This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Refined sugar prices remained steady amid slow sales. Sugar contracts for 2025 were limited due to abundant supply and uncertain demand. The USDA forecasts a tighter sugar carryover for 2025.

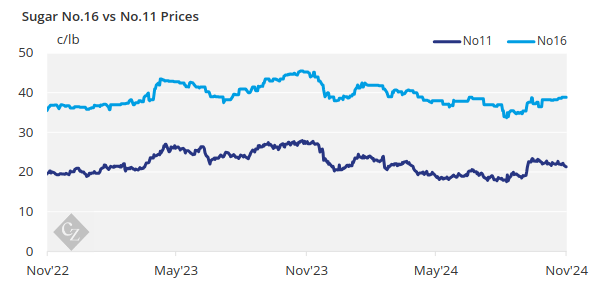

Refined Sugar Prices Steady

Cash refined sugar prices remained steady during the week ending November 8, amid slow spot and forward sales. The industry’s primary focus was on completing the sugar beet harvest and advancing the sugar cane harvest.

New sales of refined sugar for 2025 continued to be slow. Sellers indicated there may not be as much uncovered business as earlier thought, even from the small and mid-size buyers. Buyers with unmet needs appeared to be in no hurry to lock in coverage, given the expectation of limited upside potential for sugar prices due to ample supply. Another factor is food manufacturers’ uncertainty about demand for their products, opting to come back into the market later if their sales exceed expectations.

Prices for 2025 were unchanged. While some beet processors had sufficient stocks, they showed little to no inclination to lower prices to secure contracts. Additionally, one beet processor exited the 2024-25 market due to challenges with its sugar beet crop, which are expected to result in lower-than-earlier-forecast sugar production as beet tonnage declines and sugar content remains stable.

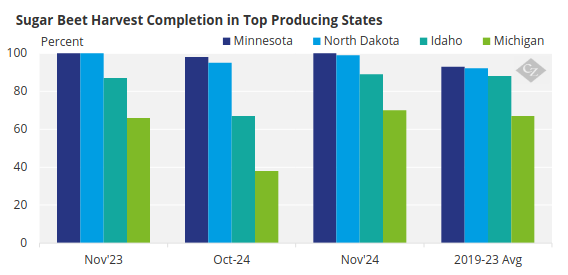

The sugar beet harvest in the four largest producing states was 93% complete as of November 3, up from 83% the previous week and ahead of the 2019-23 average of 88% for that date, according to the USDA. By state, the harvest was fully complete in Minnesota, 99% in North Dakota, 89% in Idaho, and 70% in Michigan.

Source: USDA

Most other states were also wrapping up their beet harvests, but Michigan paused harvest operations after November 3 due to warm weather, which prevented the beets from cooling sufficiently for piling.

In Louisiana, 42% of the sugar cane harvest was completed as of November 3, compared to the five-year average of 33% for this date, the USDA state office reported.

Retailers to Assess Demand in 1Q’25

Spot sugar prices were left unchanged, with beet prices through the end of the year at the same level as 2025 values, but nearby refined cane sugar prices above calendar 2025 values.

Sugar deliveries contracted for 2024 were consistent, though varied across sectors and sellers. Bulk refined sugar deliveries remained slow in some cases, although one seller hit its October target. Shipments to the consumer market remained seasonally strong and, in some cases, exceeded expectations. Retail demand will only become clear once retailers assess inventory levels after the new year.

There were ongoing inquiries for 2025-26 and calendar year 2026 sugar contracts, though actual sales for this period were scarce. Sellers maintain there is no reason to offer prices below current 2025 values (which are already down from 2024) as 2025-26 production in the US and Mexico will not be confirmed for several months, including the planting of the US beet crop.

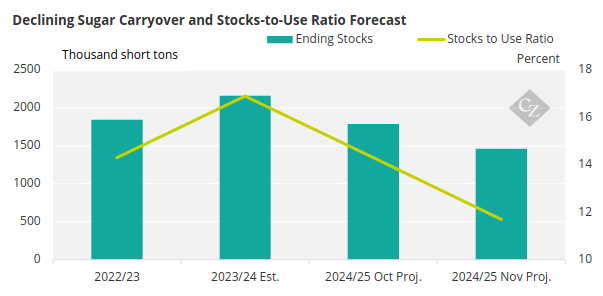

USDA Forecasts Sugar Carry Decline

While some processors expect to carry over some supplies into 2026, those stocks are not expected to be burdensome. Buyers, however, are seeking purchases at prices below 2025 levels, as they face uncertain demand for their products. Greater clarity is expected before the International Sweetener Colloquium in late February, though some expect limited sales during the event.

In its November 8 WASDE report, the USDA forecast a sugar carryover on October 1, 2025, of 1.46 million short tons, raw value (1.3 million tonnes). This represents an 18% reduction from the October forecast and a 32% decline from 2.16 million short tons in 2024.

The 2024-25 ending stocks-to-use ratio was forecast at 11.7%, down from 14.3% in October and 16.9% in 2023-24.

Source: USDA

Negotiations for 2025 corn sweetener contracts continued, with expectations that discussions will extend through December before users are forced to buy ahead of 2024 contract expirations.