This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

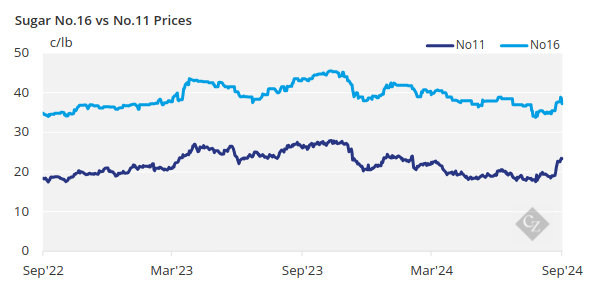

Cash refined sugar prices stabilized this week after recent declines. Despite ample supplies preventing price increases, New York raw sugar futures surged due to downgraded production forecasts in Brazil. Cash trading activity remained slow.

Stable Prices and Beet Harvest Progress

Beet processors continued selling 2025 sugar, though with some difficulty. One processor noted that demand exists but needs to be found.

Although earlier sales were strong, processors are now realizing larger beet crops mean more sugar to sell than anticipated. Buyers, many of whom have secured their 2025 coverage, remained on the sidelines.

Harvesting began in all major states and is expected to be in full swing by October 1. Sugar beet tonnage is high, and favourable late-season weather boosted sugar content. The USDA has forecast record-high production of beet, cane, and total sugar for 2024-25.

As of September 22, sugar beets were 11% harvested in the top-producing states, slightly behind last year’s 12% and the five-year average of 13%. Louisiana’s cane harvest was 2% complete, slightly delayed by Hurricane Francine.

Concerns remain in Michigan, where dry conditions have affected the otherwise excellent beet crop, especially in the Red River Valley.

Refined Sugar and Sweetener Markets

Bulk refined beet sugar prices for 2024-25 were reported mostly between 44¢/lb and 48¢/lb FOB. Midwest, though some sales were noted below this range. Refined cane sugar prices for 2025 were quoted at 57¢/lb in the Northeast and 50¢/lb to 55¢/lb in the Southeast and Gulf. Prices for both beet and cane sugar were unchanged from the previous week.

Sellers operating on a marketing year basis will transition to 2024-25 prices starting October 1, while cane refiners using a calendar year basis will adjust prices on January 1.

Deliveries of contracted sugar for 2023-24 have been mixed, with some buyers opting for high-tier sugar imports at lower prices than their contracted domestic sugar. Bulk refined sugar deliveries have lagged behind last year, mainly due to lower beet sugar and non-reporter deliveries.

However, this has been partially offset by higher refined cane sugar deliveries. A seasonal uptick in retail deliveries has been observed as the fall baking season begins, continuing through the holiday period. Overall, total deliveries have been at or slightly below expectations, weighed down by bulk sugar.

Hurricane Helene, which made landfall in Florida last Thursday, disrupted transportation across the Southeast but had minimal impact on sugar cane fields and refineries.

Corn sweetener markets remained quiet, with some tolling negotiations ongoing. However, annual contracting for 2025 has yet to begin. One broker speculated that significant movement on contracts might not occur until December, with sellers seeking firm prices and buyers hoping for steady or lower prices compared to 2024.