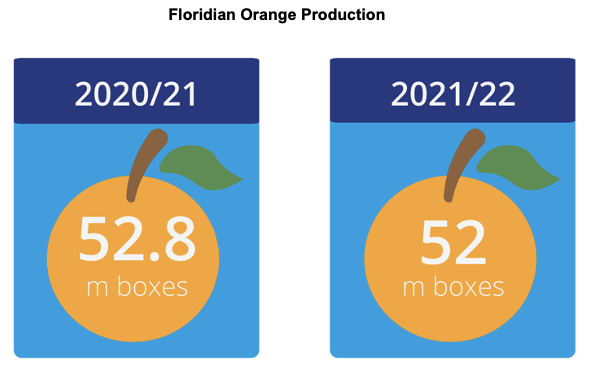

- Florida should harvest 52m boxes of orange this season.

- This is an 800k box reduction year-on-year.

- The drop comes as citrus greening took hold of Floridan orchards and weakened yields.

US Orange Producers Get (Somewhat) Lucky

- Florida should produce 52m boxes of orange this season, down 800k boxes year-on-year.

- Producers suffered heavy losses as their orchards were hit by citrus greening.

- This is spread by the citrus psyllid, which feeds on the stems and leaves of the trees, leaving them infected with the bacteria that causes the greening.

- The greening impairs the trees’ ability to take in nourishment and ultimately results fewer, smaller fruits.

- Once the tree is infected, there’s no cure, which means it’s incredibly important farmers protect themselves by applying protective treatments (if they can afford to).

- The story could’ve been a lot worse, though, had the region not avoided three hurricanes.

- US orchards avoided the wrath of Hurricane Grace, with Mexican orchards absorbing the damage.

- Hurricane Ida, which did make landfall in Louisiana, also did minimal damage to the orchards.

- Hurricane Larry narrowly missed the region too, after lingering out in the Atlantic.

- Clearly, Floridian producers have been fortunate in recent months, with storms passing either side of the state.

- Producers in the region will hope this remains the case, with the 2022/23 season set to commence in November.

- As it stands, the weather in Florida looks largely favourable (hot and humid with regular rainfall).

FOJC is priced either by its spot or futures price. Both are offers for a purchase/sales contract, but the timing of the transaction and delivery dates make them different.

On spot business, the delivery is executed immediately and is represent by the commodity’s current trading price. The futures price, however, is locked in ahead of time for a transaction that’ll happen at some point in the future, allowing buyers to lock in a reasonable price in advance.

Czarnikow offers risk management solutions for FOJC via futures contract. This allows you to manage FOJC risk ahead of time and, through hedging, offers a transparent settlement through physical delivery or cash settled swaps. Czarnikow enhances the offering with its additional supply chain and corporate financial services.

Get in touch with TAguilar@czarnikow.com for further information.

Other Opinions You May Be Interested In…

- Disease Hits US Orange Production

- Drought Hinders Brazilian Orange Production

- Mexican Orange Production Rebounds Following Drought