This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Sugar markets surged amid planting and tariff news. Spot prices rose, while 2025–26 trading remained cautious. A 2.1% increase in sugar beet acreage surprised the market.

US Sugar Market Reacts to Tariffs

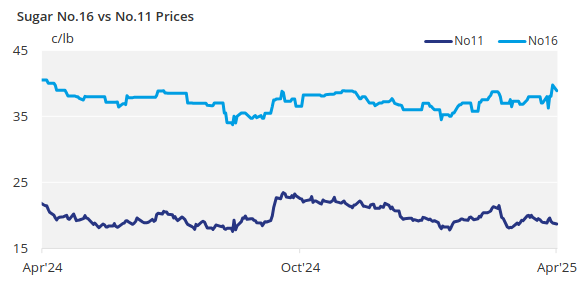

Sugar markets were roiled during the week ending April 4 by higher-than-expected sugar beet planting intentions in the USDA’s March 31 Prospective Planting Report and by the potential impact of reciprocal tariffs announced April 2 by the Trump administration. The spot domestic (No. 16) contract surged to nearly a one-year high on Friday, April 4.

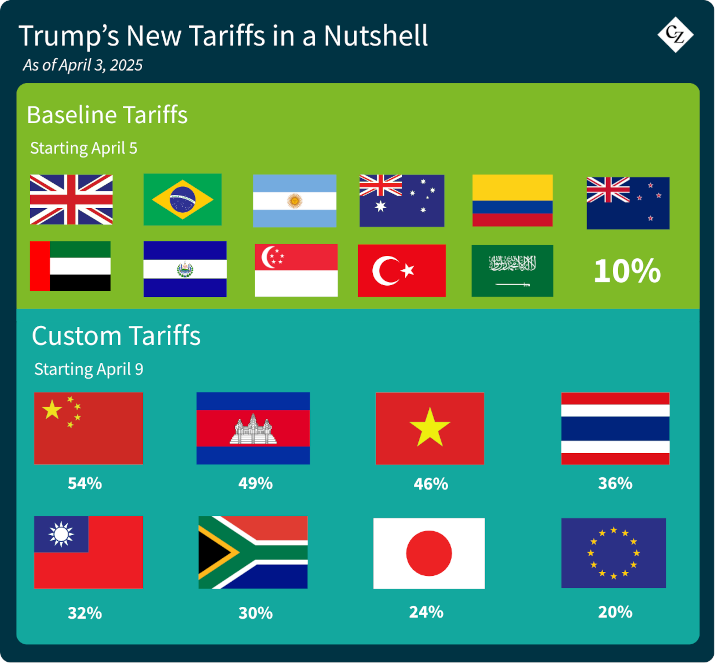

A 10% baseline tariff on nearly all imports took effect April 1, with higher reciprocal tariffs on countries that impose tariffs on US goods set to begin April 9.

Initial reviews indicate that about 928,000 tonnes of US sugar imports may be affected with a minimum 10% tariff. More than half of US sugar imports had already entered the country by the end of February, according to USDA and Customs data.

Sugar imports from Mexico—the largest single source of US sugar imports—and from Canada were excluded from the list under the US-Mexico-Canada Agreement, with potential tariffs of 25% pending.

Some in the trade noted a slight uptick in sugar trading for 2025-26, mainly attributed to reducing exposure amid tariff anticipation. But it was far from a rush. At the same time, some buyers indicated they would not enter the market until June or July. Spot and forward trading was sluggish. Even companies that issued RFPs appeared in no hurry to finalise deals. Buyers of various sizes were locking in partial coverage for next year.

USDA Planting Report Surprises Market

Bulk refined beet sugar for 2025-26 continued to sell mostly in the upper 30c/lb to lower 40c/lb range, FOB Midwest, unchanged. Sales below 40c/lb to buyers of various sizes were noted, although some beet processors continued to hold values at 40c/lb or slightly above, as that was seen as the break-even level for growers.

Spot sugar prices were unchanged in the lower 40c/lb area FOB Midwest for beet sugar, with offers for refined cane sugar holding at 54c/lb in the Northeast and West Coast, and closer to 50c/lb in the South, Southeast, and Gulf regions. One beet processor was sold out for the 2024-25 marketing year, but most others still had sugar to sell due to large 2024 sugar beet crops.

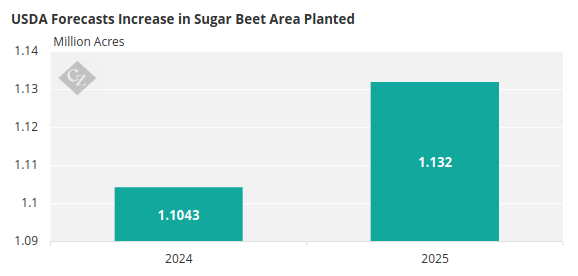

Many in the market were surprised by the USDA’s 2.5% increase in sugar beet planting intentions from 2024. Most had expected slightly lower or at least flat acreage from 2024.

Source: USDA

It should be noted that Colorado’s planting intention number is expected to be corrected to 25,000 acres from 29,000 acres due to a data entry error, according to knowledgeable sources. That adjustment would place the total increase from 2024 at 23,700 acres, or 2.1%, instead of 27,700 acres, or 2.5%.

A few acres of sugar beets have already been planted, trade sources said, although the bulk of planting season remains a few weeks away.

Louisiana sugar cane crop condition ratings as of March 30 were 36% good to excellent, up from 32% a week earlier but still far behind 77% at the same time last year.

Corn sweetener markets remained quiet.