Insight Focus

Some of the first tariffs have gone into force. Although the 25% levies on aluminium and steel don’t directly impact food, there are some unintended consequences for the food supply chain. It seems that 2025 will be the year of increasing protectionism.

Trump Steel, Aluminium Tariffs Take Force

The first phase of President Trump’s tariffs has gone into effect after 25% levies on all steel and aluminium imports to the US were targeted. This prompted the EU to announce retaliatory tariffs to the tune of EUR 26 billion (USD 28.3 billion), while Canada announced a “dollar-by-dollar” approach that will initially see tariffs slapped on USD 20 billion of goods. On Thursday, Trump then threatened 200% retaliatory tariffs on European wines and alcohol.

Mexican President Claudia Sheinbaum said that she would wait until April 2—when blanket 25% tariffs by the US are set to go into force – before making a decision about retaliation.

Canada, Brazil and Mexico are the biggest sources of US steel imports, while Canada is also by far the biggest source of aluminium imports, accounting for 58% of the total. This could set the stage for messy retaliation on agricultural products.

One product that is already impacted is Mexican tequila. At the beginning of March, Distilled Spirits Council (DISCUS) President and CEO Chris Swonger stressed that it makes “no sense” for spirits traded between Mexico, Canada and the US to be included in the tariffs.

“The North American spirits sector is highly interconnected and, as a result, tariffs on Tequila and Canadian whisky will harm U.S. spirits companies that have these products in their brand portfolios,” DISCUS said in a statement.

The organisation estimates that a 25% tariff on spirit imports from Mexico and Canada could cause losses of up to 31,000 US jobs. Not only this, but DISCUS expressed concern that Canadian retailers may remove US products from their shelves. The US exported a total of 133.6 million proof gallons of distilled spirits in 2024 at a value of almost USD 2.5 billion – all of which could now be subject to reciprocal tariffs.

Policy Changes Impact US Farmers

The new US president’s purge of government under the Department of Government Efficiency (DOGE) has been well publicised, but it has led to some unintended consequences for some of his key demographic – farmers. After all federal funding was frozen, farmers awaiting critical USDA grants to keep their farms running have been left out in the cold.

Farmers have also been hit hard by cuts to other agencies, such as USAID, which buys significant amounts of farm products. The US president has said he will approve just USD 100 million of the USD 40 billion allocated to USAID programs. In addition, funding cuts to school food and food bank programs will equate to a loss of around USD 1 billion in procurement of local farmed produce.

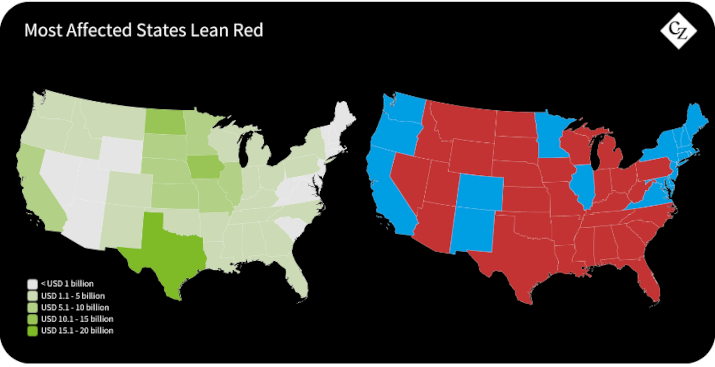

According to an analysis by the US Government Accountability Office, Texas receives the most USDA funding at USD 18.1 billion, followed by North Dakota and Iowa at USD 10.6 billion and USD 10 billion, respectively.

US Stagflation Prospects Rise

Economists are signalling alarm bells as US growth continues to stall, but the signals remain confusing.

The S&P 500 is down by about 8.5% month on month, although it remains up by about the same amount year over year. The CPI for February came in slightly under expectations although analysts believe tariffs could cause inflation to shoot up. Similarly, the February unemployment rate remained in the same range as it has held since May 2024 at 4.1% — although March figures could paint a different picture after DOGE’s rout of public sector employees. Morgan Stanley, Goldman Sachs and JP Morgan have all slashed their growth targets for the US economy, citing trade policy and sticky inflation.

Source: St Louis Fed

Inflationary Risks Persist

In addition to the flurry of protectionist measures taking place around the world, there are a host of other factors contributing to sticky inflation.

Disease Outbreaks: Bird flu has decimated bird populations, particularly in the US, which has led to soaring egg prices and reduced availability. And after battling Bluetongue disease in its cattle and sheep populations, Germany has identified its first foot and mouth disease (FMD) outbreak in 40 years. Since then, the disease has been identified in Hungary and Slovakia, prompting the UK government to ban imports from these countries. Some crops are also in danger. According to a report by the Cincinnati Enquirer, the US strawberry crop is at risk from a fungal disease called neopestalotiopsis, or Neo-P.

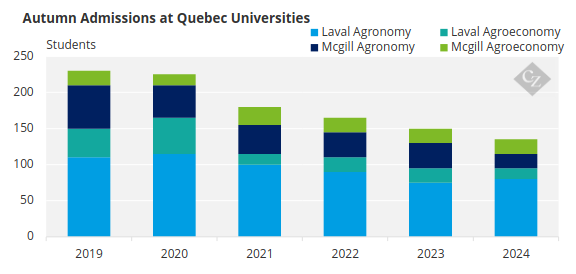

Labor Shortages: The agricultural sector globally is experiencing a decline in workforce availability, as younger generations gravitate toward non-traditional careers. This issue has been exacerbated in the US amid a crackdown in migratory controls. Typically, agricultural workers tend to be undocumented workers from Latin America, who are now failing to attend work out of fear of deportation, according to reports. Canada is also experiencing a lack of students enrolling in agricultural degrees.

Source: Mcgill, Laval University

Climate Change-Induced Weather Extremes: Increasing temperatures and unpredictable precipitation patterns are causing simultaneous crop failures, particularly across breadbasket regions. Thailand’s pineapple price has risen thanks to the impacts of the ENSO weather patterns. However, there are also extreme weather events in developed nations. Just this month, Cyclone Alfred made landfall in Queensland, Australia, disrupting food supply. The Lockyer Valley is a key growing region for leafy greens and reports by FreshPlaza suggest 82 hectares could have been wiped out. A new report by Carbon Brief maps extreme weather events globally in 2023-24.

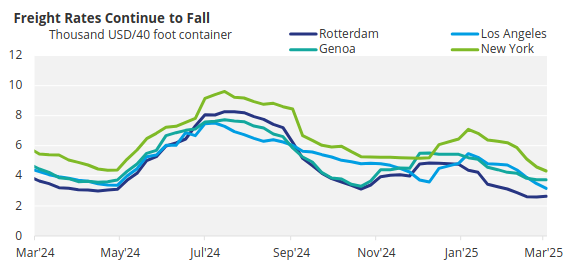

Freight Costs Continue Dip

One cost that doesn’t look like it will add inflationary pressure any time soon is freight.

After the Red Sea ceasefire, freight costs have been tumbling thanks to Trump’s tariffs and weak demand in China. We explain here why China is a crucial demand driver in global food trade.

Source: Drewry

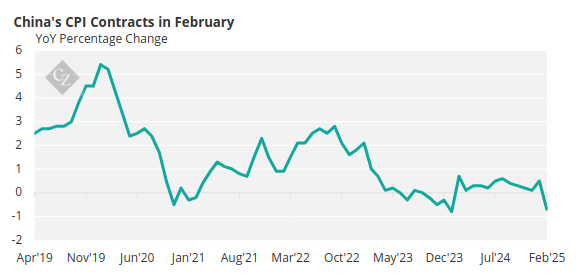

China’s CPI has dipped into negative territory, indicating a demand erosion that will impact on global freight rates. After hovering marginally above zero for most of 2024, February 2025 saw prices breach negative territory, missing analyst expectations. This raises huge questions about Chinese long-term demand, given lacklustre performance since mid-2023.

Source: St Louis Fed

One supporting factor for freight rates is the ongoing port strikes at French ports by workers protesting pension reforms. Cargo handling operations at key ports, including Le Havre and Marseille-Fos has been severely impacted, which has heaped pressure on other European hubs such as Antwerp-Bruges. The Belgian port is absorbing diverted cargos, increasing congestion and putting pressure on logistics networks.