This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Sugar trading remained slow with limited sales and deliveries. The USDA cut its 2024-25 delivery forecast as buyers pushed for lower prices, while sellers held firm amid potential Mexican import tariffs. Upcoming beet acreage decisions and post-Colloquium negotiations are expected to guide future pricing.

Sugar Trading Slows as Deliveries Lag

Spot and forward sugar trading remained slow during the week ending February 14, while negotiations for 2025-26 continued. Buyers and sellers are anticipating more meaningful talks, though not necessarily more deals, during sideline meetings at the International Sweetener Colloquium, scheduled for February 23-26.

Small volumes of sugar continued to trade on the spot market at prices steady with, and on either side of, the quoted price range. All beet processors and cane refiners were active in the market, with a few small sales noted. However, beet processors with sugar yet to sell for the current year reported difficulty finding buyers, with one noting that sales to distributors—who typically serve smaller buyers—were especially slow.

Adding to the challenge of slow sales were mixed delivery results for already-contracted sugar. While one processor noted that deliveries met expectations, most reported shipments below expectations.

This trend has persisted for several months and was confirmed in the USDA’s February 11 Sweetener Market Data report, which showed sugar deliveries for human consumption in both December and the October-December period were down 4.9% from the same periods a year earlier. Beet sugar deliveries were particularly slow in December.

USDA Cuts Sugar Delivery Forecast as Buyers Hope for Lower Prices

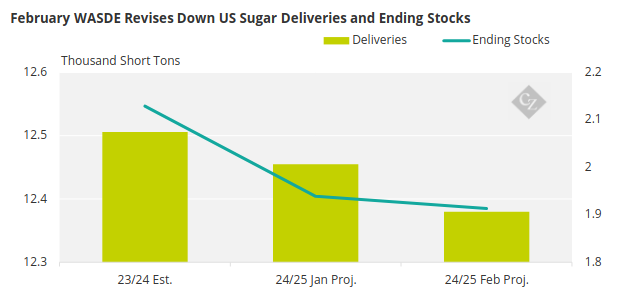

In its February 11 WASDE Report, the USDA forecast 2024-25 sugar deliveries for human consumption at 12,275,000 short tons (11,135,693 tonnes), down 75,000 short tons from January and 126,000 short tons from 2023-24, citing “lower recent period deliveries than originally projected.”

Changes to 2024-25 forecasts for production, imports, and deliveries largely offset each other, resulting in only a minor downtick to ending stocks.

Source: USDA

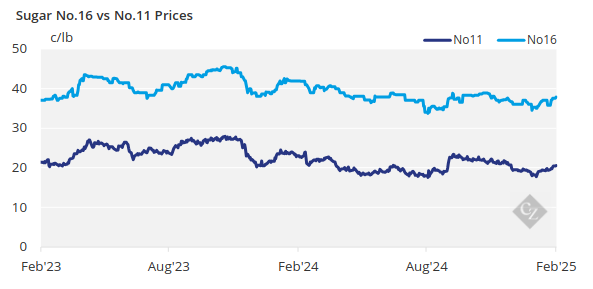

Weak deliveries contributed to buyers’ attempts to push prices down for the remainder of 2025 and for 2025-26. At the same time, lower forecast sugar production in Mexico, a 2024-25 tariff-rate quota import shortfall forecast at 199,922 short tons, and the possibility of tariffs on sugar imports from Mexico provided sellers with a case for maintaining steady, if not firmer, offers.

Beet processors reported a few small sales for 2025-26 at steady to slightly higher prices compared with 2025. However, the volumes were insufficient to shift the recently quoted price range or make it anything more than nominal.

Most negotiations have yet to result in sales, as buyers continue to hope for lower prices while sellers hold firm on their offers. Sideline meetings during the Colloquium are expected to be numerous and active. However, most participants expect few actual contracts will be finalised during the late-February event, with deals likely to be signed in the weeks following the Colloquium.

Another factor that may influence price direction in the coming weeks will be the 2025 planted area determinations by beet grower cooperatives. Early indications suggest that beet acreage will be mostly steady to slightly lower compared with 2024.

The corn sweetener market was quiet amid some weather-related disruptions to logistics. Despite the potential impact of retaliatory tariffs, the USDA raised its forecast for high-fructose corn syrup consumption in Mexico for 2024-25, most of which is imported from the US.