This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Sugar futures prices fell this week

- The USDA has increased its forecast for US sugar production.

- However, cash prices are mostly unchanged this week.

Sugar Futures Plummet

New York raw sugar futures tumbled this week, but cash prices were not yet affected. Spot and forward sales were ongoing at a slow pace. The US Department of Agriculture in its December 8 World Agricultural Supply and Demand Estimates (WASDE) report raised its total sugar supply forecast for 2023-24. However, it left the ending stocks-to-use ratio below the minimum needed for an adequate sugar supply.

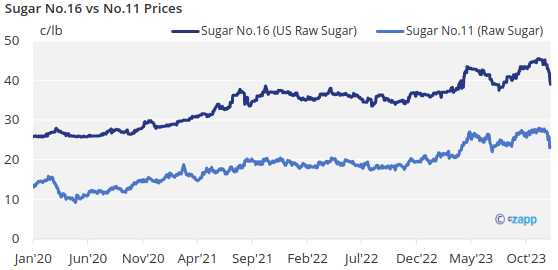

No. 11 world raw sugar futures dropped sharply on pressure from a seemingly quick turn from tight global raw sugar supplies to at least adequate supplies. Brazil’s forecast record-high production was raised even higher, and India’s government told mills to temporarily focus on sugar production rather than ethanol.

No. 16 (domestic) raw sugar futures, already under pressure from the prior week’s raw cane sugar tariff-rate quota reallocation, followed world raw futures even lower.

Beet, Cane Prices Unchanged

US bulk refined beet sugar offers for spot delivery were in the range of 59¢/lb FOB to 62¢/lb FOB. For 2024, prices were in the 57¢/lb to 59¢/lb FOB Midwest range, all unchanged. Traders indicated beet sugar could be purchased for 2024 below list in the mid-50s depending on volume and other factors.

Beet processors typically have additional sugar to sell once harvest is complete. All processors were in the market, and some were hoping to complete 2024 sales ahead of the yearend holidays. A few processors indicated they were nearing sold-out status on new-crop sugar.

Spot refined cane sugar was offered at 68¢/lb nationwide through December 31. It was offered for calendar 2024 at 63¢/lb FOB Northeast and West Coast and at 59¢/lb to 61¢/lb FOB Gulf and Southeast, all unchanged.

Bulk Refined Sugar Sales Slow

Beet sugar sales for 2024-25 were slow with offers in the low- to mid-50¢/lb range. There seemed to be less urgency to book for the next marketing year than there was a year ago due to forecast record-high 2023-24 beet sugar outturn and indications of improved weather in domestic and global cane growing areas in 2024 for the 2024-25 marketing year.

Another consideration for cautious buyers were ongoing slower-than-expected sales of products by some food manufacturers that has resulted in slower deliveries of contracted bulk refined sugar. At the same time, sugar shipments have been strong to the retail sector where consumer purchasing has met or exceeded expectations.

The USDA in its WASDE report forecast the US 2023-24 sugar ending stocks-to-use ratio at 12.8%, up from 12.4% in November but below the target 13.5% minimum that indicates adequate sugar supplies. At least another 100,000 tons of sugar is needed to reach 13.5%. Imports from Mexico were lowered sharply, and data suggests Mexico may even fall short of the lower number.

Corn sweetener contracting for 2024 was wrapping up. Some refiners were able to hold prices about flat with 2023 contracted levels, but others sold at lower prices to protect or gain market share and on buyer expectations of lower values based on sharply lower corn prices.