This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

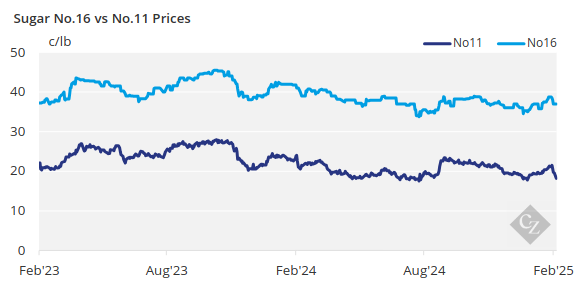

Sugar prices fell last week amid weak demand. Traders hesitated on future contracts, with some sales occurring, while sellers faced pressure to clear excess supply. The USDA projected a TRQ shortfall but has not confirmed an import reallocation, which could impact stock levels amid slowing deliveries.

Weak Sugar Demand, Ample Supply

Bulk refined sugar prices were lowered during the week ending February 28, influenced by the tone of the International Sweetener Colloquium, which concluded on February 26, indicating ample sugar supplies and weak demand.

Traders arrived in Palm Springs, California, with minimal sugar sold or purchased for 2025-26, as sellers aimed to maintain offers at 2024-25 levels—or at least above 40 c/lb FOB Midwest—while buyers clearly had lower prices in mind.

The tone was set during the North American Sweetener Market Outlook session on Monday morning (February 23) when Frank Jenkins, president of JSG Commodities, stated he saw 2025-26 prices “on either side of 40 c/lb.” Other speakers in the session projected prices slightly above that level but still weaker than earlier indications.

Numerous meetings between buyers and sellers had been taking place since the weekend, with some continuing into Wednesday. By Tuesday, some trading for 2025-26 had reportedly occurred at 39 c/lb FOB Midwest. Even after clearer price definitions emerged, sales remained sluggish as buyers saw no urgency to contract during the Colloquium. A more pressing issue may be the need to “unload” unsold 2024-25 sugar due to higher production from the 2024 sugar beet crop for some processors.

While some 2025-26 business was conducted during the Colloquium, many traders will likely ink contracts in the coming weeks or months.

USDA Weighs Sugar Import Reallocation

In its February 11 (WASDE) Report, the USDA projected a tariff-rate quota (TRQ) shortfall of 189,922 short tons (172,294 tonnes). Typically, this would prompt the USDA to reallocate imports to other TRQ countries with surplus sugar and/or to domestic producers with excess supplies, as is the case this year, allowing US producers to clear excess stocks. However, this may not happen, given the 2024-25 ending stocks-to-use ratio is forecast at 15.3%.

Barb Fecso, branch chief of commodity analysis at the Farm Service Agency, USDA, told attendees that a reallocation “remains to be determined.” A reallocation could potentially push the ending stocks-to-use ratio above 16% if high-tier imports continue to increase and deliveries remain slow.

“You need to honour your contracts,” Fecso urged sugar users from the podium, amid indications that some were not accepting contracted sugar due to double-booking earlier when supplies were expected to be tighter or after purchasing lower-priced high-tier imports after already booking domestic supplies.

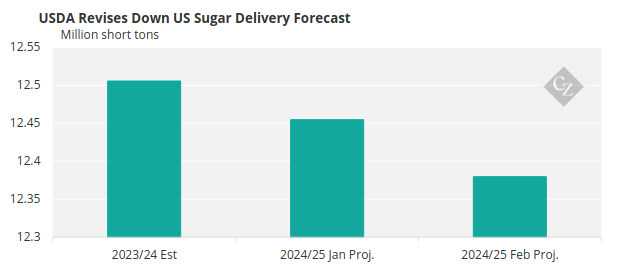

In the February WASDE, the USDA forecast 2024-25 sugar deliveries at 12.27 million short tons, down 75,000 short tons (0.6%) from January and down 1% from 2023-24.

Source: USDA

However, the USDA’s February Sweetener Market Data report showed that October-December deliveries for food use declined 4.9% compared to the same period a year earlier. The WASDE delivery forecast “could go down some more,” Fecso noted.

A reduction in Mexico’s export limit to the US is expected in the March WASDE report, though it could easily be offset by lower deliveries and increased high-tier imports.

The corn sweetener market remained quiet. With a larger corn crop expected in 2025 and ongoing weak demand in some areas, Colloquium discussions suggested that corn sweetener prices—except for glucose—could face renewed pressure when 2026 contracts are negotiated.