This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

The cash sugar market remained quiet during the week ending December 6. Prices were unchanged as traders focused on defining prices for 2025-26 sugar. Buyers sought lower prices due to ample North American sugar supplies, while sellers held steady. The market awaited the December 10 USDA report.

The cash sugar market was in its year-end lull, with slow trading and prices unchanged during the week ended December 6. Traders sought price definition for 2025-26 sugar, while 2025 corn sweetener contracting progressed at steady-to-lower prices compared to 2024.

With most sugar business for 2024-25 completed, the industry turned its attention to 2025-26. Inquiries continued, but little, if any, business had been done to date, with bids and offers remaining some distance apart.

Buyers, Sellers in Stalemate

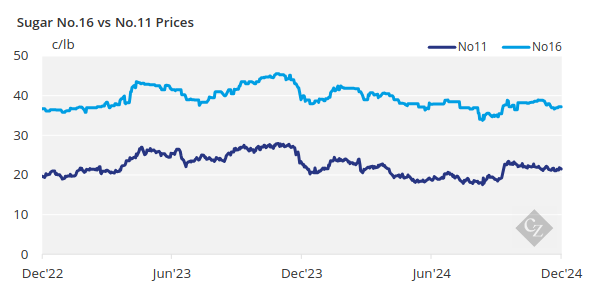

Buyers have been seeking sugar at lower prices than those for 2024-25. They noted ample North American sugar supplies after two years of high prices, along with an inverted futures market (both world and domestic raws), among other factors.

Sellers, on the other hand, appeared to be offering prices steady with 2024-25, if they were engaged at all.

Mostly just “tire kicking” was expected through the year-end holiday period, with both sides becoming more serious as the calendar moves to 2026.

The sugar cane harvest advanced in Louisiana and Florida, but no state data was available, as weekly updates had ended for the season.

Weather Becomes Major Beet Influencer

Beet processors’ focus now shift to outdoor piles, which will need to stay frozen well into spring for the long slicing campaign of the large 2024 crop. So far, the weather has cooperated, with cold temperatures in the Red River Valley.

New sales of refined sugar for 2024-25 continued at a slow pace. One processor was out of the market due to lower-than-expected sugar beet production, but others remained in the market, making sales across a range of quoted prices and, in some cases, dipping below.

Trade sources noted some pressure on West Coast beet sugar prices due to sales from other regions with abundant supplies. Otherwise, beet sugar prices for 2024-25 and cane sugar prices for calendar years 2024 and 2025 were steady. Most sellers had already sold a high percentage of their prospective 2024-25 sugar production, even if supplies were higher than initially expected.

Sugar buyers were slow to add more sugar than they might need amid uncertainty about demand for their own products. While most sellers thought some demand remained for 2025, buyers were expected to fill their final needs on the spot market as the year progresses.

Sugar deliveries to the consumer (retail) market began to slow seasonally, as orders have either been placed or shipped. The retail sector has remained strong in recent months. Deliveries of bulk refined sugar were unchanged, which for some processors were below expectations.

Market Awaits USDA Report

The trade awaited the December 10 USDA WASDE report to see how the Department balances a 13.5% ending stocks-to-use ratio, as required under the US-Mexico suspension agreements. Forecast imports from Mexico are expected to rise, with high-tier imports also likely to tick higher.

Annual corn sweetener contracts for 2025 were being signed at rollover to lower levels from 2024 contracts. Some discounting of 42% high-fructose corn syrup was noted, but good domestic demand for 55% HFCS and regular corn syrup (glucose) provided support.