This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Pricing and sales have both weakened in the US as recent USDA figures show ample sugar supply. The biggest risk for sugar supply is weather, although no adverse events are anticipated in beet areas.

Pricing Weakens

Beet sugar prices for 2025 were weaker during the week ended July 19 amid indications of large 2024 sugar beet crops. Forward sales advanced. Spot sugar prices were unchanged.

Trade sources indicated bulk beet sugar prices had dropped below the recent low end of the quoted price range as some sellers had become more aggressive in pricing amid expectations of large 2024 sugar beet crops.

Beet sugar for 2024-25 could be bought in the mid-to-upper-40¢/lb FOB area in the Midwest, depending on location, volume and other factors. Prices for 2025 also weakened for other types of sugar, such as retail bags.

Refined cane sugar was offered below 60¢/lb FOB Northeast and West Coast and slightly above the mid-50¢/lb area in the Gulf and Southeast, all unchanged. Spot beet and refined cane sugar values were above forward prices and were unchanged with limited sales activity.

Sales Slow on Ample Supply

At least two beet processors remained in the market for 2024-25 and noted ongoing sales in recent weeks that moved their volume higher but not yet to the point that would prompt an increase in offer prices. One processor remained out of the market (except for retail and private label) until at least September, and a second also was said to be out of the market amid supply uncertainty.

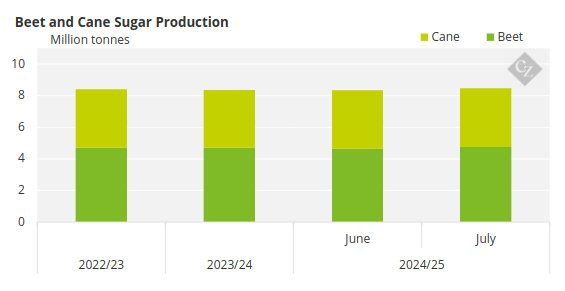

The USDA in its July 12 WASDE report boosted supply forecasts for this year and for 2024-25. Beet sugar production for 2023-24 was raised based on processors’ final production data as campaigns were concluded a few weeks ago.

Source: USDA

The USDA forecast record-high domestic sugar production in 2024-25 on higher beet sugar outturn from increased harvested area indicated in the June Acreage report versus the March Prospective Plantings report. Some in the trade doubt whether the USDA’s forecast beet sugar production can be achieved in 2024-25. While sugar beet crop ratings are high in most areas, they note “pockets” where problems persist that likely have trimmed production prospects.

Even if forecast production potential isn’t realized, trade sources still expect ample sugar supplies in 2024-25, which has created a buyers’ market that resulted in price pressure on beet sugar values. Barring a major negative weather situation (which isn’t expected in sugar beet areas) or a weather event such as a hurricane in sugar cane areas, there should be no shortage of sugar in 2024-25 with Mexico also expected to have more exportable supply than in 2023-24.

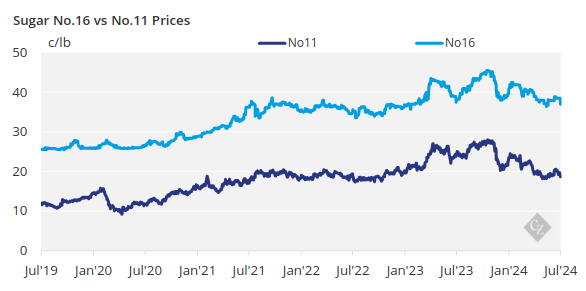

The supply situation for 2023-24 appears to have ballooned with just more than two months left in the marketing year. The situation has been exacerbated by record-high levels of high-tier sugar imports, exceeding 1 million tons (907,184 tonnes), per the USDA, more than double the year-ago level. The high-tier imports have contributed to artificially high sugar prices.

Deliveries for 2023-24 continued at a good clip during July but remained down from the same period a year ago per USDA data and anecdotal trade reports. Some expect demand weakness to persist into next year.

Corn sweetener markets were quiet.