- In February, Vietnam placed heavy import duties on Thai sugar.

- On 15th June, the government slight increased the anti-dumping duties and extended them for 5 years.

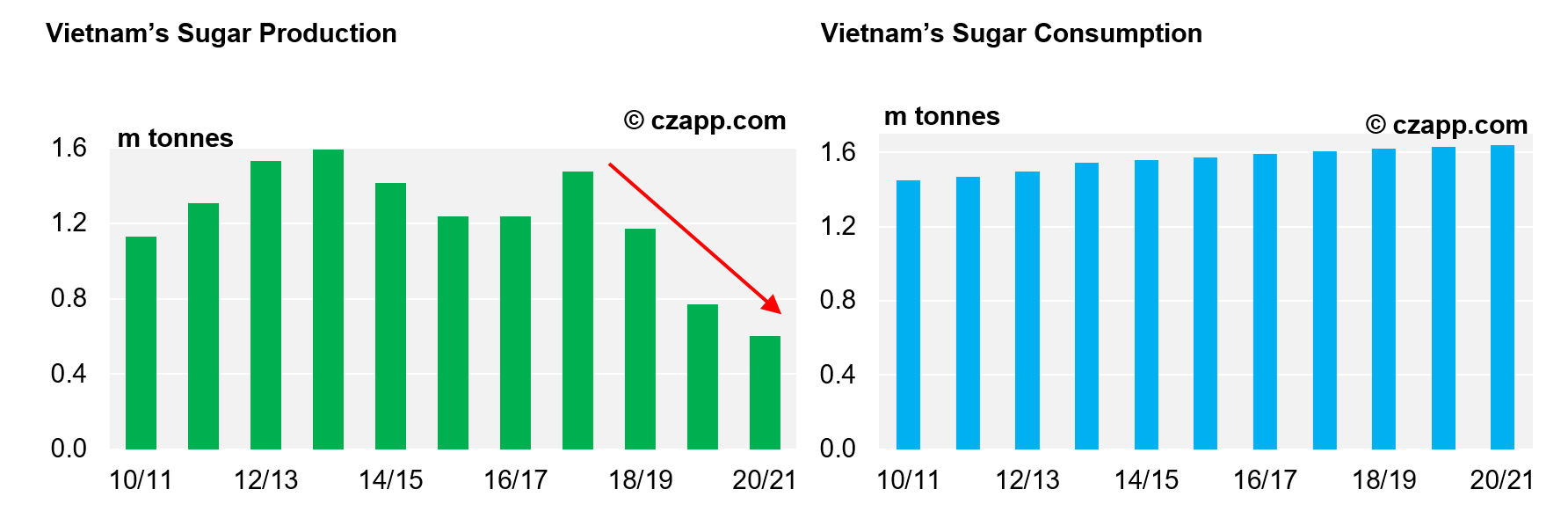

- But with a supply deficit of 1m tonnes of sugar, Vietnam still needs to import sugar.

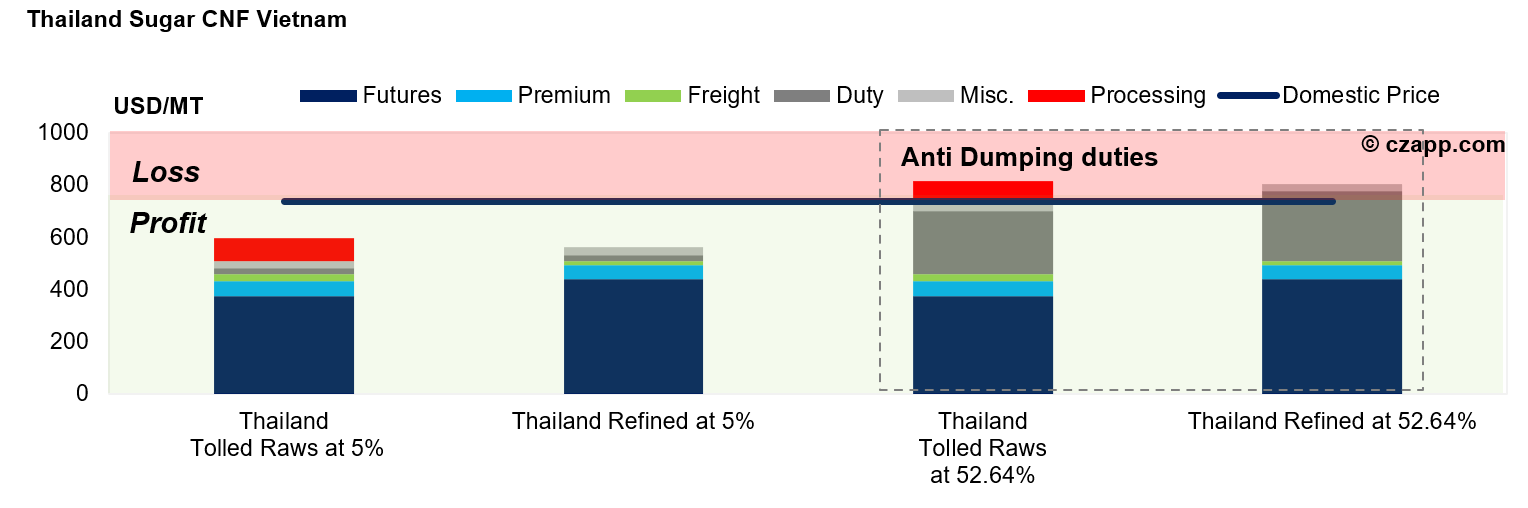

What Are the Changes in Thai Anti-Dumping Duties?

- Previously, Thai sugar imports incurred a 48.88% duty for whites and a 33.88% duty for raws.

- These were designed to prevent cheaper Thai sugar flooding their domestic market.

- With the latest review on 15th Jun’21, the Vietnamese government revised the duties to 47.64% for both raws and whites on top of the 5% ASEAN preferential duty.

- The anti-dumping duties are now valid for the next 5 years.

- Based on the latest duties, the import margin for Thai sugar is negative (-80 USD/mt for raws and -68 USD/mt for refined).

Note: Sugar Imports from ASEAN Members Face 5% Duty

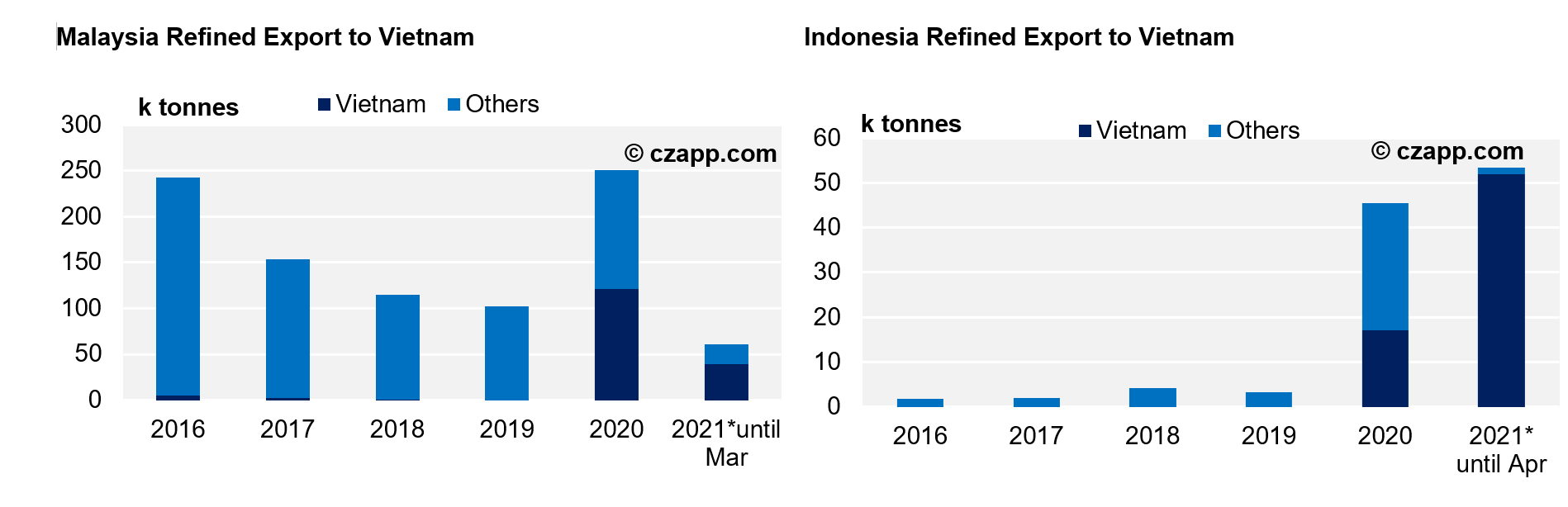

- As such, Vietnam needs to continue importing sugar from Malaysia and Indonesia to supply to their domestic market.

- Malaysia and Indonesia should be able to export 360kmt collectively, leaving the vast majority of Vietnam’s demand unsatisfied.

- Currently, Vietnam has already imported 39k tonnes from Malaysia and 52k tonnes from Indonesia.

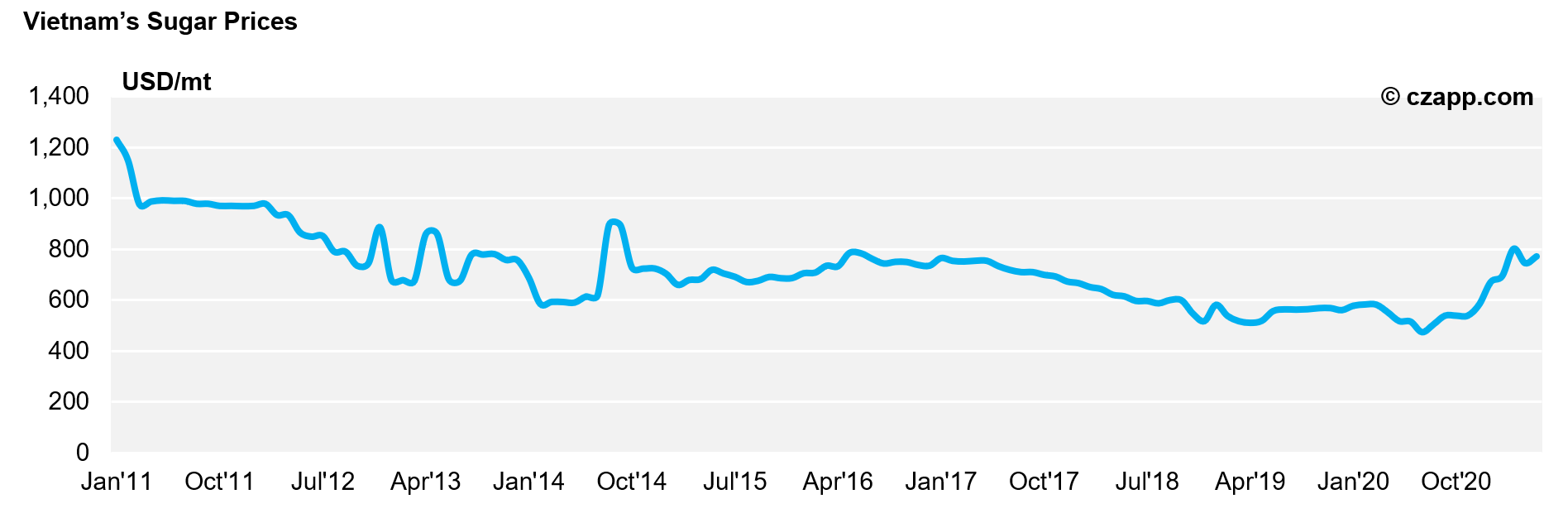

- Meanwhile, given the Thai anti-dumping duties remain, it is likely that the domestic price will continue to remain supported.

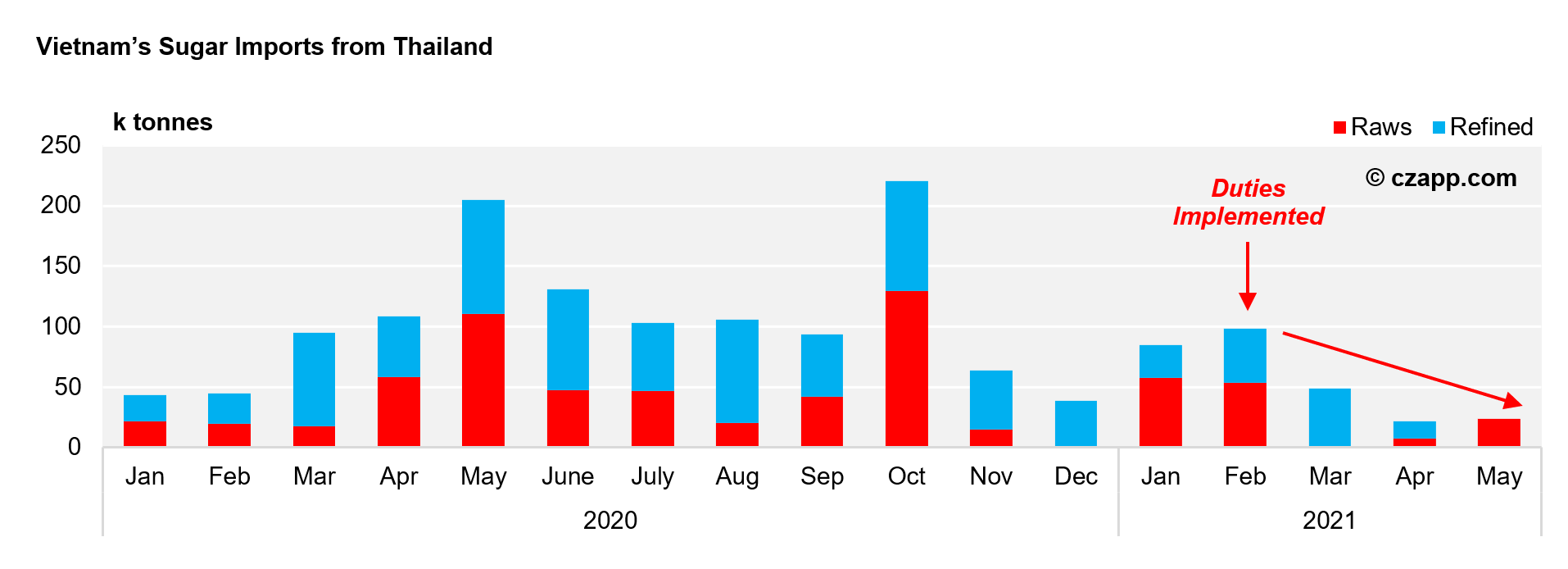

Vietnam’s Sugar Imports Slow Right Down

- Since the duties were introduced in February, sugar imports to Vietnam have fallen.

- Vietnam has imported 278k tonnes of Thai sugar this season, down 31% year-on-year.

Note: May’s refined sugar export data has not been published yet.

- However, its sugar production is at a 10-year low as many farmers have switched to planting pineapples to earn more money.

- This means it will have 1m tonnes less sugar than it needs to satisfy consumption.

- Last season, almost all of Vietnam’s sugar came from Thailand, so it needs to find new suppliers, and fast.

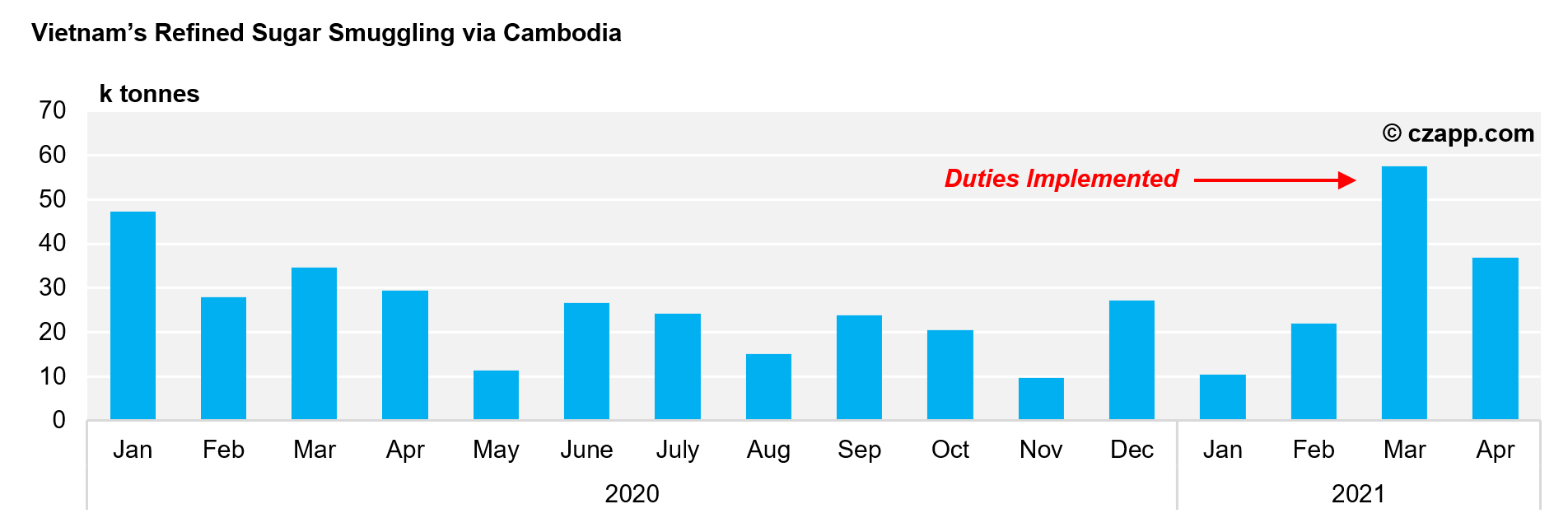

- We’ve seen sugar smuggling via Cambodia accelerate over the last couple of months.

- This should continue, given the latest change in the anti-dumping duties.

- However, Cambodia’s recent spike in COVID cases means border control is tight at present, making smuggling more of a challenge.

- This means Vietnam will continue to need imports from ASEAN origins, like Malaysia and Indonesia, although they’ll be unable to cover Vietnam’s entire deficit.