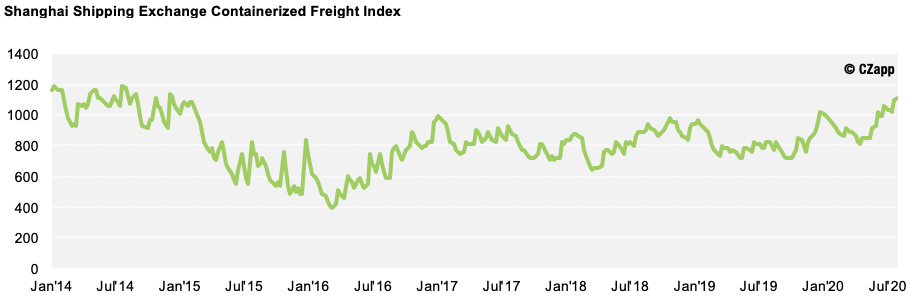

Containerised Shipments

102 sailings from Asia to the US were cancelled between 1st May and 30th July.

This, combined with a spike in US imports in July, led to US West Coast rates hitting a 10-year high on the week ending 31st July; up 17% week-on-week. Despite capacity being reintroduced, such levels should remain until the end of August as carriers continue to successfully manage capacity.

In response to growing demand, 2M Alliance announced that they would increase their fortnightly Asia to Europe sweeper service to a weekly service, with load rates in recent weeks soaring above 90%. The weekly service should run over the rest of the peak season to accommodate for increased demand.

Imports into the US and Europe ahead of the holiday period should be down this year, meaning the peak season won’t likely run very far beyond late September, as opposed mid-October on your average year. This is because retailers fear the shopping season will be shorter due to the pandemic, which will ultimately decrease sales.

Despite year-on-year volumes being significantly down, low bunker prices combined with strong capacity management and high utilisation levels have led to many carriers reporting considerably strong first fiscal quarter results. Last week, ONE announced a $167m first quarter profit, up from a $5m profit for the same period of 2019.

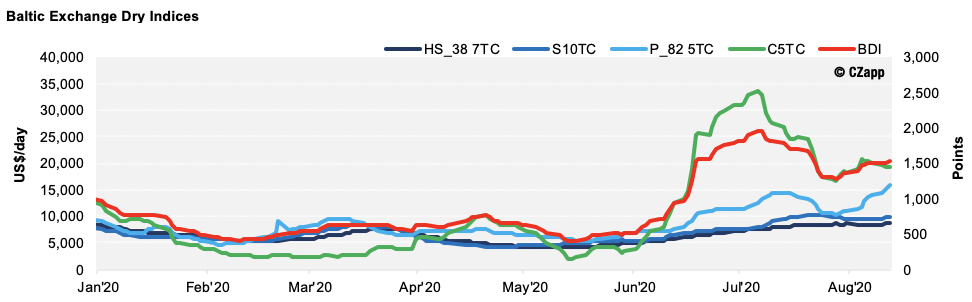

Bulk Shipments

The Baltic Dry Index settled at 1350pts on the 31st July, having reached a high of 1956pts earlier in the month.

The correction was driven by falling Capesize rates, with the 5TC shedding 50% of its value over a three-week period. This was because of excess availability of spot vessels, especially in the Pacific, thanks in part to a decline in iron ore vessels sailing from Australia.

Smaller vessels fared much better over the same period and with Capesize rates stabilising towards the end of July, market sentiment remains positive midway through August. If this continues and anticipation of strong Black Sea Wheat and US Wheat demand materialises, all sectors could benefit further from the improving demand for vessels, assuming recovering economies don’t falter in the face of a second wave of coronavirus.

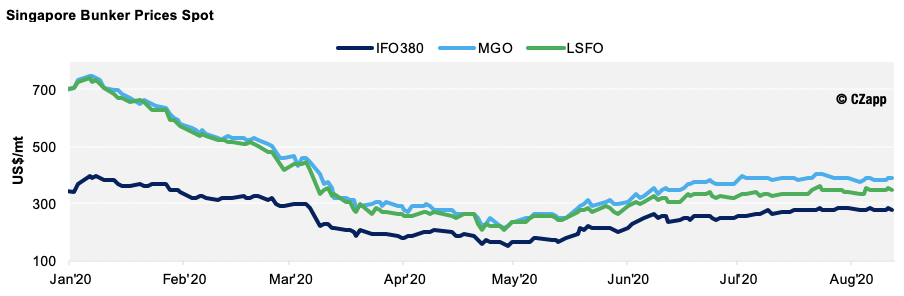

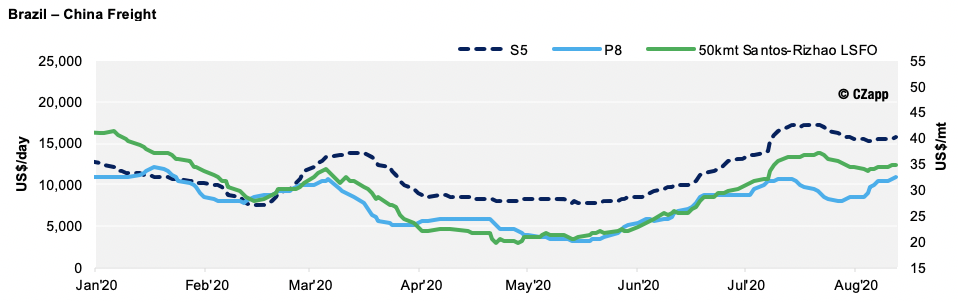

Elsewhere, Singapore bunkers have been relatively stable, with low sulphur fuel prices hovering near to $350pmt at the end of the month (down 23%). The front haul S5 index price averaged nearly $16,000 per day during July; a strong figure considering the YTD average is closer to $11,000.

Our Brazil-China 50kmt route assessment has stayed above $30pmt since the end of June too. The same route assessment exceeded $40pmt earlier in the year. However, that price was heavily influenced by the implementation of the IMO’s low sulphur fuel regulations when prices for the new fuel were over $700pmt.

Other Opinions Written by This Author…

- Indian Sugar Exports Up 43% This Year

- Why is Pakistan About to Import Sugar?

- Indonesia: Record Raw Sugar Imports