This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- The Colloquium takes place this week, but massive deals are not expected to be closed.

- The USDA shared high 2024/25 production estimates in its latest Agricultural Outlook Forum.

- There may be more cause for concern this year rather than next.

Colloquium Week Arrives

The cash sugar market was quiet during the week ended February 23 as more than 600 attendees began to make their way to the annual International Sweetener Colloquium February 25-28 in Florida. Participants will attend market outlook and policy sessions and partake in sideline trade negotiations for 2024-25. Prices were unchanged ahead of the event.

While forward sales (mostly to small and mid-size users) for at least one beet processor were ahead of last year’s pace for the date, many beet and cane sugar sellers did not yet have large volumes contracted for 2025, in part because it appeared some of the largest buyers were waiting until the Colloquium. Many don’t expect the massive sales that occurred almost immediately after the Colloquium last year, but there most certainly will be increased activity.

Pricing Remains Firm Despite High Production

Pricing indications were steady with a firm tone for 2024-25. Beet sugar for 2024-25 was offered at 53¢/lb to 55¢/lb FOB Midwest, with some at 56¢/lb but also some below the range in volume or for competitive reasons. Bulk refined cane sugar for 2025 was offered at 60¢/lb FOB Northeast and West Coast and 56¢/lb to 58¢/lb Southeast and Gulf.

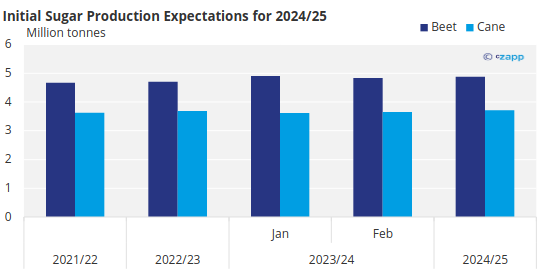

The USDA in its initial projections for 2024-25 issued at the recent Agricultural Outlook Forum predicted record-high beet and total sugar production and the second highest cane outturn based on a return to historical trends.

Note: Short tons converted to metric tonnes.

Source: USDA

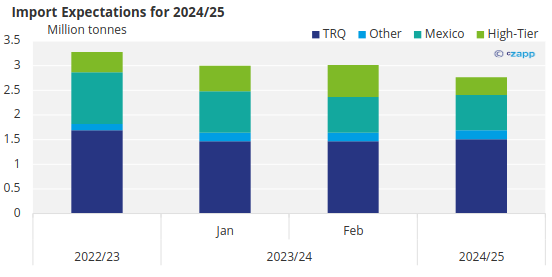

Most other numbers in the outlook were adjusted to balance for a 13.5% ending stocks-to-use ratio. The USDA also projected high-tier imports at 400,000 tons (362,000 tonnes) next year — a high starting point and supportive to prices.

Note: Short tons converted to metric tonnes.

Source: USDA

Concerns Arise for Current Year

But more concern may be developing for the current year than for 2025. Trading continued at a slow pace, and beet sugar was offered for 2024 steady in the range of 55¢/lb to 58¢/lb Midwest. One processor was a bit more aggressive in pricing (meaning weaker prices), while others were unchanged. Refined cane sugar for 2024 was offered at 62¢/lb Northeast and West Coast and at 58¢/lb to 60¢/lb Southeast and Gulf, also unchanged.

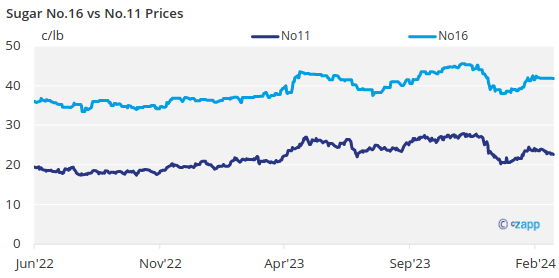

The wide premium of cane sugar (which at least in part was supported by strong high-tier imports) to beet sugar was supportive to beet sugar prices.

Warm weather has been detrimental to outside sugar beet piles in parts of the Upper Midwest and especially in Michigan. The trade expects at least another 50,000 tons (45,000 tonnes) will be trimmed from the USDA’s beet sugar production forecast in March after 79,297 tons (71,937 tonnes) were cut in February, with some expecting the cuts to deepen in later months.

Mexico remains a major concern for US sugar importers with the USDA’s current production forecast the lowest since 2009-10, but with many in the trade suggesting final outturn may be another 300,000 tonnes or more lower, which would make it nearly impossible for Mexico to hit the US import forecast.

Corn sweetener markets were quiet.