This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

The cash sugar market remains bearish amid high supplies. Beet processors reported increased supply during the ongoing harvest. Brazil’s production concerns boosted raw sugar futures to multi-month highs.

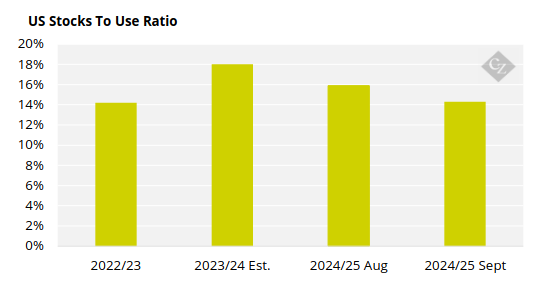

A bearish trend persists in the cash sugar market as of September 24, amid ample domestic supplies and a 20-year high ending stocks-to-use ratio estimated by the USDA. Beet processors continue to sell sugar for 2025, with supply higher than previously expected.

Harvest is underway in all states, with full harvest set for October 1. New crop sugar is reaching the market, adding to spot supplies that were already boosted by the slow draw on contracted sugar. Sugar deliveries are said to be good but not great.

Sugar Price Adjustments

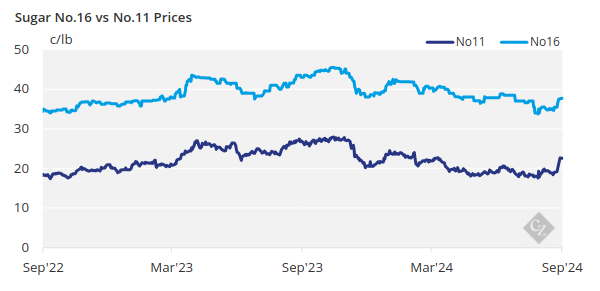

Bulk refined beet sugar prices for 2024-25 are lowered by 1¢/lb to 2¢/lb, trading mostly between 44¢/lb and 48¢/lb FOB Midwest, with some sales noted above and below that range. Refined cane sugar price offers for 2025 decreased by as much as 5¢/lb in some cases, reflecting recent sales, while list prices in other cases remained steady. Spot beet and cane sugar values are steady to lower as the end of the marketing year approaches and lower 2024-25 pricing comes into play.

Harvest Progress Affected

As of September 15, the sugar beet harvest was 8% complete in the four largest beet-growing states, slightly behind the 9% from last year and the 2019-23 average. The sugar cane harvest is about to begin in Louisiana and Florida.

Some losses were incurred in Louisiana due to Hurricane Francine, though the state will still have a large crop. The Louisiana sugar cane good-to-excellent rating dropped to 66% as of September 15 from 82% a week earlier, reflecting the hurricane’s impact.

There is considerable discussion regarding the USDA’s September 12 estimate of the US 2023-24 ending stocks-to-use ratio at 18%, up from 16.1% in August and the highest since 18.7% in 2003-04. The ratio, which exceeds the USDA target range of 13.5% to 15.5%, is boosted by record high-tier imports, estimated at 1,170,000 tonnes, up 157% from 2022-23.

While high-tier imports have increased costs for US sugar users, they also present a selling impediment for US sugar producers, with some reporting customers not taking delivery of contracted sugar in favour of buying supplies that entered the US via the high-tier route. Most agree the ratio will be adjusted lower in the coming months due to an expected shortfall of 80,000 tonnes to 150,000 tonnes in TRQ imports.

Nearby world and domestic raw sugar futures surged to multi-month highs amid concerns that drought and fire reduced production in Brazil. Negotiations for 2025 annual corn sweetener contracts have yet to begin, with corn refiners expected to offer flat to higher prices while buyers seek flat to lower values compared to 2024.