Insight Focus

US lawmakers have turned their attention to Chinese shipbuilding. There is a new proposal to levy a fee on Chinese made vessels that dock in US ports, as well as imposing duties on Chinese-made port cranes.

Docking Fees Gain Bipartisan Support

Stephen Edwards, CEO of the Virginia Port Authority, submitted a comment to the USTR arguing that the measure would increase the cost of cranes, while compromising the quality. “Many STS crane manufacturers produce cranes that are either of insufficient size or insufficient quality to meet the needs of US marine terminal operators,” he said. “It is for this reason that Chinese-manufactured STS cranes account for more than 80% of the STS cranes at US ports.

A proposal to impose port fees on vessels built in China that dock in US ports is garnering widespread bipartisan support after it was proposed by a group of trade unions in March. This support reflects growing concerns among US Congressional lawmakers about China’s rising influence in maritime, logistics, and shipbuilding sectors.

At a congressional hearing on June 26 held by the House Select Committee, Representative Ro Khanna of California called for “unequivocal” support of the petition as well as USTR remedies.

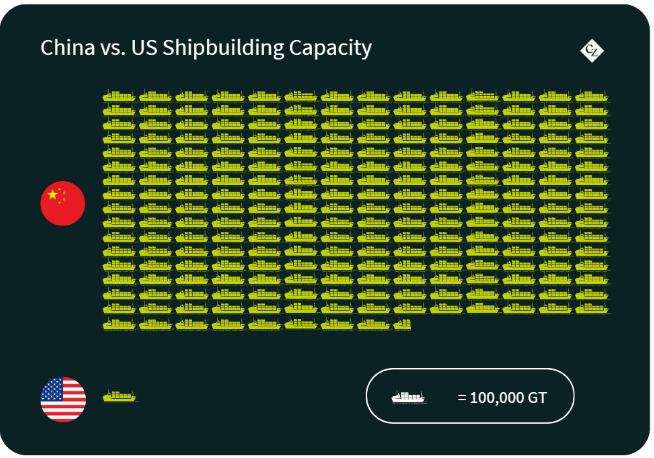

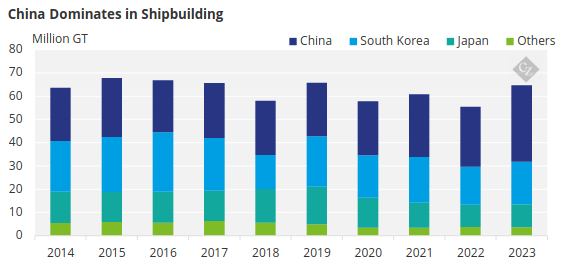

He went on to add that China has gone from a market share of 5% of the global market in shipbuilding in 1999 to around 50%, producing 1,000 ships every year. The US, which used to be a leader, now produces about 10 ships every year. “This committee is for American leadership,” he said. “We should be for ensuring that we’re not losing 100 to one on shipbuilding to China.”

He noted that the request for a docking fee of about USD 1 million would translate into about less than USD 50 per container.

In March, unions petitioned the USTR, arguing that the Chinese government has invested “hundreds of billions of dollars” into its shipbuilding industry, resulting in China dominating the global production of commercial vessels, while the share of the US is now only 1%.

The unions are urging the USTR should take action against China’s practices under Section 301 of the U.S. Trade Act of 1974, proposing measures such as a port fee on Chinese-built ships docking at U.S. ports and the creation of a shipbuilding revitalization fund.

Ports Hit Back

In addition to the unions’ petition, the USTR announced in May plans to introduce a 25% tariff rate on ship-to-shore cranes from China in 2024. However, this plan is facing opposition from U.S. port stakeholders, who argue that the tariff could cost over USD 130 million for seven U.S. ports with preexisting orders for 35 ship-to-shore cranes from Chinese manufacturers.

Cary Davis, the President and CEO of the American Association of Port Authorities (AAPA) expressed the association’s view that the tariff, if imposed, would fail to meet its stated objectives. On the contrary, he said, it would only lead to negative outcomes, including severe harm to port efficiency and capacity, strained supply chains, increased consumer prices, and a weaker U.S. economy.

Stephen Edwards, CEO of the Virginia Port Authority, submitted a comment to the USTR arguing that the measure would increase the cost of cranes, while compromising the quality. “Many STS crane manufacturers produce cranes that are either of insufficient size or insufficient quality to meet the needs of US marine terminal operators,” he said. “It is for this reason that Chinese-manufactured STS cranes account for more than 80% of the STS cranes at US ports.

China is Shipbuilding Behemoth

The Congressional hearing and USTR review highlight increasing apprehension among lawmakers and the private sector about China’s rapid expansion in shipbuilding and the manufacturing of ship-to-shore cranes and shipping containers. There are arguments that China’s dominance in these key sectors could potentially jeopardize U.S. national security.

Scott Paul, president of the Alliance for American Manufacturing, testified that existing policy measures are insufficient to address China’s “predatory market distortions.”

Paul highlighted that China controls over 50% of the world’s shipbuilding today, starting construction on nearly 1,800 large ocean-going vessels in 2022. In contrast, the US was constructing five vessels that year.

Source: UNCTAD

The decline in US shipbuilding since the 1970s and China’s rising dominance have led to situations where the US Navy relies on Chinese-made dry docks. “We currently have a tonnage advantage, but it’s not sustainable. We don’t have a surge capacity,” highlighted Paul.