533 words / 2.5 minute reading time

- Mexican sugar flows into the USA nearly tripled in February, but more are still required.

- Free Trade Agreement (FTA) sugar arrivals could slow down in April and May too, as Colombia’s wet season has hindered production.

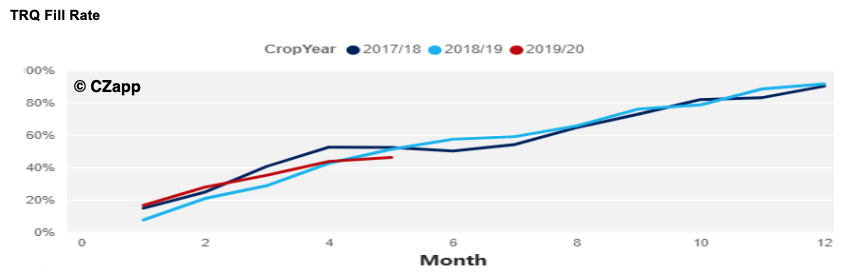

- Tariff Rate Quota (TRQ) raw sugar imports are a little behind the previous seasons’ rate, but this is not a worry at the moment.

Imports from Mexico

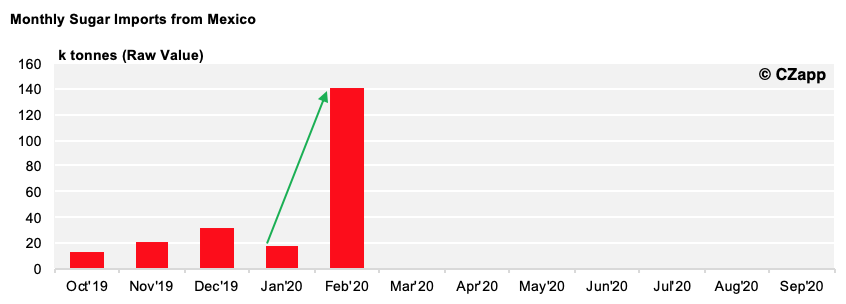

- In February alone, 133k tonnes of Mexican sugar entered the USA.

- This was a welcome change after a very slow start to shipments this season.

- However, the latest WASDE release highlighted fears held by the US Department of Agriculture (USDA) that Mexico might not fulfil its quota.

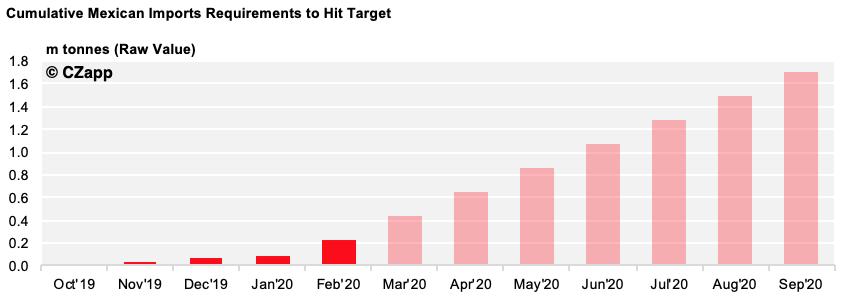

- The quota is currently estimated to reach 1.7m tonnes (or 1.9m short tons).

- To hit this target, Mexico will need monthly shipments of 210k tonnes until October this year.

- This rate of sugar arrivals seems highly unlikely though, due to crop shortfall (track this using our interactive Crop Models).

- According to some reports, Mexico will soon inform the USDA that they only ship 1.4m tonnes this season.

- This means the US will indeed need to source more supply from the world market.

Imports Under Free Trade Agreements (FTA)

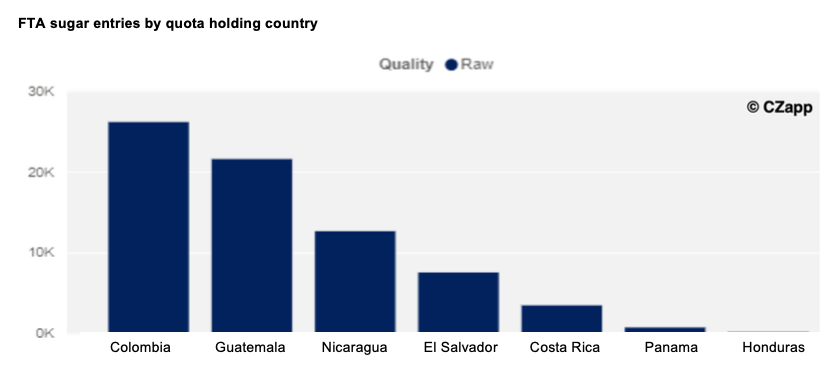

- Shipments of FTA sugar have been faster than in previous years so far this season.

- This is mostly due to Colombia, the largest quota holder, shipping nearly 50% already.

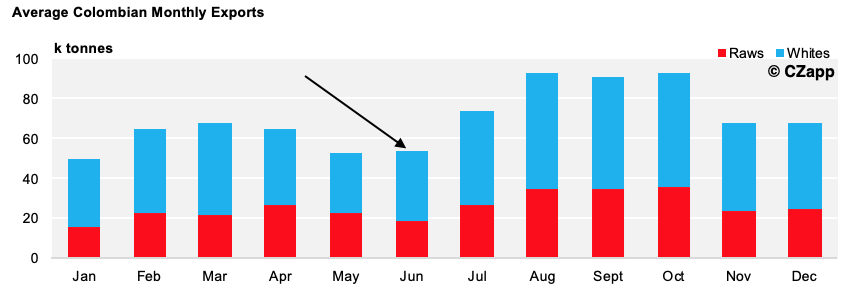

- The rate of shipments should slow down in the coming months, however, as Colombia reduces exports in the wet season.

- This rain usually disrupts production and, hence, the amount of sugar available to export in April, May and June.

- This means shipments from another origin will need to increase for the high FTA import rate to continue.

- However, if a global refined quota is opened, we expect to see these entries reduce and instead enter as global refined quota sugars.

Imports Under Raw Sugar TRQs

- Raw sugar TRQ entries are behind the historical norms.

- This is surprising given that the refineries are expected to be working at maximum capacity during the current period.

- 500k tonnes have been cleared under this quota to date.

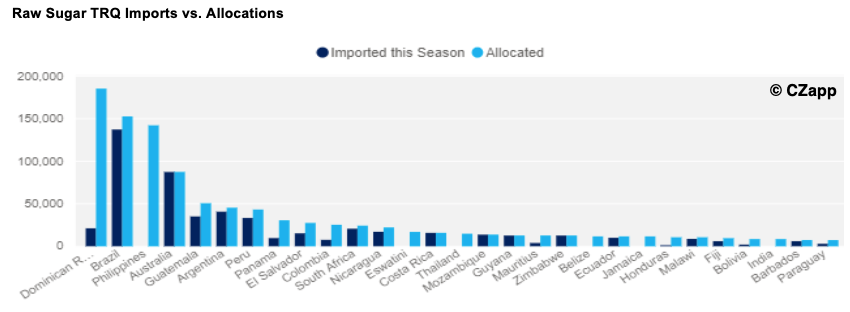

- And most large quota holders have already shipped their allocation (or a large portion of it).

- Many small quota holders who don’t usually fill their quotas have seen their volumes redistributed to countries that do.

- Whilst the Dominican Republic are also behind on imports so far this season, we have no doubt that the TRQ will be met.

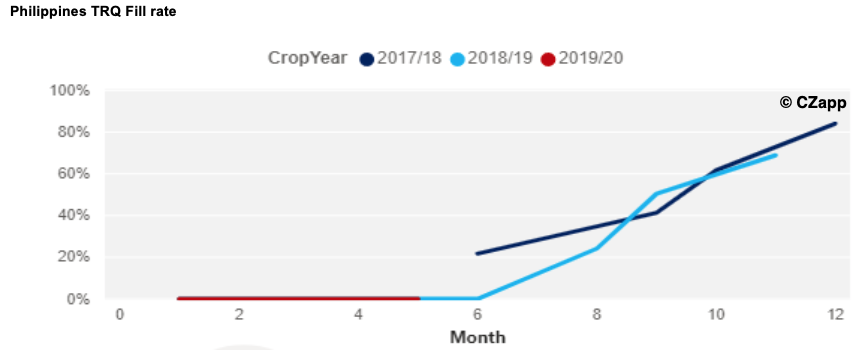

- However, the third largest quota holder – the Philippines – remains a significant concern.

- They have failed to ship their full quota in the last two seasons and it looks like they will fail to do so again…

- The only question is by how much will they fall short this season?

- You can explore individual TRQ fill rates by country in the ‘Imports – WTO Raws Imports’ section of the USDA Dashboard.