This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Beet sugar deliveries in the US were sluggish as supplies remained high.

- USDA revises Mexican sugar production down.

- Record high imports by US refiners show there is still appetite for raw sugar.

Futures Market Firms

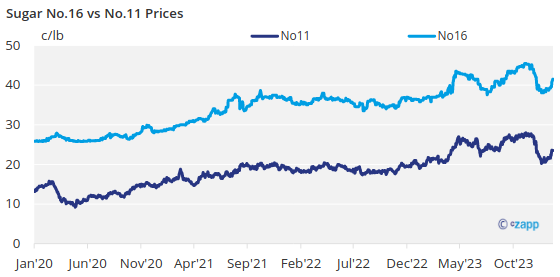

Spot and forward sales of bulk refined sugar were slow in the week ended January 19, and prices were unchanged. Beet sugar supplies were forecast record high, and deliveries of contracted beet sugar were slow, casting a soft tone over the market. Raw sugar futures firmed from recent lows.

1111

1111

Beet sugar for 2024 was offered mostly at 55¢/lb to 58¢/lb FOB Midwest, unchanged from a week earlier. Most processors have spot sugar to sell, and sales are occurring within the quoted range even as some other users have been slow to take their contracted supplies. Bulk refined cane sugar for 2024 was offered at 62¢/lb FOB Northeast and West Coast, and at 58¢/lb to 60¢/lb FOB Southeast and Gulf, also unchanged.

Beet sugar sales for 2024-25 and calendar 2025 were ongoing at a slow pace. One beet processor noted a large sale in the low- to mid-50¢/lb range, unchanged. Refined cane sugar was offered for calendar 2025 at 60¢/lb FOB Northeast and West Coast and at 58¢/lb FOB Gulf and Southeast. Inquiries from buyers have picked up since January 1, but most buyers appear willing to wait until after the International Sweetener Colloquium in late February before contracting.

Production Estimates May Overshoot

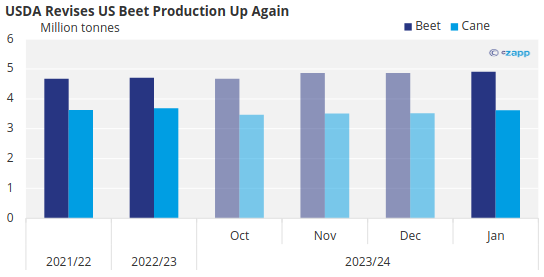

The US Department of Agriculture in its January World Agricultural Supply and Demand Estimates (WASDE) report raised its forecast for 2023-24 US beet sugar and total sugar production to fresh record highs, along with a new record-high for high-duty imports, while lowering Mexico’s sugar production and export forecasts.

Some in the trade feel the USDA’s beet sugar forecast at a record 5.4 million short tons (4.9 million tonnes) may be as much as 100,000 short tons (90,718 tonnes) too high as outdoor beet piles have a long season and shrink may be higher than the USDA expects.

Note: Values converted to metric tonnes from short tons

Source: USDA

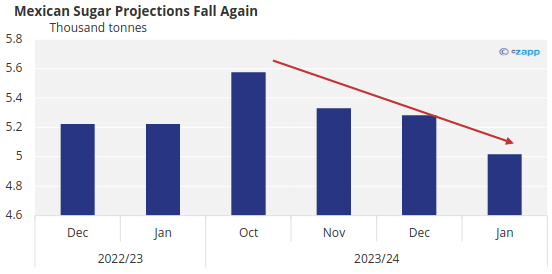

The trade also is closely watching the situation in Mexico. The USDA has lowered its production forecast for Mexico for four consecutive months, currently at 5.016 million tonnes, actual weight, which some believe may still be about 200,000 tonnes too high given sugar production data to date.

Source: USDA

US Imports Rise as Mexico Faces Production Problem

As the major sugar exporter to the US, Mexico typically accounts for more than 30% of total US sugar imports and 8% to 10% of total US supply. If Mexico’s production falls further, it may not be able meet the forecast for exports to the United States, which could crimp raw sugar supplies available to US cane refiners. Imports of sugar by Mexico, including from the US, were forecast higher as Mexico attempts to backfill for exports to the US with high-duty imports.

Meanwhile, record-high imports of high-duty sugar at 575,000 short tons (521,000 tonnes) indicates more raw sugar is needed by US refiners despite the record-high beet sugar supply. High-duty sugar, which tends to be the most expensive to use, mainly is needed to fill the gap left by Mexico this year. Sugar users would much prefer a tariff-rate quota increase.

The USDA didn’t adjust its forecast of sugar deliveries for food in 2023-24 even though beet processors have consistently reported slow deliveries for the past few months. While that should help boost sugar supplies, it also may further add to the large beet sugar supply, further distorting the beet/cane sugar mix.

Corn sweetener contracting for 2024 was mostly complete except for spot buyers.