This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

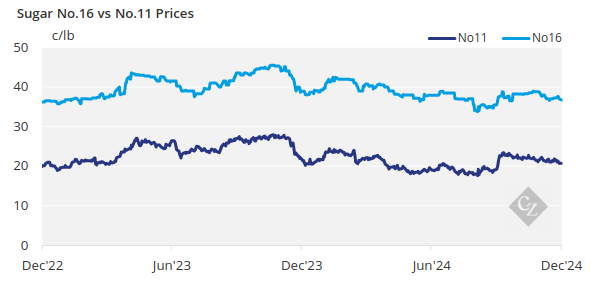

Cash sugar trading remains slow, with prices unchanged. Sales for 2024-25 remain slow, and 2025-26 inquiries continue at a cautious pace. The USDA forecasts lower sugar deliveries due to weak demand from food manufacturers.

Cash sugar trading was slow during the week ending December 13, and prices were unchanged with a slightly weaker tone. Industry focus has shifted to 2025-26 negotiations, with corn sweetener contracting for 2025 moving to a conclusion by the end of the year.

As Sugar Sales Slow, 2025-26 Inquiries Continue

New sales of refined sugar for 2024-25 have continued at the anticipated slow pace, given the time of year, the strong sales positions of most beet processors, and buyers’ “no rush” attitude, fuelled by indications of adequate supplies and limited upward price potential. One beet processor remained out of the market, but all others offered sugar.

Prices were said to be mostly within the current quoted ranges, although some beet sugar sales below the ranges were noted as sellers protected market share or moved into new areas.

Inquiries for 2025-26 continued with few if any deals completed. Buyers sought lower prices, while sellers were hesitant to lower offers this early in the season. Some beet sugar was said to be offered flat with 2024-25 prices in the mid- to upper-40¢/lb range.

Inquiries and sales are expected to slog along to year-end before gaining momentum ahead of the International Sweetener Colloquium in late February.

Retail shipments have met or exceeded expectations throughout the fall baking season. While they are expected to decline in the second half of December, there will be a brief uptick as retailers restock post-Christmas, followed by another decrease in the first quarter. Of greater concern, however, are slow bulk deliveries to industrial users, which have been an issue for several processors.

The WASDE report largely met expectations for 2024-25, as the USDA balanced for a 13.5% ending stocks-to-use ratio, as required under the US-Mexico suspension agreements.

USDA Forecasts Weaker Sugar Deliveries

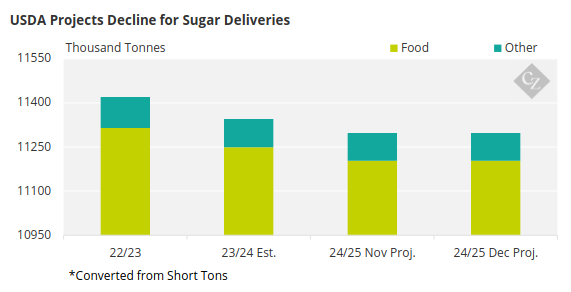

Weak demand from food manufacturers has been evident for several weeks, with the USDA’s December Sweetener Market Data report showing deliveries for food in October down 14.5% compared to October 2023. Deliveries to key sectors include a 6% drop for the baking sector, a 9% decline for confectionery, and a 7% decrease for dairy.

In the new World Agricultural Supply and Demand Estimates (WASDE) report published on December 10, the USDA forecasted 2024-25 sugar deliveries for food to be down 0.4% from 2023-24 and down 1% from 2022-23.

Source: USDA

The WASDE report largely met expectations for 2024-25, as the USDA balanced for a 13.5% ending stocks-to-use ratio, as required under the US-Mexico suspension agreements.

An additional 231,000 short tons (209,559 tonnes) of supply from the November report came from Mexico (up 226,000 short tons) and high-tier imports (up 118,000 short tons). This more than offset a 63,000-ton (57,152 tonne) drop in beginning stocks and a 50,000-ton (45,359 tonne) reduction in 2024-25 beet sugar production.

Contracting of corn sweeteners for 2025 was at least 70% complete, with traders confident that business will be wrapped up by year-end, except for spot buyers and the usual few “stragglers.” Prices were said to be mostly weaker for 42% high-fructose corn syrup and steady to slightly weaker for regular corn syrup (glucose) and 55% HFCS, depending on buyers’ contracted price levels for 2024.