This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- US sugar sales and planting for next season are progressing slowly.

- High cocoa prices and stubborn inflation are slowing demand for products.

- The USDA raised projections of high-tier sugar imports amid Mexico’s ongoing production issues.

High Cocoa Prices Sow Doubt

Sales of bulk refined sugar for 2024-25 progressed at a steady but slow pace during the week ended April 12. Spot and forward prices were unchanged, but some sellers were a bit more aggressive in seeking to secure new sales.

All beet processors remained in the market, although one was well enough sold that it was limiting the volume on some offers and holding prices firm rather than withdraw from the market.

Bulk beet sugar for 2024-25 was offered at 53¢/lb FOB to 55¢/lb FOB Midwest with variations below that range depending on volume and buyer/seller situation. Bulk refined cane sugar for 2025 was offered at 60¢/lb FOB Northeast and West Coast and 56¢/lb to 58¢/lb FOB Southeast and Gulf.

There was no rush by buyers to lock in 2025 supplies. Many remained uncertain about demand for their own products amid food inflation in general and especially anything cocoa or chocolate related due to record high cocoa prices.

Plantings, Sales Progress Slowly

Sugar beet planting for 2024 progressed slowly with 2% of the crop planted in the four major states as of April 7. This compared with 4% as the 2019-23 average for the date, the USDA said. Beets in Idaho were 12% planted, while none were planted in Minnesota, North Dakota or Michigan. Cold, rainy weather slowed progress to date, but forecasts called for improved planting conditions in key areas in the coming week.

Louisiana sugar cane ratings dropped to 66% good-to-excellent from 77% a week earlier but remained high for the date.

Beet sugar was offered for 2024 steady at 55¢/lb FOB to 58¢/lb FOB Midwest. Refined cane sugar for 2024 was offered steady at 62¢/lb FOB Northeast and West Coast and at 58¢/lb to 60¢/lb FOB Southeast and Gulf.

One beet processor remained withdrawn from the 2024 market and was assessing supply status as slicing operations wrapped up. Another processor was selling only spot supply, while others remained in the 2024 market. Beet slicing was ongoing in the Red River Valley amid continued unseasonably warm weather.

Deliveries of contracted sugar were at a steady but not great pace for most processors, which was an improvement from earlier in the year.

WASDE Numbers Revised

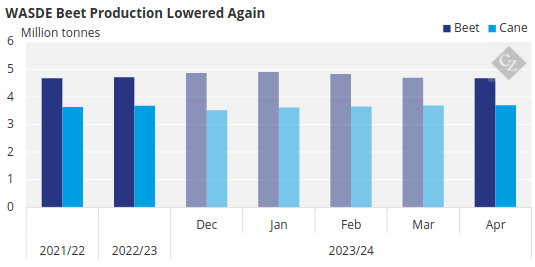

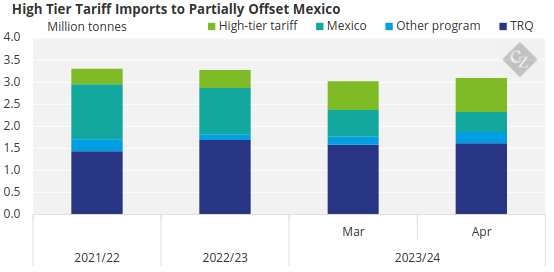

Lower forecasts from March for 2023-24 domestic beet sugar production and imports from Mexico were more than offset by higher tariff-rate quota, re-export program and high-tier imports, resulting in slightly higher ending stocks, the USDA said in its April 11 WASDE report.

Domestic beet sugar production was forecast at 5.14 million short tons (8.4 million tonnes), down 27,340 short tons from March and down 43,000 short tons from 2022-23. Cane sugar production was unchanged from March at 4,071,000 tons. There were no changes in domestic delivery forecasts.

Source: USDA

US 2023-24 sugar imports from Mexico were forecast at 498,644 short tons, raw value, down 167,020 short tons, or 25%, from the March forecast and down 657,000 short tons, or 57%, from 2022-23.

Source: USDA

Mexico’s 2023-24 sugar production was forecast at 4.57 million tonnes, actual weight, down 175,090 tonnes, or 3.7%, from March and down 651,856 tonnes, or 12.5%, from 2022-23. This marks the lowest level since at least 1999-2000 due to two consecutive years of drought.

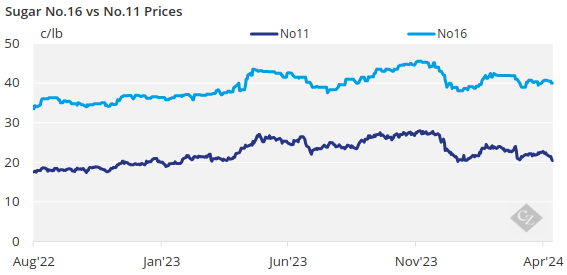

New York No. 11 world raw sugar futures dropped sharply on pressure from improving global sugar supplies.

The corn sweetener market was quiet.