This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Sugar sales slowed amid ample supplies and weak demand. Buyers delayed full-year coverage, anticipating lower prices as production forecasts rose. The USDA cut delivery estimates, reflecting weaker demand and adding to market pressure.

Sugar Sales Slow Amid Weak Demand

Sales of bulk refined sugar for 2025-26 were ongoing at a slow pace and within a wide price range during the week ending March 14. Ample supplies, weak demand and price weakness were dominant themes.

Processors reported that sales required longer negotiations for even small volumes. Many buyers were covering just part of their needs for the year rather than locking in supplies for the entire 2025-26 period.

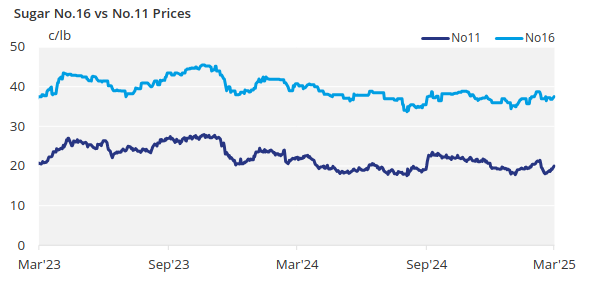

Prices were unchanged from the previous week. Sugar was selling within the quoted range of 39c/lb to 42c/lb FOB Midwest, although transactions occurred above and below this range. Aggressive sellers were willing to sell below 40c/lb to move supplies, while others held prices above this level to ensure adequate returns for the grower members of their cooperatives.

“Pricing is all over the board,” said one processor. “I’ve never seen anything like it.”

Despite the already wide discount compared to 2024-25 prices, buyers are eyeing forecasts of record-high domestic sugar production this year and next, weak demand and economic uncertainty as reasons for delaying coverage of their full 2025-26 needs, with some hoping still for lower prices. However, the risks associated with waiting to complete forward coverage—such as weather and potential tariffs on imports from Mexico—seemed to be less of a concern in the current bearish market.

The USDA’s Louisiana field office rated the state’s sugar cane crop as 27% good-to-excellent, 66% fair and 7% poor to very poor as of March 10. This compares with 49% good-to-excellent, 41% fair, and 10% poor to very poor at the same time last year.

Sales for the current year were also slow, with prices remaining weak. Buyers are mostly covered, but most beet processors still have sugar to sell.

USDA Lowers Delivery Forecasts

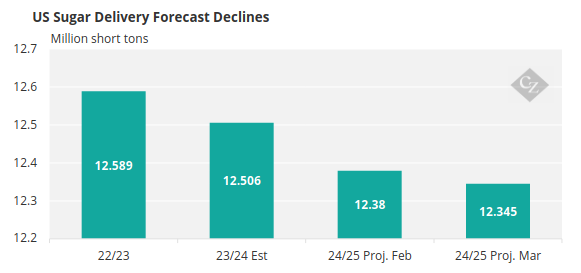

A major theme of the current crop year has been weak demand, as reflected in USDA delivery data and forecasts. Anecdotal reports from most processors have indicated contract performance below expectations, though retail sales have been a bright spot for some.

The USDA, in its Sweetener Market Data (SMD) report, stated that sugar deliveries for human consumption during the October-January period were down 4.1% compared to the same period last year. This was an improvement from the October-December period, which was down 4.9%, but still well below the USDA’s World Agricultural Supply and Demand Estimates (WASDE) Report, which pegged deliveries down 1.3%.

The WASDE delivery forecast was reduced by 35,000 short tons (31,751 tonnes) from the February forecast and was down 161,000 short tons from 2023-24. However, some industry sources suggest that an additional 50,000 to 100,000 short tons should be removed from the WASDE forecast to account for the lower SMD number.

Source: USDA

Another major factor pressuring prices has been the ample sugar supplies. The USDA forecasted 2024-25 beet sugar production at a record-high 5.4 million short tons, up 35,980 short tons from February. Cane sugar production was forecasted at 4.01 million short tons, up 1,916 short tons, and total production came in at a record 9.4 million short tons. In its first 2025-26 projection from the recent Agricultural Outlook Forum, the USDA also forecasted record-high total sugar production for 2025-26.

Many in the trade had earlier suggested that the 2024-25 beet sugar forecast was at least 50,000 short tons too high, as outside piles in the Red River Valley would need to last into the spring due to the large crop, along with issues at a couple of other processors.

The USDA’s WASDE provided considerable discussion as to why forecasts were raised and why they were not expected to decrease. However, more in the trade are now accepting the USDA forecast for the 2024-25 slicing period.

The corn sweetener market remained quiet.