This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Sugar beet 95% planted in largest growing states.

- Manufacturers report reduced demand for sugar containing products.

- Refined sugar sales for 2024 slower than in March.

Cash sugar markets were quiet during the week ended May 26 as sugar beet planting was wrapping up and new sales of bulk refined sugar for 2023-24 were steady at a slow pace. Spot and next-year cash prices were unchanged.

The US Department of Agriculture in its Crop Progress report said beets were 95% planted in the four largest beet growing states as of May 21, up from 79% a week earlier, up sharply from 48% a year ago and ahead of the 2018-22 average for the date of 84%.

Planting of about 20,000 additional acres in the Red River Valley (Minnesota, North Dakota) was ongoing. Like last year, extra acres were added to offset potential lost production due to later-than-desired spring planting. Even with the additional acres, total planted area in the two states will be down from 2022.

Bulk refined sugar sales for 2024 were ongoing but at a slow pace compared with the rabid activity seen in March. Buyers who wanted to be covered had done so, and those who typically buy in the spot market will continue that activity throughout the year. One trade source noted spot market buyers were becoming fewer after high spot prices the past couple of years, opting to forward contract to limit risk in the spot market. Beet processors and cane refiners were well sold for the date. One beet processor was out of the market until harvest begins in October.

Spot and 2024 sugar prices were unchanged. Above-quota high-tier importing continued, with one source noting high-tier sugar could be bought below the refined cane sugar spot price.

Most processors who noted slow deliveries of contracted 2023 sugar the past couple of months and into early May said deliveries had improved in the second half of the month. The slower deliveries left most with small amounts of bulk sugar to offer on the spot market, although some were opting to hold back the sugar until the July-September quarter when supplies typically are tightest. No processors had officially re-entered the spot market, and prices were not affected. Delivery status varied by sector, with one processor noting shipments to foodservice were weak, to retail were as expected, and to bulk users were stronger, with overall shipments “just” okay.

Trade sources also said several sugar-using food manufacturers indicated demand for their products was down from a year ago, which was reflected in slower sugar deliveries.

Any additional domestic supply may be needed if Mexico falls short of its projected exports to the United States, as many expect will be the case. Mexico’s sugar production for the season as of May 13 was 5.101 million tonnes. Some expect final sugar production for the year will be around 5.2 million tonnes as more mills than usual are closing for the season early. The USDA in its May supply-and-demand report forecast Mexico’s 2022-23 sugar production at 5.385 million tonnes, but left room for lower production in comments.

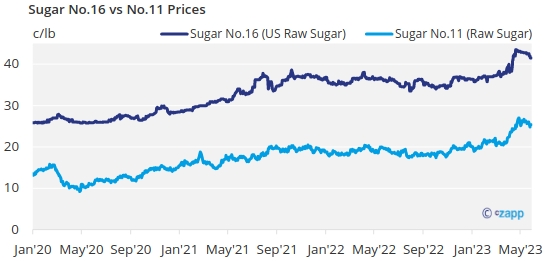

Raw sugar futures prices declined as cane harvest in Brazil gained momentum, increasing export supplies and easing global raw sugar tightness.

Corn sweetener markets mostly were routine with spot supplies limited.