This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

There was a weakening in the sugar market this week as lacklustre demand weighed on sugar prices. While the next season looks strong, with planting continuing ahead of schedule, drought conditions could present a wildcard.

Slow Demand Impacts Prices

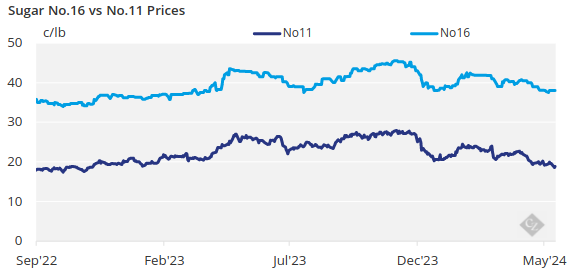

Cash sugar prices were steady to weaker during the week ended May 10 amid slow forward sales. World raw sugar price forecasts from the annual New York Sugar Week took on a more bearish tone due mainly to expectations of increased 2024-25 production.

Steady-to-strong deliveries of contracted sugar continued to support prices in the spot market even with limited sales. The low end of the price range was left unchanged, but the top side was lowered 1¢/lb. In comparison, this time last year, sugar prices were moving higher. Most beet processors and cane refiners continued to offer sugar for 2024, although some were selling selectively.

Bulk refined beet sugar for 2024-25 and calendar 2025 was said to be trading mostly in the low 50¢/lb FOB area in the Midwest with indications of some activity below 50¢/lb for large volume sales. As a result, the low end of the beet sugar price range was dropped by 1¢/lb.

Bulk refined cane sugar for 2025 was offered 1¢/lb lower at 59¢/lb FOB Northeast and West Coast and steady to 1¢/lb lower at 56¢/lb to 57¢/lb FOB Southeast and Gulf.

Sales for next year advanced but at a slow pace. One beet processor was out of the market but continued to sell to specific segments such as retail and private label. Another processor was evaluating its position for next year as beet planting advanced. Buyers have been in no rush to complete contracting for 2025 amid price weakness. At the same time, most beet processors’ sales were slow enough that they were not in a position to raise prices to slow sales once certain thresholds are reached.

Sugar beet planting continued to run ahead of the five-year average pace in all reporting states except Idaho. Aggregate planting in the four largest states was 80% complete as of May 5, up from 66% a week earlier, 36% at the same time last year and 46% as the 2019-23 average, the USDA said.

Drought Could Impact Production

While not yet a major concern, sugar cane in areas of drought was increasing, according to the USDA’s analysis of the May 7 US Drought Monitor. Forty-two percent of US cane production was in areas of moderate drought, up from 39% a week earlier and 6% a year ago.

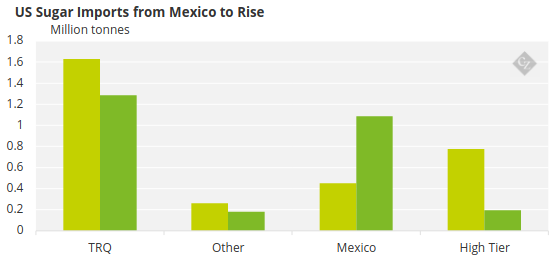

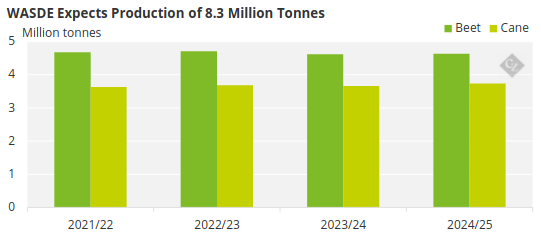

The USDA in its May 10 WASDE report initially projected 2024-25 US sugar production at 9.2 million short tons (8.3 million tonnes), raw value, up 101,000 short tons, or 1.1%, from this year. Imports from Mexico were projected at 1.2 million short tons, up 140% from 497,000 short tons in 2023-24.

Source: USDA

Note: Figures converted to tonnes from short tons

US sugar production in 2023-24 was forecast at 9.1 million short tons, down 84,000 short tons from April. Imports were forecast at 3.4 million short tons, up 21,000 short tons. Deliveries for food were forecast at 12.4 million short tons, down 100,000 short tons based on the delivery pace to date.

Source: USDA

Note: Figures converted to tonnes from short tons

The corn sweetener market was quiet. There was limited inquiry for 2025 pricing, but no indication of contracting any time soon.