- The US Dept of Agriculture expects American sugar stocks remain high for 2020/21.

- The USDA increased the Mexican quota by 50kmt to offset worries of a TRQ shortfall.

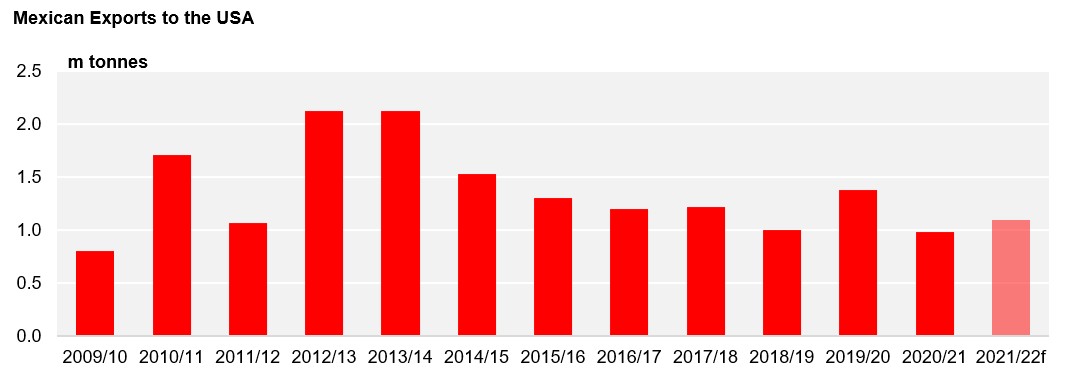

- The US sugar market should be balanced in 2021/22 with a Mexican quota forecast at 1.1m short tons.

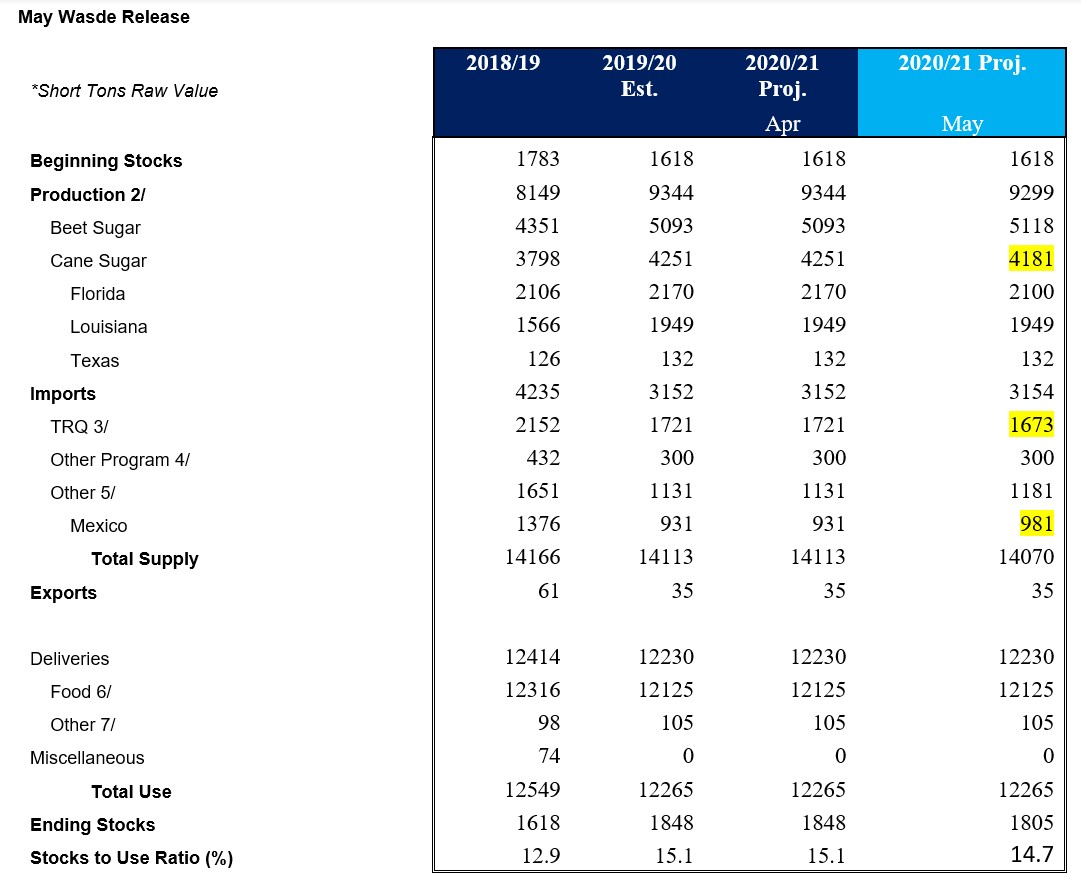

The May WASDE Release

- The 2020/21 WASDE has increased the quota allocation received by Mexico by 50kmt.

- This is to counteract the expected TRQ raw sugar import shortfall from the April forecast.

- We had wondered if TRQs might be reallocated to other quota holders, but this was not the case.

- This could help relieve some of the pressure on the No.16 futures market that has been trading at high levels recently.

- Mexican producers are sure to maximise their US allocation as they look to reduce their world market sales this year.

- Therefore, this should see more sellers hedging the No.16 contract (US delivered futures contract).

- Supply dynamics show no sign of being affected by the fire at the Baltimore refinery last month, as we reported earlier.

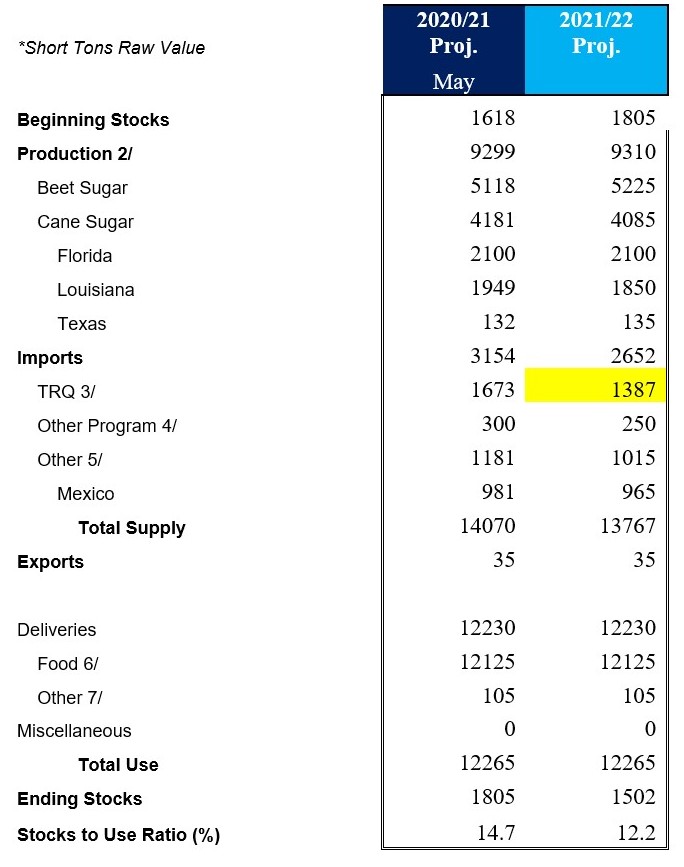

2021/22 WASDE Outlook

- The May release is also the first look forward to the next season.

2021/22 WASDE estimate

- The USDA expects a normal production year next season, with a strong beet crop and slightly reduce cane yields.

- The need for imports will reduce, and raws sugar quota (TRQ) will return to normal levels.

- They had been increased in 2019/20 and 2020/21 as a result of the disastrous beet crop in 2019.

- The impact of that crop shortfall looks to finally be over.

- At current estimates, Mexico will likely receive 1.1m short tons of access to the US market next season.

Other Opinions You Might Be Interested In…

Other Interactive Data You Might Be Interested In…