651 words / 4 minute reading time

- There may not be enough sugar in the US to meet demand after the beet crop failure.

- Imports are arriving quickly, but most of the sugar is raw and needs to be refined; this takes time.

- The US Department of Agriculture (USDA) needs to find a solution.

Are Enough Imports Coming In?

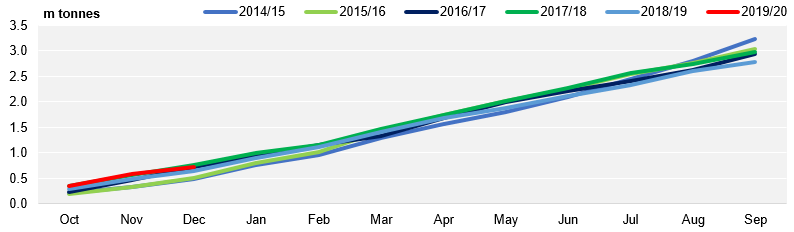

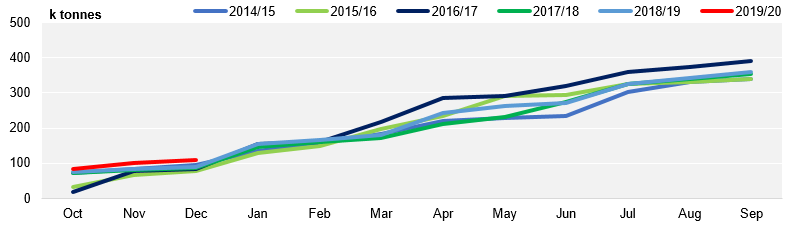

- The overall import rate into the US has got off to the fastest start since the 2014/15 season.

- This speed indicates just how stretched the whites supplies are in the US.

Total Imports Into the USA

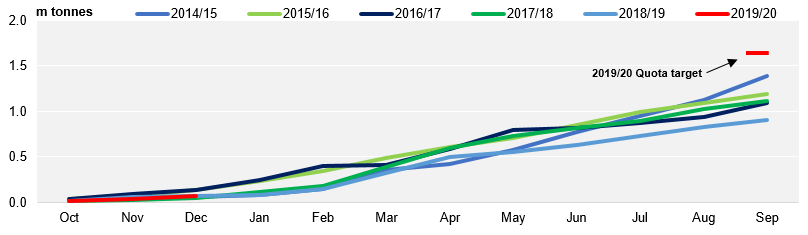

- Most of the imports come from Tariff Rate Quotas (TRQs). These are quotas allocated to various countries by the US Government, which ensure a sufficient amount of raw sugar gets shipped into the US.

- TRQs account for 1.1m tonnes raw value of the 3.5m tonnes imported into the US.

- Note: This is only the projected total, as we are yet unsure whether the US Government will allocate any more at a later point.

- TRQ’s are by far the most significant form of getting imports into the country, along with what Mexico can offer.

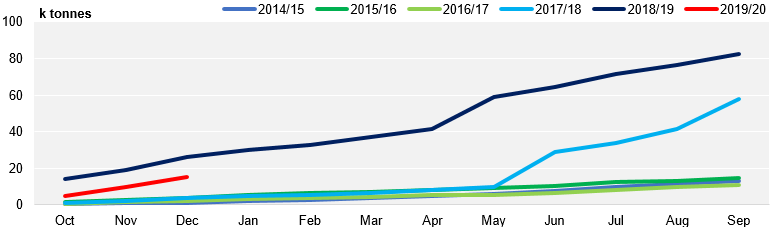

TRQ Fill Rate

- However, TRQ’s only allow for raw sugar imports, which need to be processed by refineries before they can be used in the domestic market.

- This means the market is still reliant on the refineries to supply sugar, and they will struggle to import it due to the limited domestic refining capacity.

- With these limitations considered, the USDA turns to Mexico for their short term supply of white sugar.

- This was especially clear last month when they allowed for 100k tonnes of the quota volume to be allocated to refined sugar rather than raws…

Can Mexico Really Cover the Whites Shortfall?

- Aside from the worries about Mexico being able to fill their 1.6m tonnes quota allocation, the short-term whites supply is also unstable.

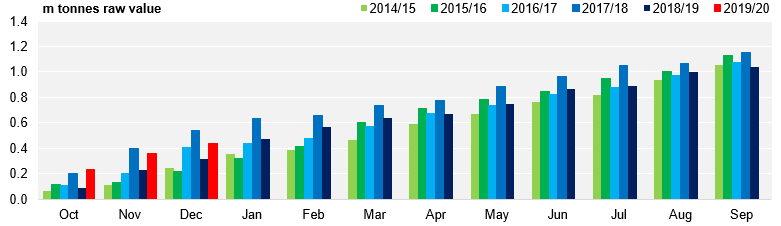

- As expected, the Mexican crop started late and this had a knock-on effect on the export pace.

- Mexico has only shipped 70k tonnes to the USA to date; the five year average for this period is 89k tonnes.

Mexican Exports to the USA

- There is plenty of time for the Mexican export rate to recover, however, and they could fill their total quota by the summer of 2020.

- However, in the short term, the Mexican industry is restricted in how much of the quota it can fill before March 2020.

- There is no indication that Mexico is pushing for early refined sugar production (the sugar type the US is lacking) and so far, Mexico has only shipped 9.3k tonnes of refined sugar to the US.

So, What Other Options Are There?

- The US quota system allows for white sugar imports via white sugar quotas as well as “Tier 2” (full duty paid) sugar.

- The white sugar quotas have been filling quickly but do not represent a very significant volume overall.

CAFTA and Refined TRQ Fill Rate

- So far, 109k tonnes have entered the country as part of the white sugar quotas, compared to 88k tonnes last year.

- The beet crop shortfall represents a supply drop of 600k tonnes, meaning a short-term increase of 21k tonnes is not enough.

- Tier 2 imports have also been expected by the market to cover the deficit.

Tier 2 Import Rate

- US consumers are likely to be reliant on more Tier 2 sugars than usual, but the rally in the world market makes this expensive.

- This means that even though the USDA have done enough to ensure their year-end stocks are sufficient, short term supply may remain an issue.

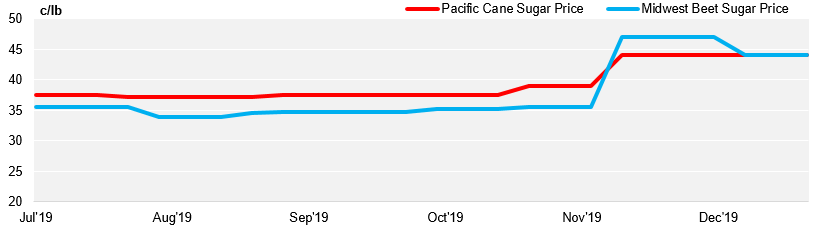

- The domestic prices, that are usually steady, have flared as a result of the beet crisis and they may not normalise just yet.

US Domestic Refined Sugar Price