This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

The cash sugar market was quiet this week. Buyers delayed 2025-26 contracts due to ample supplies and lower price expectations. The USDA’s high beet sugar production forecast for 2024-25 raised doubts, and weak demand was impacted by factors like GLP-1 drugs.

Quiet Cash Sugar Market

The cash sugar market was quiet during the week ending January 17. Buyers were in no rush to begin contracting for 2025-26, amid indications of ample supplies and hopes for weaker prices, fuelled in part by slumping raw sugar futures.

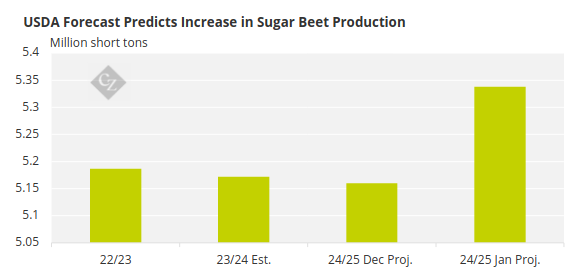

The market has experienced a rash of bearish news. In its latest WASDE report published on January 10, the USDA forecast record-high US beet sugar and total sugar production for 2024-25, though many doubt the beet sugar projection.

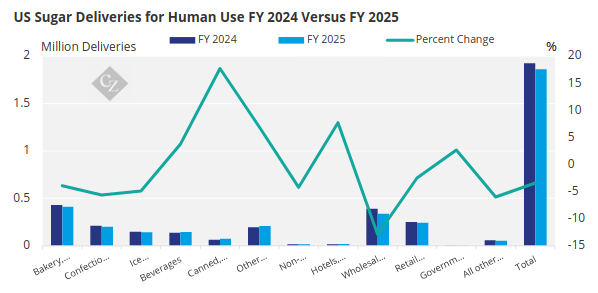

The USDA also published its Sweetener Market Data report on January 10, which showed that November deliveries of sugar for human use had improved compared to October but remained negative for the first two months of the marketing year. Several reports highlighted the negative impact of GLP-1 weight-loss drugs on food consumption and spending.

Source: USDA

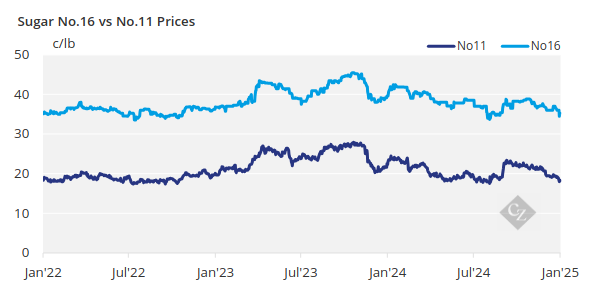

The FDA released its plan for front-of-package labelling, which includes added sugars. Additionally, both No. 16 and No. 11 futures dropped sharply nearby, with the No. 11s pressured by improving global sugar supply prospects.

Most beet processors still have 2024-crop sugar to sell for use in 2025 and are finding sales difficult as buyers are either well covered or holding out for lower prices. A large sugar beet crop with good sugar content has resulted in higher-than-expected supplies in many cases.

Many in the trade believe the USDA’s 5.338-million-short-ton (4.82-million-tonne) beet sugar forecast for 2024-25 is too high. Only once in history has US beet sugar production exceeded 5.2 million short tons (2017-18). The USDA cites quality issues with beet piles in Michigan and the need for outdoor piles in the Red River Valley to remain frozen longer into the spring due to the large crop.

Uncertainty Ahead of 2025-26 Contracts

There is also debate regarding sugar delivery (use) estimates and forecasts from the USDA. Forecasting demand has been complicated by new data showing an increasing impact from GLP-1 weight-loss drugs. Sugar deliveries for human consumption have declined for two consecutive years, despite the typical small increase driven by population growth.

Excess sugar to sell for 2025 has set the stage for buyers seeking lower prices for 2026. Little, if any, business has been done to date for next year, although inquiries are expected to increase as the International Sweetener Colloquium approaches, scheduled for February 23–26.

While traders anticipate lots of negotiations during the Colloquium, most sales are expected to develop in the weeks following, as users appear in no hurry to purchase.

Beet sugar sellers seem to be holding offering prices for 2025-26 near 2024-25 levels, with 2025 beet acreage yet to be determined and slicing of the 2024 crop still underway.

The corn sweetener market was quiet after 2025 contracting concluded by the end of 2024, with prices mostly steady to lower.