336 words / 1.5 minute reading time

- As expected, the US has expanded Raw Sugar TRQs by 317k tonnes and increased refined quota imports by 181k tonnes.

- Existing TRQ quotas will be expanded, subject to availability; it’s not clear how the refined quota will function.

- Unless American sugar consumption falls or Mexican imports increase, further imports will be needed.

Raw Sugar TRQ Expansion

- A TRQ expansion is a straightforward process; TRQ holding countries with sugar available will see their quotas expanded.

- Volume received will depend on sugar availability and shipments to date.

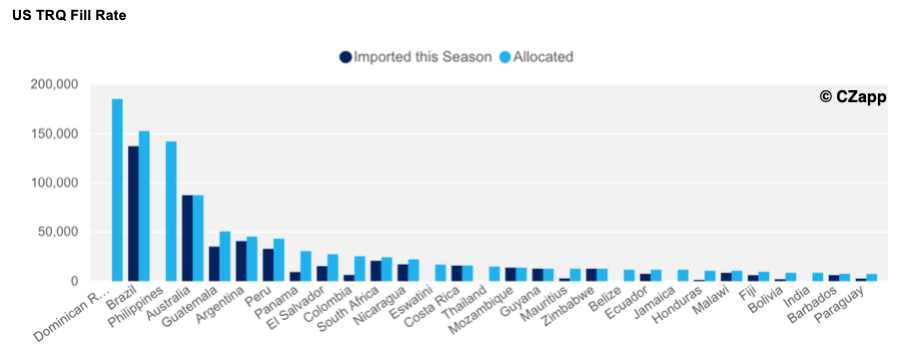

- It is likely significant volume will go to Brazil, Dom. Rep, Guatemala, El Salvador, Peru, Australia and Argentina.

- The USDA should publish a formal expansion notice in the coming days.

Refined Sugar Quota

- We are still unclear as to how this quota will operate.

- The official release states that the “US Trade Representatives will allocate this refined sugar TRQ increase.”

- It is most likely the quota will be distributed on a first come first serve basis starting on a chosen date.

- Distributing a quota by country would be complicated and delay the arrival of the sugar.

- World market refined quota expansions or increases are rare as Mexico usually ships any shortfall in volume.

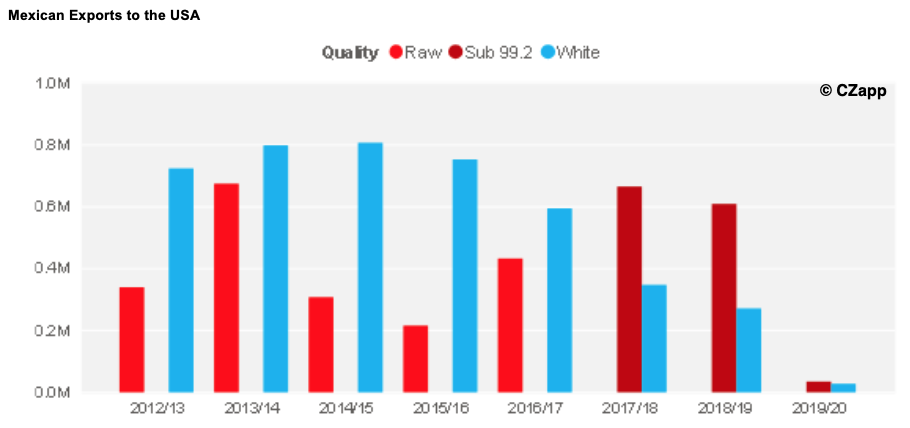

- However, we expect Mexico to struggle to ship its existing quota this season, let alone extra sugar.

Will this be Enough?

- If this the USDA assumption for Mexican shipments this season is accurate, more sugar imports will be needed in the future.

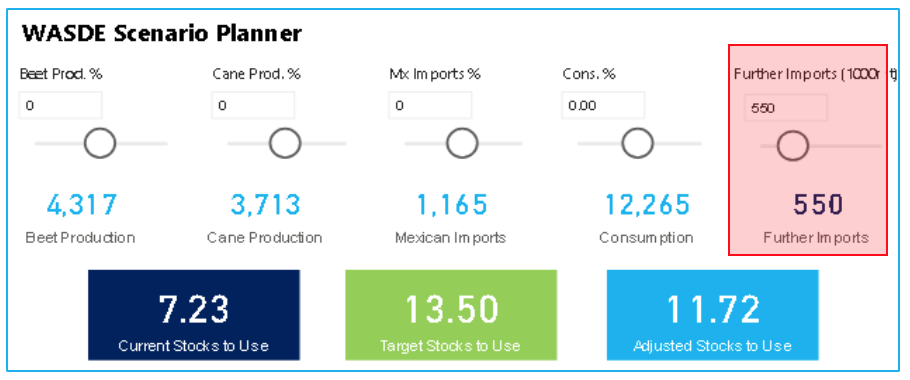

- Our model, shown above and available to you here, suggests a closing stock-to-use ratio this season of 11.7%, versus the USDA’s goal of 13.5%.

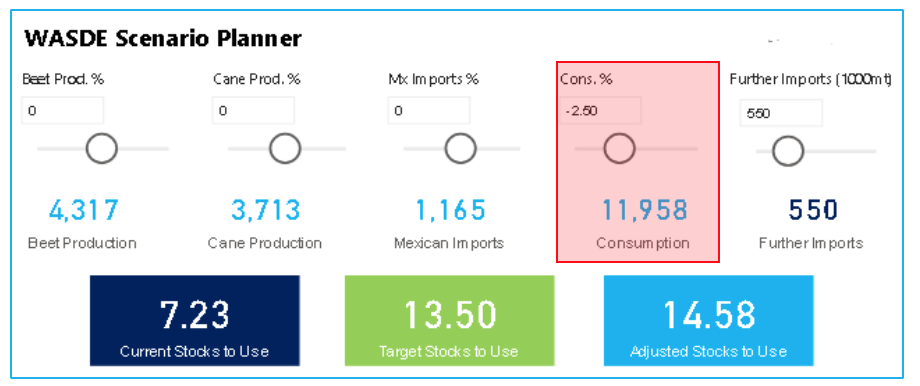

- It is possible the USDA intends to reduce its forecast of American sugar consumption due to the impact of COVID-19.

- We are currently expecting a 2.5% reduction in consumption in the USA in 2019/20.

- If this assumption is correct, the increased imports will enough to ensure adequate stocks.

*The further imports are shown in short tons to match the WASDE report.