no change to our forecast for Chicago corn for the 2024/25 crop, which averages USD 4.55/bushel, with some downside risk depending on the trade war.

Grains rallied in the US following a bullish WASDE for corn, while European futures had a negative week on a stronger dollar and good corn planting pace in France. With the 90-day pause in the trade war, the market will turn its focus to pure fundamentals. Rains in the Corn Belt could delay the planting pace of US corn, but as planting has just started, any delay is still likely to be recovered in the coming weeks.

We may see some correction after last week’s rally, but with tighter corn stocks and continued potential for higher ethanol demand, the market should remain well supported.

Corn Rallies on Tariff Pause

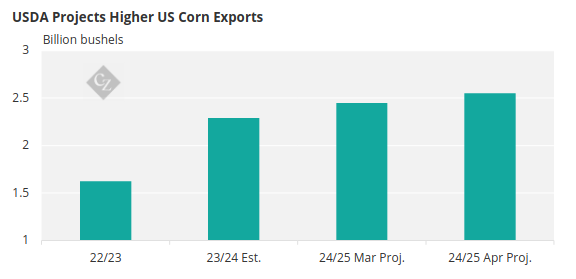

The market rallied by midweek after US President Trump announced a 90-day pause in the imposition of higher-rate tariffs, with the only exception being China. In the April WASDE last Thursday, higher exports were finally reflected, resulting in lower stocks, and the market rallied until Friday’s close.

The April WASDE reduced US corn carry by 75 million bushels to 1.465 billion bushels. This compared with previous estimates of 1.54 million bushels, with a combination of 100 million bushels of higher exports and 25 million bushels of lower demand for feed and residual. With this change, the stock-to-use ratio falls from 10.2% to 9.6%.

On the international front, global ending stocks were reduced by 1.29 million tonnes thanks to higher demand, despite a 1.3-million-tonne increase in EU production. Production in Brazil and Argentina was left unchanged.

The first crop progress report of the year was released showing French corn is 15% planted, well above the 3% planted last year and the five-year average of 7%.

In Brazil, Safrinha planting was 99.1% complete, on par with last year. The summer corn harvest was 59.2% complete, just ahead of last year. In Argentina, corn harvesting is 23.1% complete, over 8 percentage points ahead of last year. BAGE maintained its corn production forecast at 49 million tonnes.

The WASDE has finally reflected higher corn exports—something we had expected a couple of months ago, but the USDA was waiting for the right moment. Although it left corn for ethanol usage unchanged, we think there is also room for an additional 100 million bushels of corn usage. Ethanol production is running about 4% above last year, while the USDA is only increasing corn demand for ethanol by 0.4%.

Source: USDA

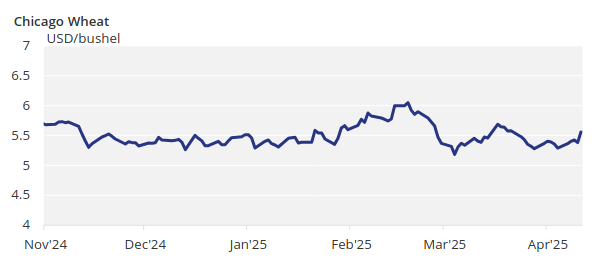

Wheat Market Gains Despite Bearish WASDE

The wheat market rallied despite a bearish WASDE. A weaker dollar, weather worries and the rally in corn all overshadowed this. US wheat started the week rallying on beliefs that the heavy rains last week may have damaged the crop.

The US wheat condition was 48% good or excellent in the first crop report—much lower than the 56% of last year. But even with a low number compared to last year, it was much better than the 39% the market was expecting.

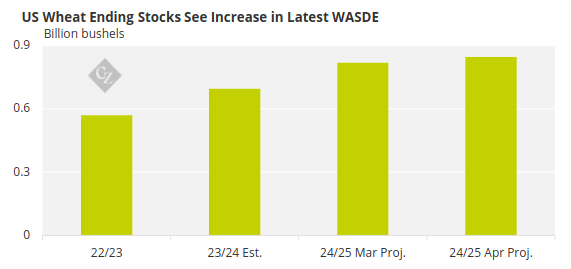

The April WASDE increased US wheat ending stocks by 27 million bushels to 846 million bushels due to 10 million bushels of higher imports, 15 million bushels of lower exports and 2 million bushels of lower demand for seed. Global ending stocks were left unchanged, with some marginal changes to production figures.

Source: USDA

The French wheat condition is 75% good or excellent, down one point from last week and significantly lower than the 64% reported last year.

The US is expected to experience dry weather across the Plains, with wheat yields at risk, but the Corn Belt is expected to receive good rains. Both Brazil and Argentina are expected to have beneficial weather, including some rain. Western Europe is expected to remain dry, while rains are forecast in the Black Sea region.