This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Sugar prices looked steady to weaker this week. With the harvest well underway, little stands in the way of a large beet crop save the condition of outdoor frozen beet piles.

Sugar Prices Weaken

Forward sales of bulk refined sugar slowed during the week ended August 23 as the market’s attention turned to the sugar beet harvest. Prices were steady to lower.

Bulk refined beet sugar prices for 2024-25 were unchanged at 45¢/lb to 49¢/lb FOB Midwest with a weak tone. Refined cane sugar price offers for 2025 were lower, with the Southeast and Gulf at 55¢/lb, down 1¢/lb to 2¢/lb, and the Northeast and West Coast at 57¢/lb, down 2¢/lb. Spot beet and cane sugar values were unchanged. With only about a month left in the marketing year, the spot market was quiet, although sugar was available.

While forward sales continued, most users have a comfortable amount of sugar contracted for 2024-25 amid forecast record-high US production and uncertainty about demand for their products. Those with uncovered needs appeared confident there was limited upside potential to sugar prices, and they have been rewarded so far this year by not rushing to buy.

Beet processors were getting more comfortable with the amount of prospective production sold, even if some have more to sell than expected earlier in the season. All processors were in the market for 2024-25.

Harvest Advances

With sugar beet crops in their final sugar-depositing stage, little stood in the way of large beet crops other than an early freeze in northern states. But even that risk is reduced because of the early start to harvest in several areas. The only remaining threat after harvest is how well outdoor beet piles stay frozen through the winter with processing times running longer than usual.

The sugar beet harvest was underway in South Dakota and Michigan — about two to three weeks earlier than last year in the latter. The beet harvest in the Western Sugar Cooperative states will be staggered across the first two weeks of September with pre-pile a few days earlier.

Sugar beet crop condition ratings as of August 18 were unchanged to mostly lower from a week earlier. With the harvest underway or about to begin, the ratings become less significant.

Sugar cane crops in Louisiana and Florida were outstanding, with the harvest expected to start later in September.

Deliveries Slow

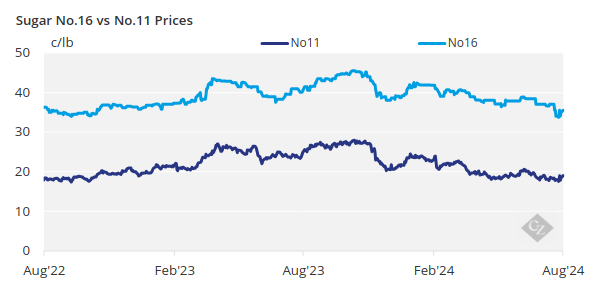

Deliveries of 2023-24 contracted sugar continued at a mixed pace. Most processors noted steady if not good shipments. At the same time, some said shipments had slowed from the past couple months. One factor was thought to be sugar users not drawing on domestic contracted sugar since it was bought last year at prices above what they can currently purchase high duty imported sugar at since raw sugar prices have dropped to near two-year lows.

The early start to beet harvest will result in additional sugar before the marketing year flips to 2024-25 on October 1.

Corn sweetener markets were quiet. Negotiations for annual contracts were expected to begin soon, although buyers were in no rush amid mostly weaker fundamentals for sweetener prices.