This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

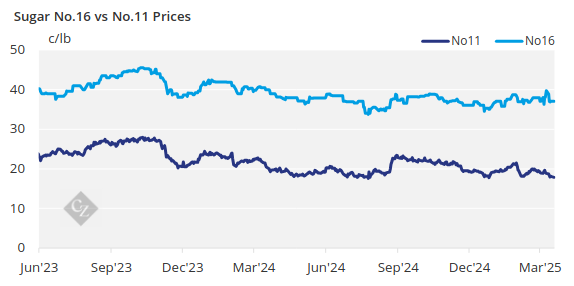

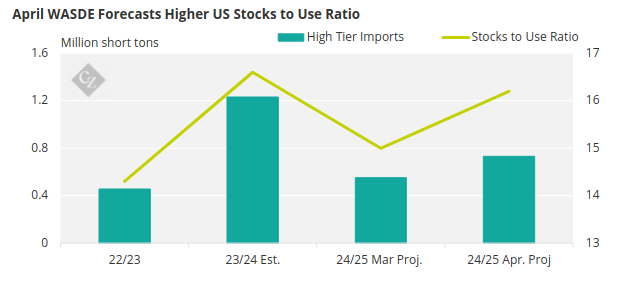

Tariff uncertainty kept the sugar market off balance. Prices held steady as sellers used tariff concerns to encourage early coverage, though many buyers remained cautious. The USDA forecast higher 2024-25 high-tier sugar imports, offsetting lower Florida cane production and raising the stocks-to-use ratio.

The on-again, off-again import tariffs kept the sugar industry off balance during the week ended April 11, with the situation currently being 10% additional tariffs on all US sugar imports except those from Mexico, which is the largest sugar exporter to the US. Spot and forward trading in the cash market was slow and steady. Beet sugar prices for next year were weaker.

Some sellers were using the tariffs and potential tariffs as a reason to talk prices up—and, at a minimum, to encourage buyers to lock in coverage sooner rather than later. While some users were steadily adding partial coverage for 2025-26, there was no rush for many to fully cover next year’s needs. RFPs continued to come in, but few carried any urgency for signing.

The 90-day reciprocal tariff delay was seen as a chance to import sugar, if it could clear customs before the moratorium expires. At a minimum, “kicking the can down the road” made it hard to write contracts because of the uncertainty.

Beet and Cane Sugar Prices Hold Steady

Bulk refined beet sugar for 2025-26 continues to sell mostly in the upper 30c/lb to lower 40c/lb range, FOB Midwest, with the range lowered slightly based on traders’ reports. Some beet processors tried to hold values at 40c/lb, as that was seen as the break-even level for growers.

Spot sugar prices were unchanged in the lower 40c/lb area FOB Midwest for beet sugar, with offers for refined cane sugar holding at 54c/lb in the Northeast and West Coast, and closer to 50c/lb in the South, Southeast and Gulf regions. One beet processor was sold out for 2024-25, but most others still had spot sugar to sell.

The arguments for price strength include tariffs, a long growing season with weather uncertainties, and a large volume of uncovered needs for 2025-26. Arguments for weakness include increased sugar beet acreage indicated in the USDA’s March 31 Prospective Plantings report, ample spot supplies and weak demand—especially in the industrial sector.

The USDA, in its April 10 WASDE Report, forecast higher 2024-25 high-tier sugar imports, more than offsetting lower cane sugar production in Florida, boosting the ending stocks-to-use ratio to 16.2% from 15% in March.

Source: USDA

The 2025 sugar beet crop was 2% planted as of April 6 in the four largest producing states (mainly in Idaho), about par for the date. Planting was expected to make strong progress amid favourable weather forecasts into the last half of April.

Louisiana sugar cane good-to-excellent ratings as of April 6 declined after rising for three weeks and were the lowest in at least a decade.

The corn sweetener market was quiet.