- 500k tonnes of raw sugar has already been cleared into the USA as Tariff Rate Quota (TRQ) this season.

- Some of this volume is late 2019/20 entries, which could ease pressure on US refiners to import the full 2020/21 TRQ.

- This means redistribution of licenses is less likely this season, but the value of TRQ licences should not be affected.

US Imports 500k Tonnes of Raws in First Four Months of 2020/21

- The US imported 500k tonnes of raw sugar between October and November 2020; this is 45% of the usual TRQs for bulk raws.

- This comes as 225k tonnes of the 2019/20 TRQ entered late once the quotas were expanded.

- If the usual TRQs are utilised, nearly 1.25m tonnes of bulk raw sugar will enter the US market this season.

- This effectively means the US refiners would import and refine 50k tonnes more than they did in 2019/20 when the beet crop collapsed.

- It therefore seems likely the pressure on the USDA to re-allocate TRQs will ease this season.

Who Will This Affect?

- We think the 2020/21 TRQ will fall short by at least 80k tonnes as certain historical quota holders do not export sugar.

- In the last few years, the USDA has been keen to reallocate this unused tonnage, but that may not occur this year.

- However, any licenses still unsold for 2020/21 shouldn’t directly suffer from this early arrival.

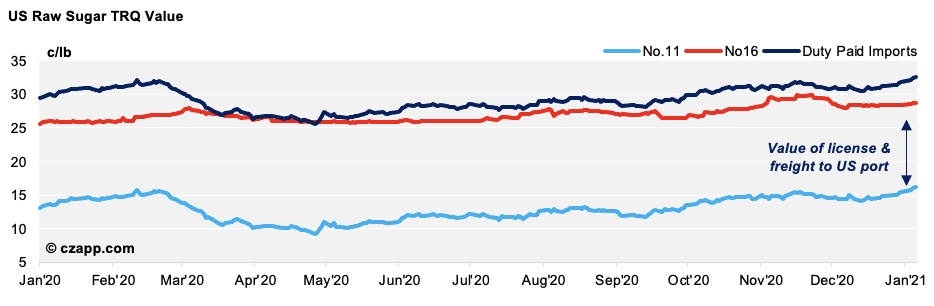

- This is because the regulated US market rarely makes duty paid (360 USD/mt) imports viable.

- The US’ No.16 raw sugar contract is a delivered contract, so the spread between the No.11 represents the license value + the freight to deliver it to the USA.

Other Opinions You Might Be Interested In…

Interactive Data You Might Be Interested In…

- USA Dashboard