- Venezuelan sugar consumption has fallen for five successive years.

- This is because of the collapse of the economy, but also because the population has shrunk by 15% in that time as people emigrate.

- Despite this, sugar production won’t meet consumption this year as mills cannot access sufficient funding to operate.

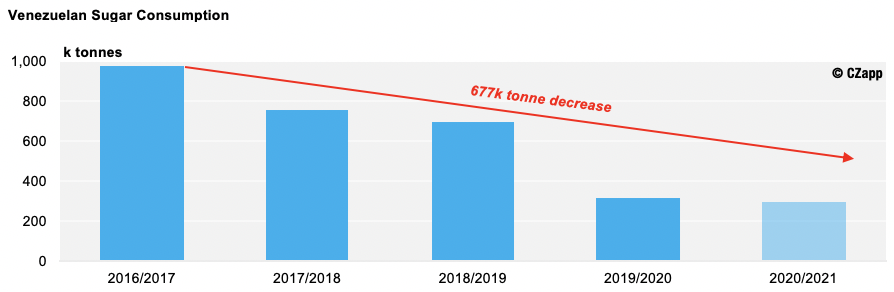

Sugar Consumption: Down by 70% in Five Years

- We think Venezuelan sugar consumption will amount to 295k tonnes in 2020/21.

- This is down 677k tonnes from the 2016/17 season.

- The continual decrease in sugar consumption stems largely from the fact that Venezuela’s population has shrunk by 15% in the past five years.

- More and more Venezuelan residents are leaving the country as it becomes more violent, financially unstable, and unchanged in its political setup.

- The shrinking population has naturally led to weakened sugar demand.

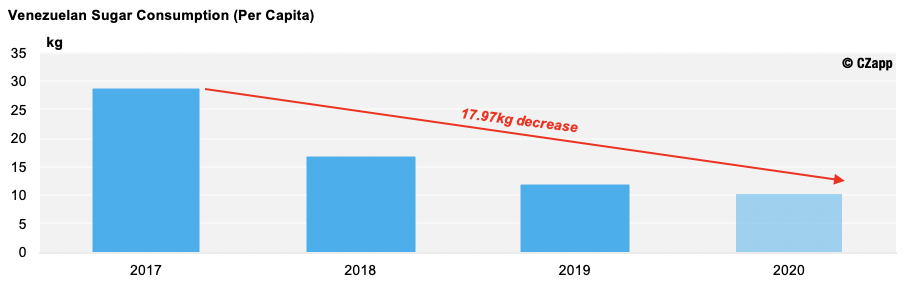

- Venezuela’s sugar consumption per capita has also decreased by almost a third in the space of three years.

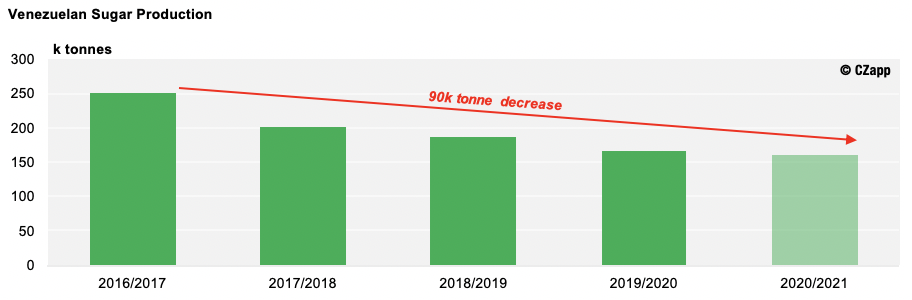

Sugar Production: Underfunded and in Decline

- We think Venezuela will produce 160k tonnes of sugar in the 2020/21 season.

- This is 90k tonnes less than what they produced just five years ago.

- Venezuela’s sugarcane production depends heavily on the reliability of its irrigation systems and agrichemicals.

- However, they face shortages of key inputs such as fertilizers, fuel, replacement parts, and mechanical services for their irrigation systems.

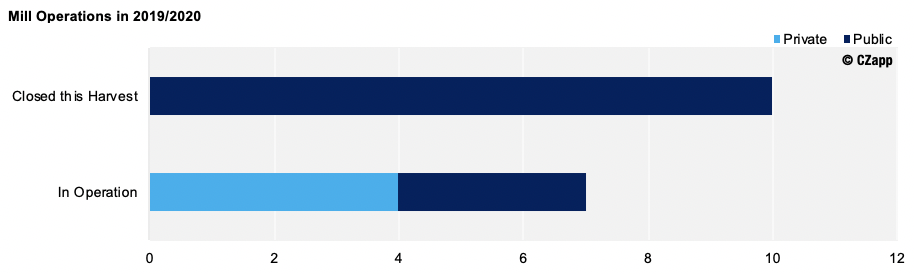

- As well as this, the Government funding for public mills is insufficient meaning 10 of the 13 public mills subsequently shut.

- The three public mills in operation account for just 5% of Venezuela’s total production…

- With this, it is now cheaper to import sugar (including ocean freight and premiums) than it is to purchase domestically produced sugar.

Imports Required to Meet Demand

- As domestic production falters, Venezuela is more reliant on imported sugar.

- In 2019, Venezuela removed its import restrictions meaning they became duty-free and any sanitary and phytosanitary concerns reduced.

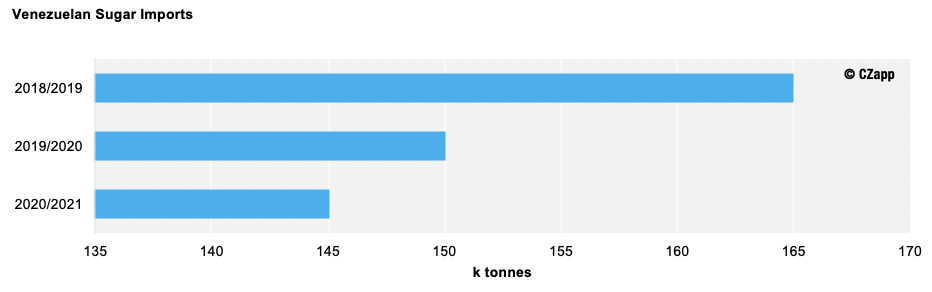

- The removal of these restrictions initially led to a large increase in imports, and although the highs of 2018/19 have not been reached since, imports remain strong.

- There has also been new demand for specialty products such as sugar syrups and alternative sweeteners since they eased.

- Venezuela has moved from importing raw sugar to refined sugar in the past two years.

- This is because the state of its domestic industry means they are no longer able to refine large amounts of raw sugar imports domestically.

- Instead, they have started importing cheaper refined sugar from Brazil, Mexico and Colombia replacing domestic production.

- However, importing sugar is not that simple due to complications surrounding the foreign currency exchange with Venezuela’s hyperinflation.

What Does the Future Hold?

- We don’t see the dynamic of Venezuela’s sugar market changing in the near future.

- The Venezuelan economy is closely linked to the price of oil which doesn’t seem likely for a large rebound in the short-term.

- Without strong oil incomes, it seems unlikely the Government will be able to revive the struggling domestic sector, and imports may even dwindle if consumption continues to fall or multinationals start leaving the country.

The Interactive Data Section

- You can monitor Venezuela’s sugarcane crop and its wider market in the Interactive Data Section’s Country Balance Sheets dashboard.