Opinions Focus

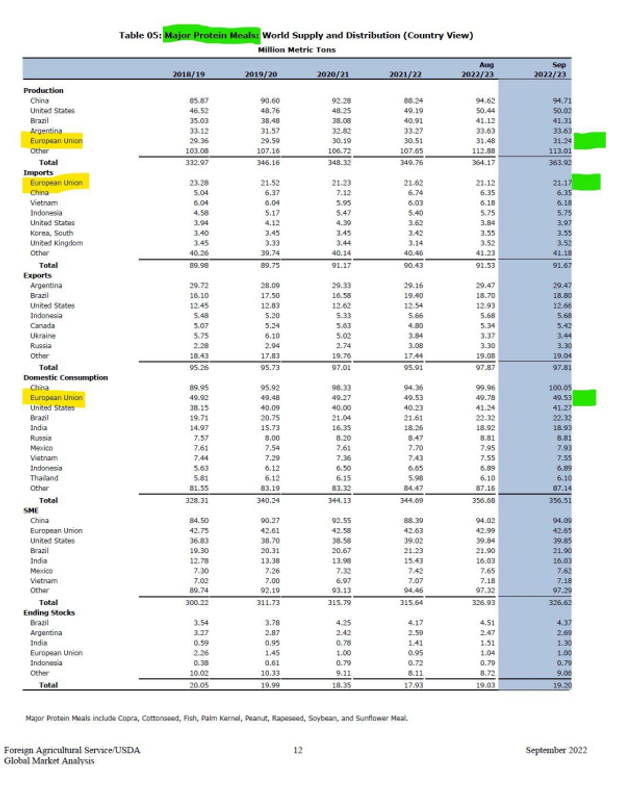

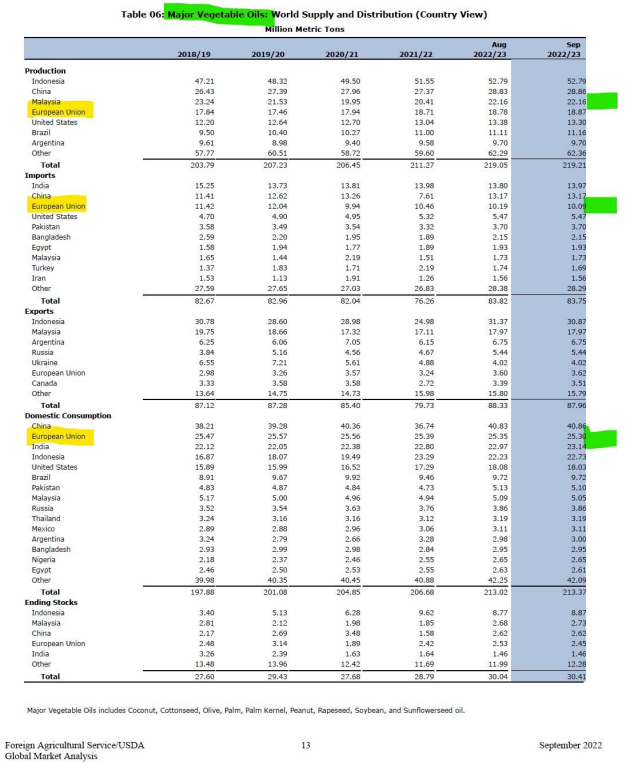

- USDA S&D Estimates for Protein Meals and Vegoils almost unchanged on a month ago.

- This is despite extreme strength in European energy costs.

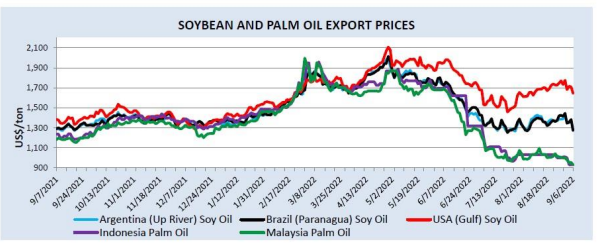

- US soybean oil prices remain ad a premium to palm oil.

I have been highlighting the risk to European oilseed crush operations, protein meal supplies, and vegetable oil supplies given the extreme rally in European natural gas prices and power costs. In my last post I wondered if/when USDA economists would make any adjustments to forecasts in recognition of the power costs challenges to European producers. Today’s monthly update from the USDA: no change.

See highlights below; all the supply and demand estimates remain virtually the same as a month ago.

USDA economists also made insignificant adjustments to supply and demand factors for vegetable oils.

Below is a chart detailing the USDA’s monthly update for major vegetable oil exporters’ prices: the palm oil price collapse and the huge premium of US soybean oil prices to global palm prices remains. US soybean oil remains well above Brazilian and Argentine prices as well. The impact on prices from soybean oil demand from the US renewable diesel industry appears evident.